Trump's tariffs "halted," Asian stock markets surged collectively, U.S. stock futures rose, the dollar increased, and gold plummeted

財報後百思買跌超 7%、C3.ai 漲近 21%、戴爾盤後一度漲超 9%;中概指數漲超 1% 終結七連跌,京東漲超 4%。特朗普政府擬為關税裁決打到最高院,美債收益率加速下行,美元指數跌幅擴大,期金一度漲近 2%。原油盤中轉跌,美油一度跌超 2%。

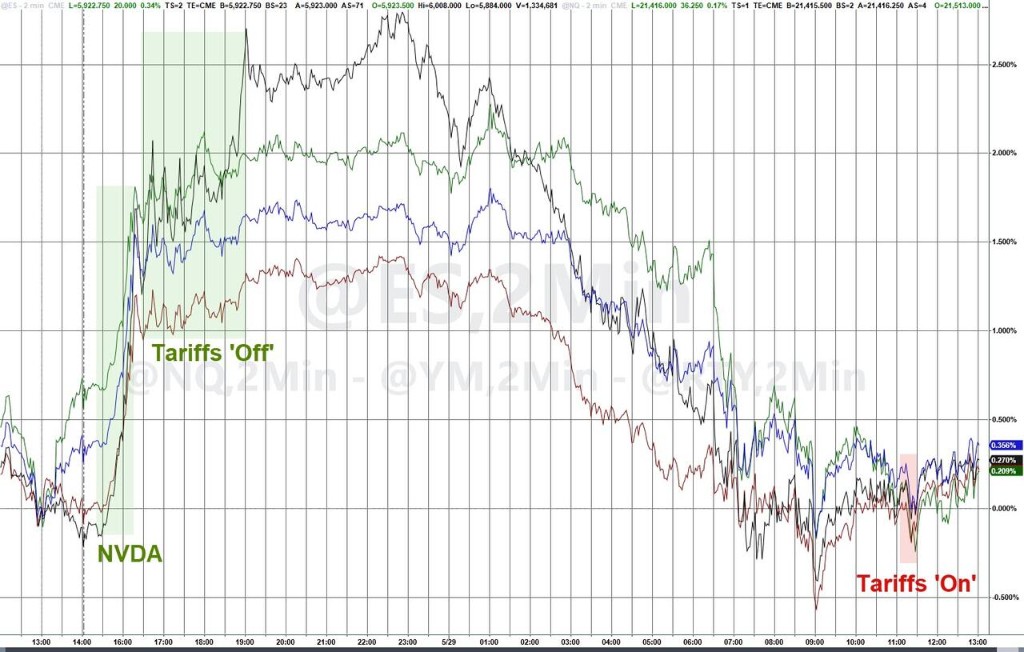

貿易政策混亂限制美股漲幅,標普指數盤中曾短線轉跌。科技七巨頭漲跌不一,英偉達一季度強勁財報支撐股價收漲。特朗普政府擬為關税裁決打到最高院,關税前景不明,投資者保持謹慎。美債收益率加速下行,美元指數衝高後轉跌,黃金、日元和瑞郎等避險品種走強。

美股早盤,儘管美國宏觀數據疲軟,但前一日英偉達強勁財報提振樂觀情緒,美股科技、芯片板塊盤初走高,帶動美股三大指數齊漲。納指盤初漲約 1.5% 領漲,英偉達一度漲超 6%,特斯拉盤初漲超 3%。

特朗普政府在週三美國國際貿易法院判決後迅速提交了上訴通知,上訴法院於週四下午恢復了徵税。特朗普政府表示,如有必要,最早可能於週五向最高法院請求暫停聯邦法院的原裁決。關税前景不明壓制美股反彈,標普指數盤中轉跌,道指跌幅一度擴大至 0.6%。美債收益率加速下行,美元指數跌幅擴大。

美股午盤,7 年期國債拍賣 最終得標利率 4.194%,投標倍數 2.69 較此前有所增長。7 年期國債收益率跌至兩週低點。

美股盤後,戴爾公佈業績,一季度 AI 服務器積壓幾乎是市場預估的兩倍,二季度指引也超預期,盤後股價拉昇一度漲超 5%。

週四美股三大指數收漲,科技七巨頭多數上漲,英偉達盤初漲超 6% 後小幅回落,Q1 業績表現亮眼。財報後百思買跌超 7%、C3.ai 漲近 21%、戴爾盤後一度漲超 5%。中概指數漲超 1% 終結七連跌,熱門中概股普漲,京東漲超 4%,小鵬汽車一度漲超 5%。

美股基準股指:

標普 500 指數收漲 23.62 點,漲幅 0.40%,報 5912.17 點。

道瓊斯工業平均指數收漲 117.03 點,漲幅 0.28%,報 42215.73 點。

納指收漲 74.93 點,漲幅 0.39%,報 19175.87 點。納斯達克 100 指數收漲 45.78 點,漲幅 0.22%,報 21363.95 點。

羅素 2000 指數收漲 0.34%,報 2074.78 點。

恐慌指數 VIX 收跌 0.67%,報 19.18。

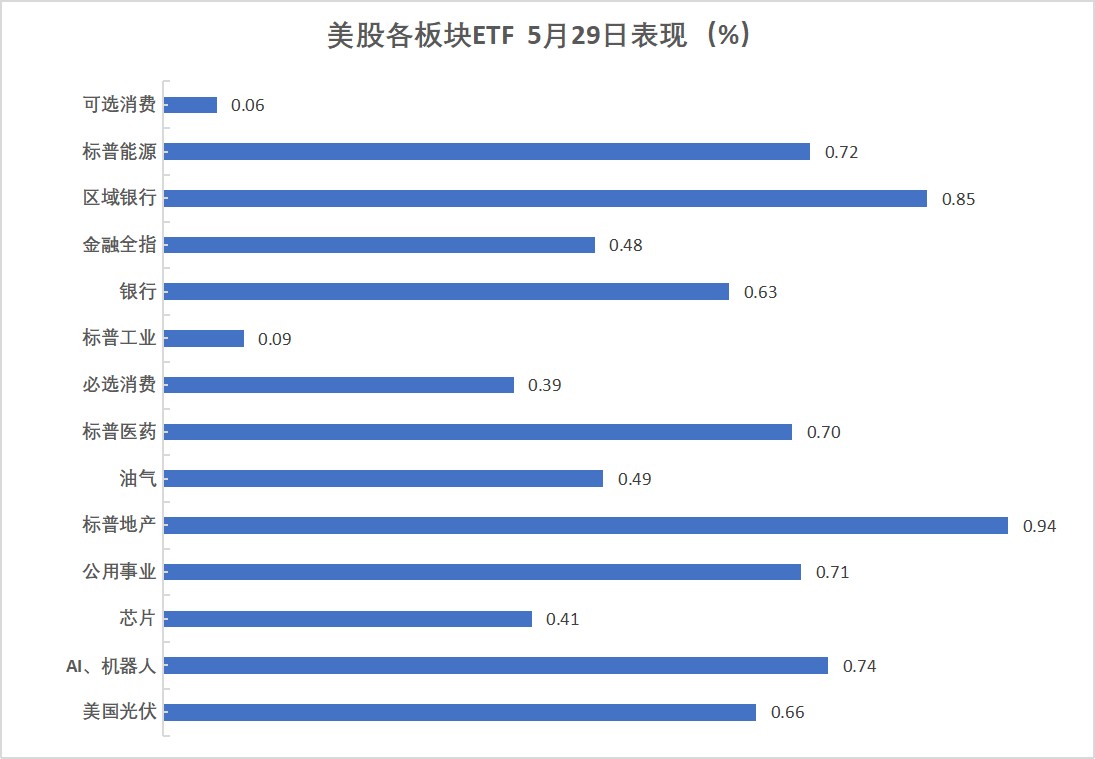

美股行業 ETF:

標普地產收漲 0.94%,領漲美股各行業板塊。

區域銀行收漲 0.85%,ai 機器人收漲 0.74%,標普能源收漲 0.72%。

“科技七姐妹”:

美國科技股七巨頭(Magnificent 7)ETF 收漲 0.61%。

英偉達收漲 3.25%,亞馬遜漲 0.48%,特斯拉漲 0.43%,微軟漲 0.29%,Meta Platforms 漲 0.23%,蘋果公司收跌 0.23%,谷歌 A 跌 0.29%。

AI 概念股:

Applovin 收跌 1.55%,Tempus AI 收漲 2.31%。

中概股:

納斯達克金龍中國指數收漲 1.44%,報 7226.88 點。

熱門中概股京東收漲 4.2%,小鵬漲 4%,新東方漲 3.5%,理想漲 2.3%,百度漲 1.5%。

其他重點個股中:

戴爾一季度 AI 服務器積壓幾乎是市場預估的兩倍,二季度指引也超預期,盤後股價一度漲超 9%。

財報後百思買跌超 7%、C3.ai 漲近 21%

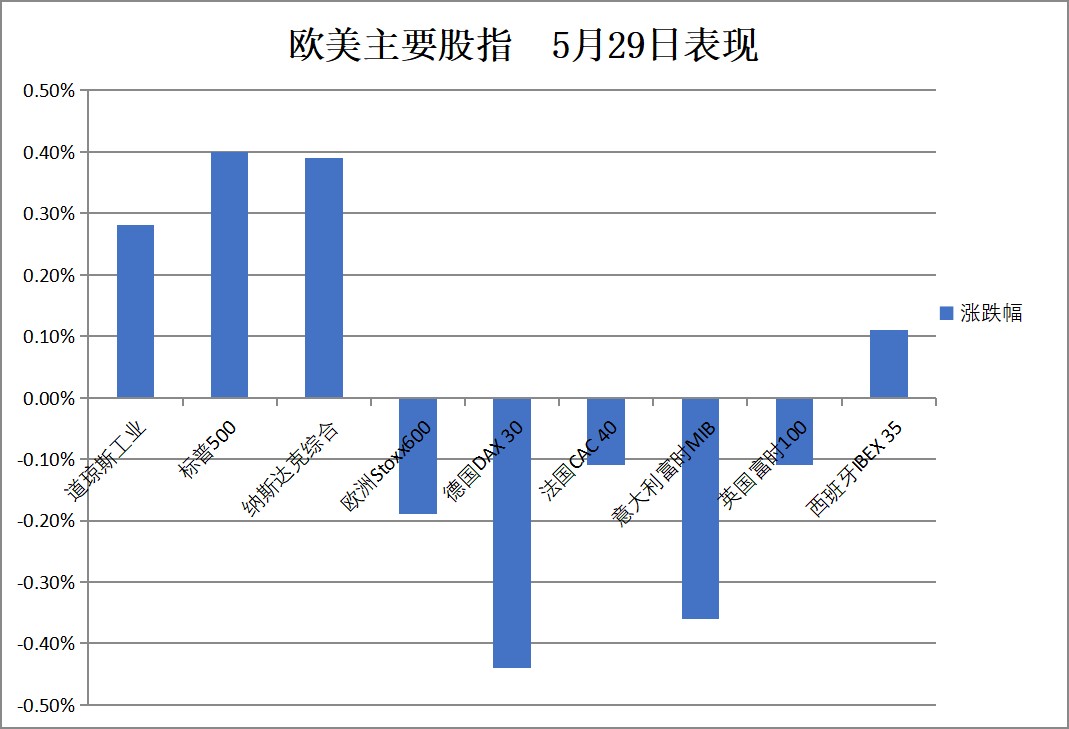

歐股呈現衝高回落走勢。泛歐股指收跌,富時泛歐績優 300 指數收跌 0.22%,報 2171.39 點。德國股指收跌超 0.4%。

泛歐歐股:

歐洲 STOXX 600 指數收跌 0.19%,報 547.88 點。

歐元區 STOXX 50 指數收跌 0.14%,報 5371.10 點。

各國股指收漲:

德國 DAX 30 指數收跌 0.44%,報 23933.23 點。

法國 CAC 40 指數收跌 0.11%,報 7779.72 點。

英國富時 100 指數收跌 0.11%,報 8716.45 點。

板塊和個股:

歐元區藍籌股中,西門子收跌 2.25%,寶馬跌 1.58% 表現倒數第二,裕信銀行跌 0.88%、德國大眾汽車跌 0.75% 表現較差。

歐洲 STOXX 600 指數的所有成分股中,Auto Trader 集團收跌 11.27%,蒂森克虜伯跌 5.47%,贏創工業集團跌 4.85% 跌幅第三大。

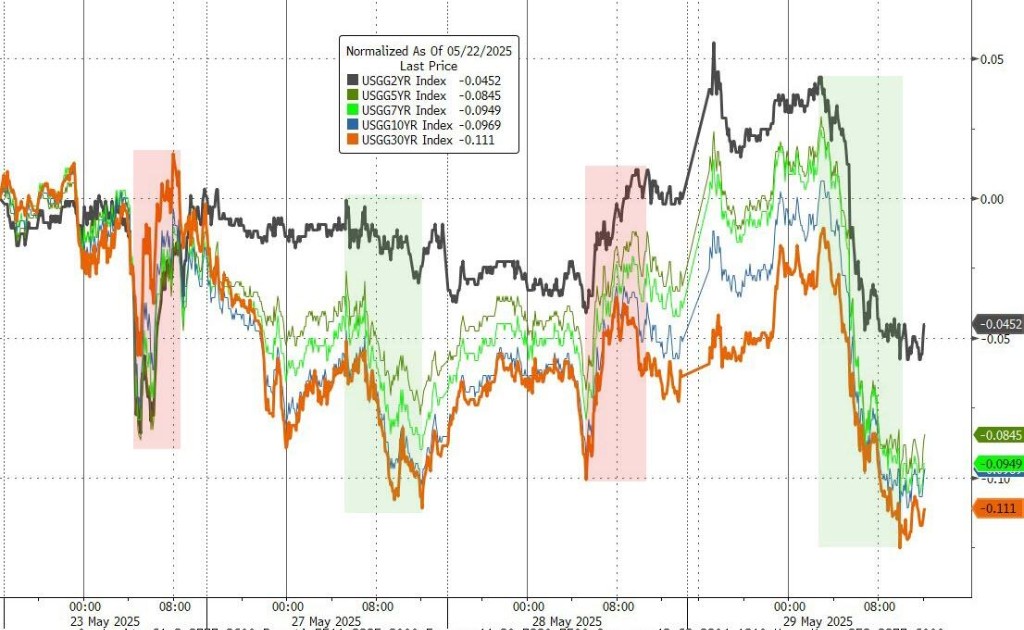

特朗普政府請求上訴法院暫停美國貿易法庭的關税裁決。美國政府表示,可能會在週五要求最高法院維持關税不變。美債收益率全線跌幅擴大,美國 10 年期國債收益率跌超 4.9 個基點,刷新日低。

美債:

紐約尾盤,美國 10 年期基準國債收益率跌 5.93 個基點,報 4.4180%,日內交投於 4.5370%-4.4121% 區間。

兩年期美債收益率跌 5.35 個基點,報 3.9386%,日內交投於 4.0478%-3.9324% 區間。

歐債:

歐市尾盤,德國 10 年期國債收益率下跌 4.6 個基點,刷新日低至 2.508%。

兩年期德債收益率跌 3.0 個基點,刷新日低至 1.767%,美國貿易法庭否決總統特朗普的關税政策之後 “跳空高開”;30 年期德債收益率跌 4.4 個基點,刷新日低至 2.987%。

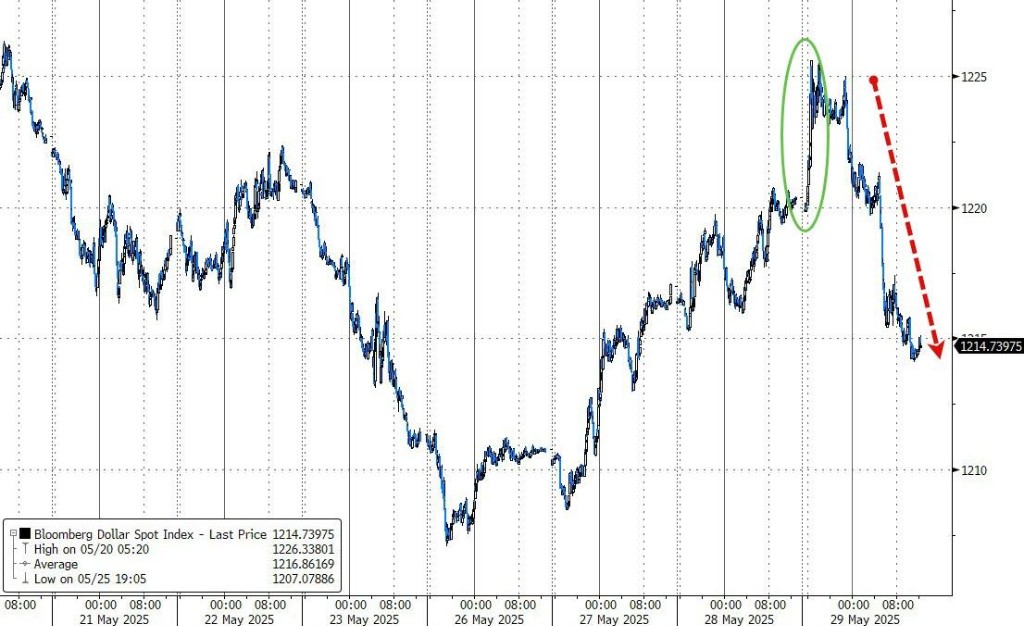

週三美國貿易法庭判決總統特朗普的關税政策無效後,美元指數一度回升至 100 關口上方。但隨着上訴法院判決恢復了徵税,貿易前景的不確定性打壓美元走勢,日內倒 V 反轉。美元疲軟背景下,非美貨幣普漲。

美元:

紐約尾盤,ICE 美元指數跌超 0.6%,刷新日低至 99.217 點,美國貿易法庭判決總統特朗普的關税政策之後,北京時間 09:04 還曾漲至 100.481 點刷新日高。

彭博美元指數跌 0.5%,刷新日低至 1214.11 點,07:44 也曾漲至 1225.58 點刷新日高。

非美貨幣:

紐約尾盤,歐元兑美元漲 0.66%,報 1.1369。

英鎊兑美元上漲 0.16%,至 1.3492。

美元兑瑞郎日內下跌 0.55%,至 0.8228。

美元兑日元跌 0.47%,報 144.136 日元。

離岸人民幣:

紐約尾盤,離岸人民幣兑美元報 7.1876 元,較週三紐約尾盤漲 49 點,日內整體交投於 7.2087-7.1826 元區間。

加密貨幣:

紐約尾盤,CME 比特幣期貨 BTC 主力合約較週三紐約尾盤跌 0.76%,報 10.6 萬美元。

CME 以太幣期貨 DCR 主力合約漲 0.25%,報 2642.00 美元,北京時間 10:32 曾漲至 2791.00 美元。

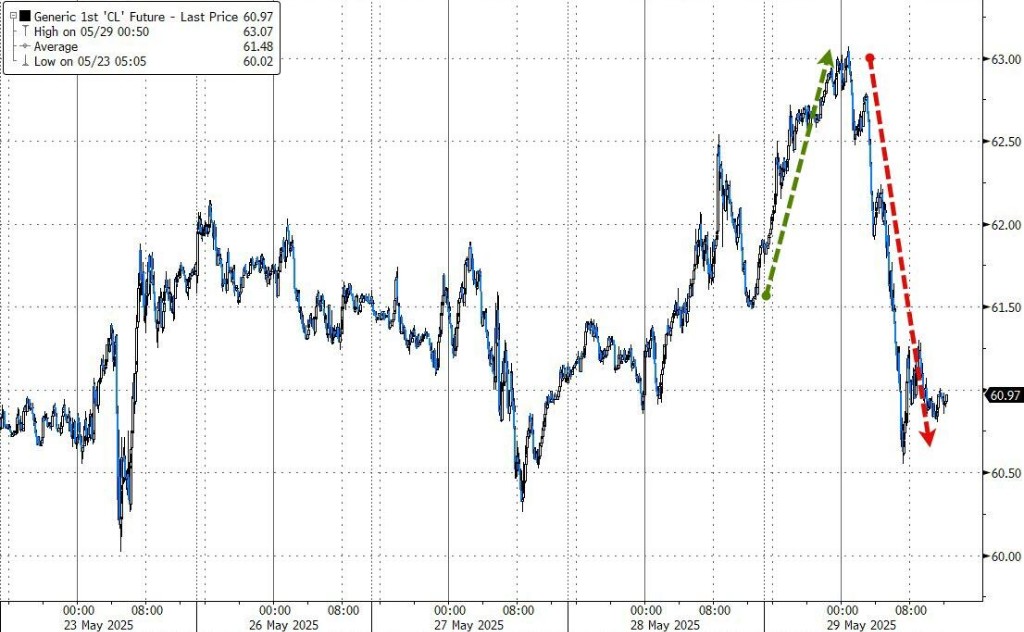

油價也一度因 “關税結束” 而上漲,然後因疲軟的數據和避險情緒拖累市場而回落。此外,哈薩克斯坦能源部副部長 Alibek Zhamauov 稱,OPEC+ 將在週六會議上宣佈再次增產石油。美國原油期貨收跌超 1.4%,紐約天然氣也跌將近 1%。

原油:

WTI 7 月原油期貨收跌 0.90 美元,跌幅超過 1.45%,報 60.94 美元/桶。

布倫特 7 月原油期貨收跌 0.75 美元,跌幅超過 1.15%,報 64.15 美元/桶。

天然氣:

NYMEX 7 月天然氣期貨收跌 0.98%,報 3.5220 美元/百萬英熱單位。

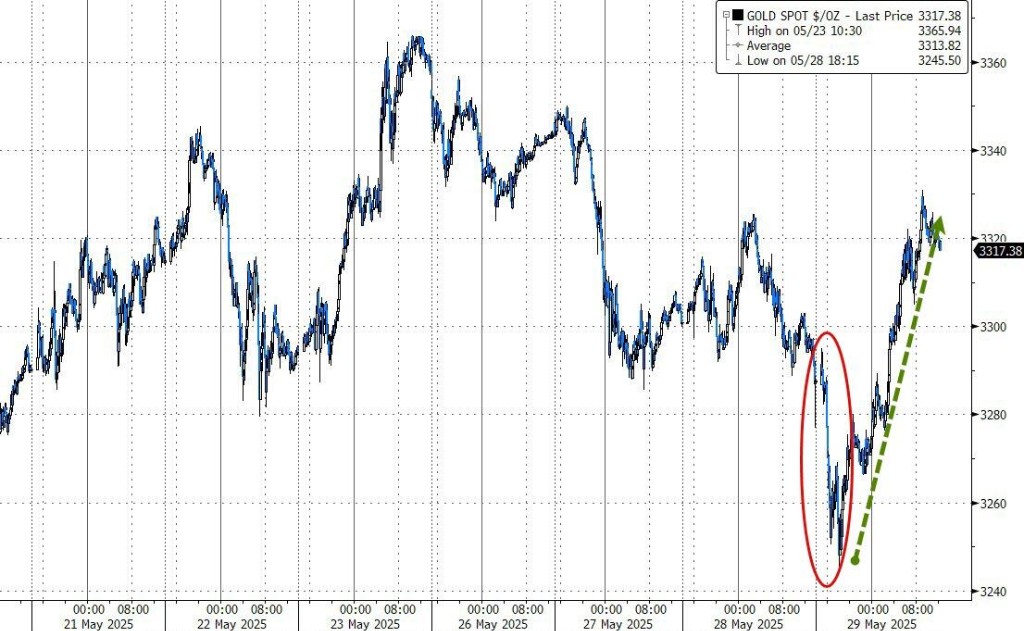

避險情緒疊加疲軟美元,現貨黃金漲超 0.9%,一度突破 3330 美元。倫鉛和倫錫收跌超 1%,倫鎳則漲約 2%。

黃金:

紐約尾盤,現貨黃金漲 0.92%,報 3317.94 美元/盎司,北京時間 09:19 跌至 3245.50 美元刷新日低,隨後持續上行。

COMEX 黃金期貨漲 0.60%,報 3314.60 美元/盎司,日內交投區間為 3242.40-3328.80 美元。

白銀:

紐約尾盤,現貨白銀漲 1.00%,報 33.3148 美元/盎司,日內交投區間為 32.6990-33.5037 美元。

COMEX 白銀期貨漲 0.84%,報 33.440 美元/盎司。

其他金屬:

紐約尾盤,COMEX 銅期貨跌 0.35%,報 4.6695 美元/磅。

LME 期銅收漲 3 美元,報 9568 美元/噸。LME 期鋁收跌 18 美元,報 2450 美元/噸。

LME 期錫收跌 400 美元,報 31236 美元/噸。LME 期鎳收漲 365 美元,報 15376 美元/噸。