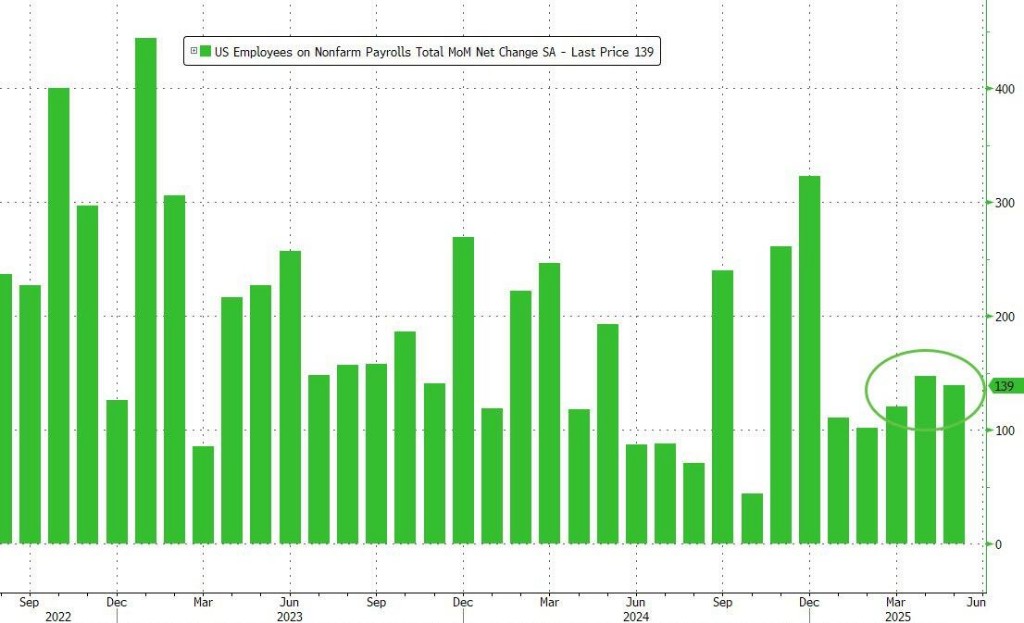

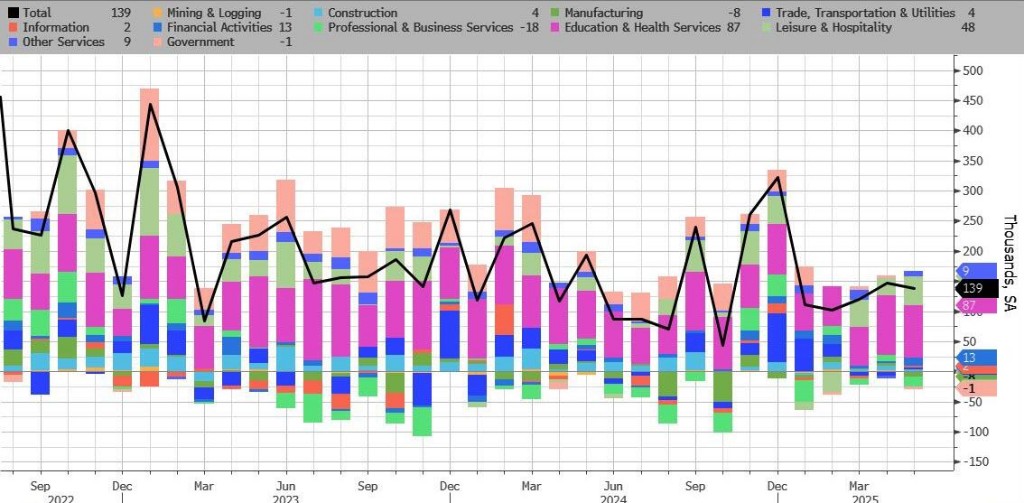

In May, the U.S. non-farm payrolls increased by 139,000, hitting a new low since February, with the data for the previous two months significantly revised down by 95,000, and the unemployment rate at 4.2%

5 月新增非農就業 13.9 萬人,超出市場預期,但前值和 3 月數據被合計下調 9.5 萬人,這一修正幅度足以抵消表面上的積極表現。儘管工資意外增長,但勞動力總量卻在萎縮。“新美聯儲通訊社” 表示,放大看,美國失業率其實在走高。

美國 5 月非農數據勉強過關,但 “魔鬼” 藏在修正值裏,多項指標揭示勞動力市場潛在疲軟。

6 月 6 日,美國勞工統計局公佈的數據顯示,就業人數增加 13.9 萬人,雖然創 2 月以來新低,但略高於市場預期的 12.6 萬人。然而,前兩個月的就業數據被合計下調 9.5 萬人,這一修正幅度足以抵消表面上的積極表現。

- 美國 5 月非農就業人口增加 13.9 萬人,預期 12.6 萬人。

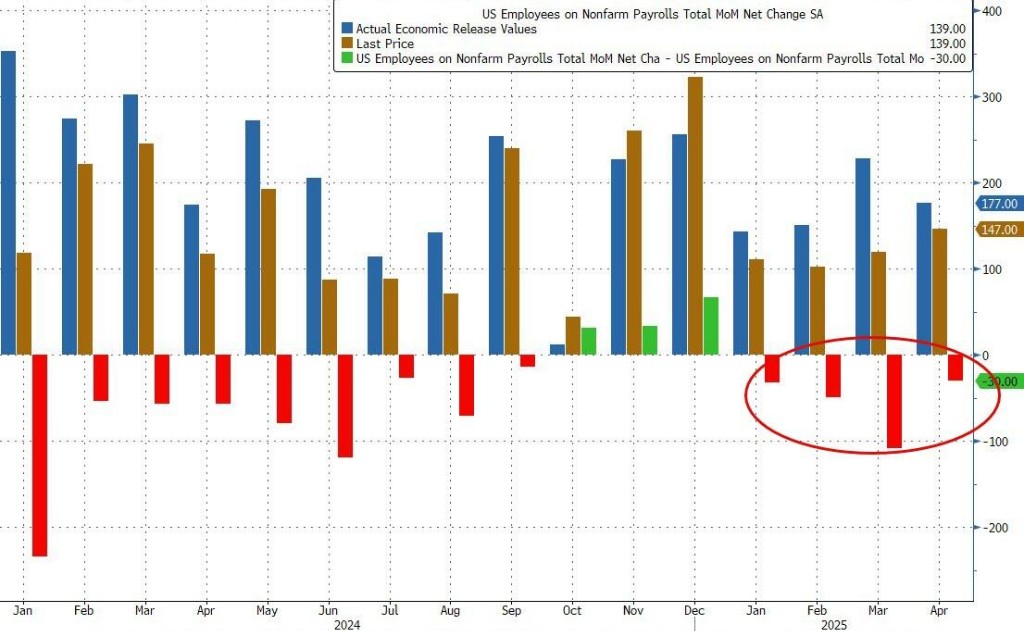

- 然而,4 月數據從 17.7 萬下調至 14.7 萬,降幅達 3 萬;3 月更是從 18.5 萬大幅下調至 12 萬,降幅高達 6.5 萬。

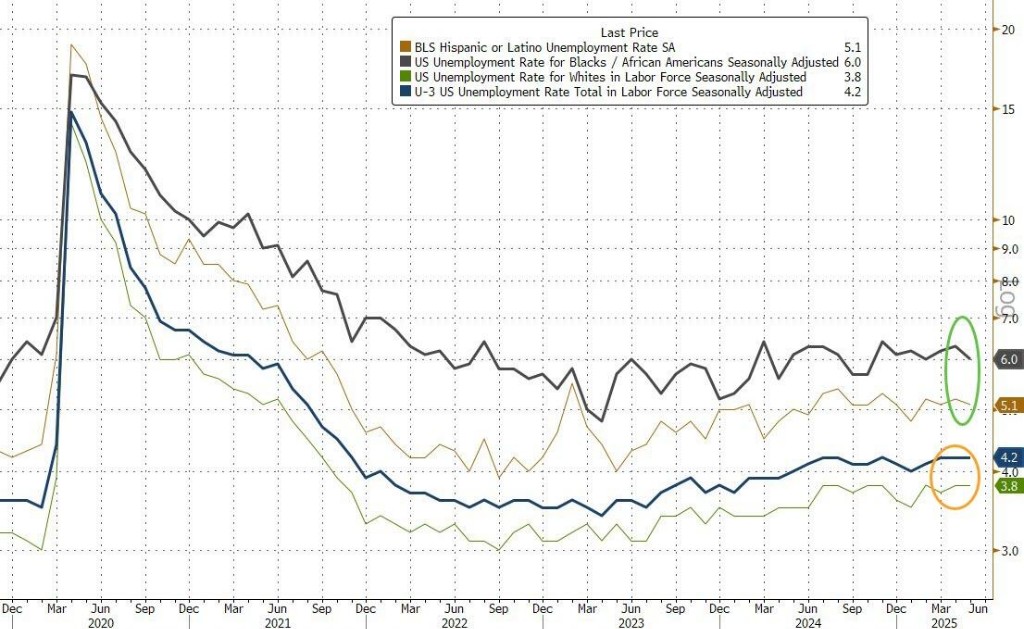

- 美國 5 月失業率 4.2%,預期 4.2%,前值 4.2%。

非農數據部分緩解了市場對企業快速削減就業的擔憂。此前,面對關税帶來的更高成本以及經濟活動放緩的前景,企業界普遍表現出謹慎態度。

數據公佈後,交易員下調對年內美聯儲降息兩次的押注。

失業率保持穩定,工資意外增長,勞動力卻在萎縮

表面上看,5 月失業率維持在 4.2%,符合市場預期,自 2024 年 5 月以來一直在 4.0% 至 4.2% 的狹窄區間內波動。失業人數 720 萬,月度變化微乎其微。

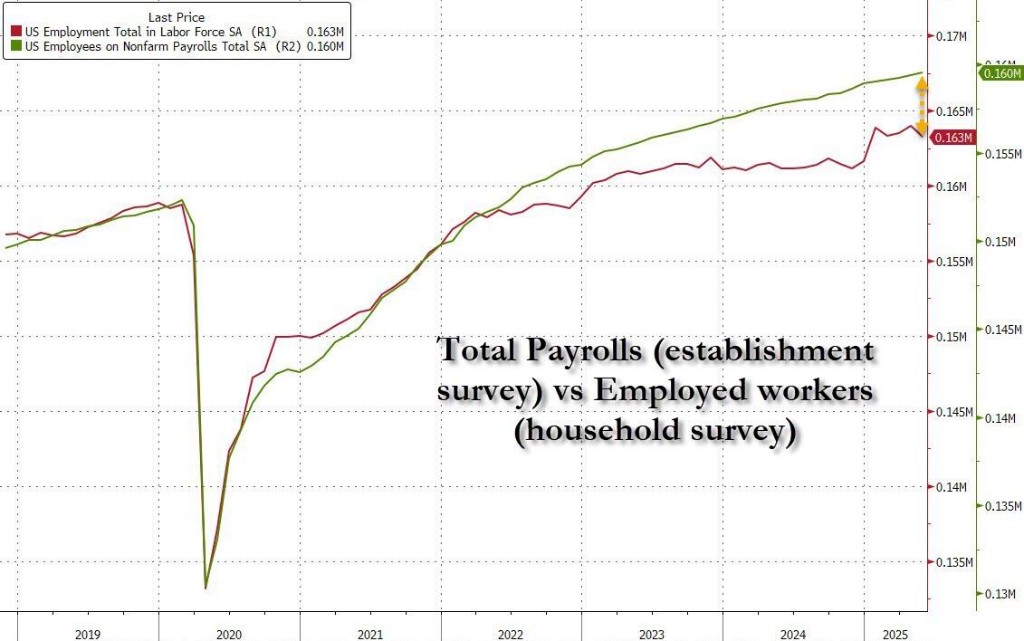

但這種"穩定"的代價是勞動力總量的萎縮。勞動力隊伍從 1.711 億下降至 1.705 億,減少約 60 萬人。家庭調查顯示就業人數暴跌 69.6 萬,而企業調查卻顯示就業增長——這種調查方法間的巨大分歧再次浮現,暴露出勞動力市場統計的內在矛盾。

在經濟放緩的背景下,工資數據反而展現出意外的韌性。5 月平均時薪環比增長 0.4%,是預期 0.2% 的兩倍,同比增幅 3.9% 也超出 3.7% 的預期。私營非農部門員工平均時薪達到 36.24 美元。

然而,這種工資增長更多反映的是勞動力供給端的收緊,而非需求端的強勁。報告顯示,全職就業崗位減少 62.3 萬個,而兼職崗位僅增加 3.3 萬個,這表明企業可能正在通過減少用工時間來應對經濟不確定性,而不是大規模招聘。

此外,美國 5 月勞動參與率跌至三個月低點 62.4%,環比下降 0.2 個百分點。25-54 歲核心勞動力參與率同樣下降。因經濟原因從事兼職工作的人數仍維持在 460 萬左右,這些員工本希望從事全職工作,但因工時縮減或無法找到全職崗位而被迫兼職。

紐約聯儲本週的研究顯示,隨着本地企業開始應對特朗普貿易政策帶來的更高成本,"有跡象表明關税的急劇快速上升影響了就業水平和資本投資"。

製造業亮起紅燈,聯邦政府大幅裁員

受關税衝擊更為直接的行業已經閃現警示信號——製造業就業崗位減少 8000 個,創今年最大降幅。運輸和倉儲業就業增長微弱,此前連續兩個月下滑。

聯邦政府 5 月裁員 2.2 萬人,創 2020 年以來最高紀錄。自 1 月以來累計減少了 5.9 萬人。經濟學家警告,隨着聯邦支出削減波及承包商、大學和其他依賴公共資金的機構,至少 50 萬個美國就業崗位可能面臨威脅。

相比之下,醫療保健領域 5 月新增就業 6.2 萬人,高於過去 12 個月的月均增幅。休閒和酒店業就業持續增長 4.8 萬人,主要得益於餐飲服務業的推動。社會援助領域就業也繼續呈現增長趨勢。

其他主要行業,包括採礦、建築、製造業、批發貿易、零售貿易、運輸和倉儲、信息、金融活動、專業和商業服務以及其他服務業的就業人數月度變化不大。

本土出生工人就業人數下降 44.4 萬,外國出生工人也減少 22.4 萬,顯示勞動力市場的收縮正在全面展開。

“新美聯儲通訊社” Nick Timiraos:放大看,美國失業率其實在走高

“新美聯儲通訊社” Nick Timiraos 發文稱,從未經四捨五入的數據看,5 月的失業率從 4 月份的 4.187% 上升至 4.244%。去年失業率的最高值出現在 2024 年 11 月,為 4.231%。

可以説,美國 5 月失業率是自 2021 年 10 月(當時為 4.500%)以來的最高水平(未經四捨五入)。

惠譽評級(Fitch Ratings)美國經濟研究主管奧盧·索諾拉 Olu Sonola 表示:

“綜合考慮,這是一份不錯的就業報告。勞動力市場繼續穩步放緩,但天並沒有塌下來。鑑於貿易政策不確定性的背景,美聯儲將對這份報告感到寬慰。關税形勢仍然非常不確定,美聯儲的謹慎立場將持續數月——可能持續到 9 月或 10 月。未來的通脹軌跡仍然是使美聯儲受到限制的最重要風險,而有彈性的勞動力市場進一步鞏固了他們的觀望態度。

市場反應

美元指數短線拉昇約 10 點,現報 99.15。

美股期貨短線拉昇,納斯達克 100 指數期貨漲 0.8%。美國 10 年期國債收益率短線拉昇,現報 4.407%。

現貨黃金短線走低約 5 美元,現報 3351.75 美元/盎司。

更多消息,持續更新中……