What is the recent structure of capital inflow in the Hong Kong stock market?

Recently, the inflow of funds into Hong Kong stocks has been mainly driven by southbound funds. From April 8 to June 9, the net inflow of Hong Kong Stock Connect reached HKD 151.45 billion, with a total annual accumulation exceeding HKD 660 billion. International intermediary funds continue to flow out, with the main increase in positions in software services, pharmaceuticals, biotechnology, and automobiles, while reducing holdings in the financial and energy sectors. Southbound funds have increased positions in Meituan, China Construction Bank, Alibaba, etc., while reducing holdings in Tencent, Xiaomi, etc

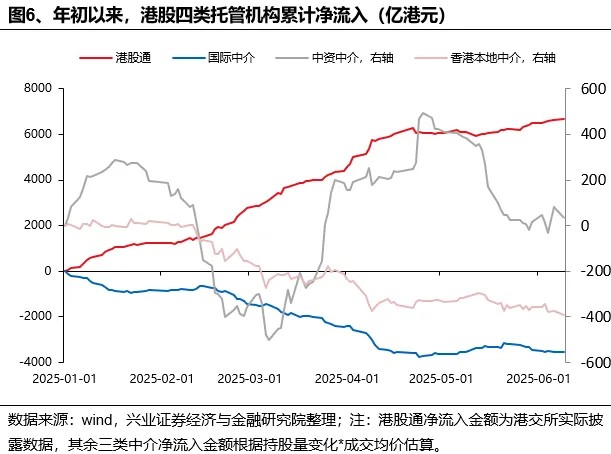

According to the split from the Hong Kong stock custody institution, southbound funds have been the main driving force behind the Hong Kong stock market recently and this year. From April 8 to June 9, the cumulative net inflow of the Hong Kong Stock Connect reached HKD 151.45 billion, while during the same period, international intermediaries, Chinese-funded intermediaries, and local Hong Kong intermediaries reduced their positions by HKD 84.72 billion, HKD 18.04 billion, and HKD 8.42 billion, respectively. For the entire year, as of June 9, the cumulative net inflow of the Hong Kong Stock Connect has exceeded HKD 660 billion, far surpassing the other three types of custody institutions.

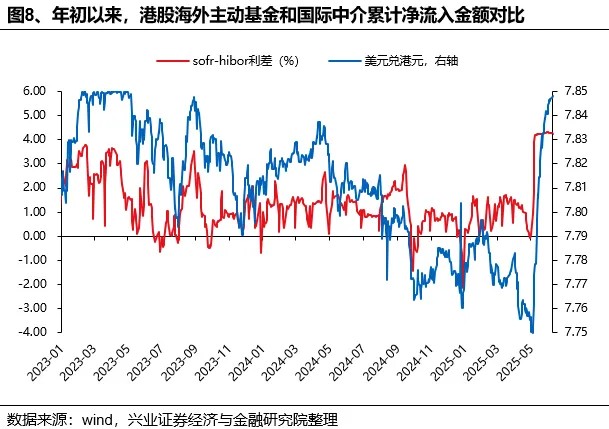

From the perspective of international intermediaries, foreign capital may have continued the outflow trend from the beginning of the year in the past two months. On one hand, hedge funds may have seen a temporary inflow from late April to mid-May, but the persistently low Hibor rates have driven flexible funds to increase their positions in USD assets through arbitrage trading. On the other hand, according to EPFR data, long-term funds represented by overseas active equity funds continue to experience outflows.

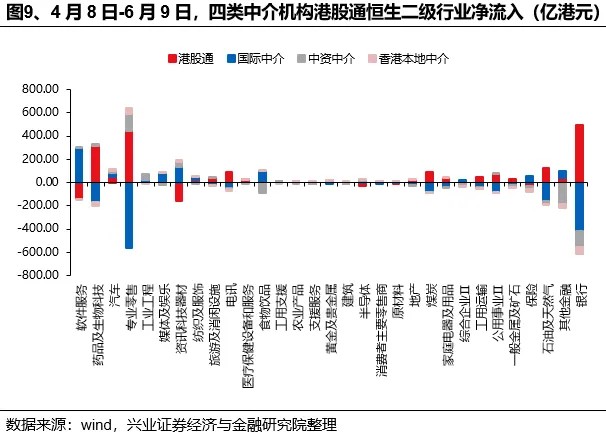

In terms of industry, the main directions for recent capital increases are internet, automotive, new consumption, and innovative pharmaceuticals, while dividend sectors such as finance and energy have seen significant reductions. According to estimates, from April 8 to June 9, funds mainly increased their positions in software services, pharmaceuticals and biotechnology, automotive, professional retail (Alibaba + Meituan), and industrial engineering, while experiencing net outflows in banking, other financials, oil and gas, insurance, and general metals and minerals.

By type of institution:

-

Southbound funds have net inflows in innovative pharmaceuticals, professional retail, telecommunications, banking, and oil and gas sectors, while significantly reducing positions in software services and information technology equipment;

-

International intermediaries favor software services and information technology equipment, significantly reducing positions in banking, innovative pharmaceuticals, and professional retail;

-

Chinese-funded intermediaries and local Hong Kong intermediaries mainly increased their positions in professional retail, information technology equipment, automotive, and semiconductors, while experiencing net outflows in dividend sectors.

It is worth noting that the southbound funds in the Hong Kong Stock Connect show significant divergence from the other three types of institutions in software services, information technology equipment, and dividend sectors, only reaching a consensus with Chinese-funded intermediaries and local Hong Kong intermediaries in the professional retail industry

In terms of individual stocks, looking at the top ten stocks with net inflows from four types of institutions:

Southbound funds continue the "dumbbell" allocation strategy. From April 8 to June 9, the Hong Kong Stock Connect mainly increased positions in Meituan-W, China Construction Bank, Alibaba-W, Bank of China, and China Merchants Bank, while there was significant net outflow from Tencent Holdings, Xiaomi Group-W, SMIC, China Pacific Insurance, and China Resources Beer.

Foreign capital significantly favors technology and consumer companies with distinctive business models, reducing holdings in the dividend sector, with some differentiation in pharmaceuticals. From April 8 to June 9, international intermediaries mainly increased positions in Tencent Holdings, Xiaomi Group-W, Zhenjiu Lidu, Hong Kong Exchanges and Clearing, and XPeng, while there was net outflow from Meituan-W, Alibaba-W, China Construction Bank, CNOOC, and China Shenhua.

Chinese intermediaries mainly net inflow into technology stocks like Alibaba, reducing positions in the financial sector. From April 8 to June 9, Chinese intermediaries mainly increased positions in Alibaba-W, Lenovo Group, Meituan-W, SMIC, and Suoteng Juchuang, while there was net outflow from CITIC Securities, Zhenjiu Lidu, Hong Kong Exchanges and Clearing, Tencent Holdings, and HSBC Holdings.

Hong Kong local intermediaries also primarily increased positions in technology stocks like Alibaba and reduced positions in the financial sector. From April 8 to June 9, Hong Kong local intermediaries mainly increased positions in Alibaba-W, BYD Company, SMIC, JD Group-SW, and Xiaomi Group-W, while there was net outflow from Hong Kong Exchanges and Clearing, HSBC Holdings, Tencent Holdings, Agricultural Bank of China, and China Mobile.

Author of this article: Zhang Qiyao, Source: Yao Wang Hou Shi, Original Title: "How is the recent capital inflow structure of Hong Kong stocks? [Zhang Qiyao Team, Xingzheng Strategy]"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk