Zhitong Decision Reference | Consumer Electronics Faces Headwinds, Pharmaceuticals and Gold May Remain Active

Hong Kong stocks have ample liquidity, and external market instability may reinforce the overweight of Hong Kong stocks in dollar assets. Consumer electronics are affected by tariffs, while pharmaceuticals and gold may remain active. Trump's announcement of tariffs on the EU and mobile phone manufacturers may increase pressure on US stocks. The Federal Reserve will release the minutes of its monetary policy meeting; if they lean hawkish, the market will be under pressure. Nuclear energy, environmental protection, and photovoltaic stocks are boosted by new policies, and chip stocks will also benefit. The index adjustments by MSCI, effective May 30, are worth paying attention to

[Editor’s Market View]

The overall external market is in a turbulent phase, but interest rate cuts provide a hedge, and Contemporary Amperex Technology Co., Limited (03750) has been warmly welcomed upon listing, boosting market confidence. The Hang Seng Index continued to rise last week.

Over the weekend, negative news about the tariff war emerged again, with Trump stating that a 50% tariff will be imposed on the EU starting June 1, and a 25% tariff on mobile phone manufacturers not producing in the U.S. Tariffs will be imposed on Apple and Samsung before the end of June. Trump mentioned that if Apple and Samsung build factories in the U.S., they will be exempt from tariffs. This news is negative for consumer electronics.

This week marks the last week of May, and market changes are likely at the end of the month. On Monday, Federal Reserve Chairman Jerome Powell will deliver a commencement speech at Princeton University. On Thursday, the Federal Reserve will release the minutes from the May monetary policy meeting. If the tone is hawkish, pressure on U.S. stocks will intensify.

Considering the pressure from U.S. Treasury bonds in June, it is expected that funds will seek safety in advance. Pharmaceuticals and gold may remain active.

In terms of hot topics, the recent State Council meeting reviewed and approved the "Action Plan for Green and Low-Carbon Development of the Manufacturing Industry (2025-2027)."

Trump announced a new nuclear power policy, aiming to start the construction of 10 large nuclear power plants before 2030 and quadruple U.S. nuclear power capacity by 2050. This will provide a boost to nuclear energy, environmental protection, and photovoltaic sectors.

According to CCTV reports, the Harmony OS folding computer uses the self-controlled 5nm Kirin X90 chip. This is favorable for chip-related stocks.

The domestic sci-fi animation "Ling Cage" Season 2 has been exclusively launched on Bilibili (09626), produced jointly by the well-known domestic animation team Yihua Kaitian and Bilibili. Only 2 episodes have been released so far, with views nearing 80 million.

Recently, MSCI announced the results of the May index review, with adjustments taking effect after the market closes on May 30. Selected varieties are worth paying attention to.

[This Week's Golden Stock]

China General Nuclear Power Corporation (01164)

On Friday, Eastern Time, U.S. President Donald Trump signed an executive order to promote the development of the U.S. nuclear power industry, causing related company stock prices to soar. The executive order requires the U.S. Nuclear Regulatory Commission to reduce regulatory measures and expedite the approval of new reactors and nuclear power plant licenses. The order also aims to revitalize U.S. uranium production and enrichment to meet the surging electricity demand.

China General Nuclear Power Corporation is expected to achieve a revenue of 8.624 billion yuan in 2024, a year-on-year increase of 17.05%; achieve a pre-tax profit of 814 million yuan, a year-on-year increase of 48.3%; and achieve a net profit attributable to shareholders of 342 million Hong Kong dollars, a year-on-year decrease of 31.2%.

In 2024, the company’s self-produced and traded uranium amounted to 1,294tU, remaining basically flat compared to the previous year, with an average selling price of $75.04/lbU3O8 and an average selling cost of $80.80/lbU3O8.

The actual uranium extraction by the company was 976tU, with a total production of 964tU after deducting processing losses, including 407tU produced from the Xie Mine, with a production cost of $32/lbU3O8; and 569tU produced from the Yi Mine, with a production cost of $24/lbU3O8. The actual uranium extraction by the Ao Company was 1,783tU, with a total production of 1,739tU after deducting processing losses, including 1,663tU produced from the Zhong Mine, with a production cost of $22/lbU3O8; and 120tU produced from the Zha Mine, with a production cost of $31/lbU3O8 The average production cost of uranium mines is $24/lb U3O8, an increase of $4/lb U3O8 year-on-year, mainly due to the increase in raw material prices caused by the supply gap of sulfuric acid, as well as the increase in underground resource usage tax due to rising sales prices.

【Industry Observation】

The progress of the AI industry is accelerating, and the commercialization of Agents will speed up. The Google I/O conference will be held, updating the Gemini 2.5 series models, with significant upgrades to Agent intelligence; Anthropic has released the Claude 4 model and launched the Claude Code coding tool; both Google's and Anthropic's foundational large models have made significant breakthroughs in key capabilities such as coding and reasoning, which will promote the application of Agents in various professional fields. In addition, Microsoft released more than 10 agents at the Build 2025 conference. The year 2025 is expected to be a major year for agents, with domestic and foreign tech giants actively promoting the implementation of Agents in various fields.

Furthermore, Huawei's chain is intensively catalyzing, with HarmonyOS and Ascend reaching a significant turning point. The HarmonyOS PC has been officially released, completing a key puzzle in the HarmonyOS ecosystem: Huawei's HarmonyOS PC has officially launched (mass production of the 5nm Kirin X90 chip), marking a new breakthrough for open-source HarmonyOS in the consumer sector. The year 2025 is expected to be a major year for agents, with domestic and foreign tech giants actively promoting the implementation of Agents in various fields. In the future, Huawei's HarmonyOS consumer terminals will work together with open-source HarmonyOS industry terminals to form a unified ecosystem of interconnectivity. DeepKaihong has released the first desktop operating system based on open-source HarmonyOS, KaihongOs desktop version, which can run on X86 devices, and has launched the open-source Jimon computer Kaihong Bot series products aimed at open-source HarmonyOS developers. The potential market space for HarmonyOS PCs is large, with the total annual market shipment volume of PCs in mainland China in 2024 estimated at about 40 million units (Lenovo 13.7 million units, Huawei 4.3 million units), and the total number of Xinchuang PCs is about 15 million units. The Hong Robot also has new developments, with DeepKaihong releasing the first open-source HarmonyOS robot operating system, M-Robots OS (the brain of the robot).

Key stocks to watch in Hong Kong include Huawei supply chain company China Software International (00354), as well as leading companies in AI, cloud computing, and domestic Xinchuang in Hong Kong, Weishi Jiajie (00856).

【Data Monitoring】

According to data released by the Hong Kong Stock Exchange, the total number of open contracts for the Hang Seng Index futures (May) is 101,082, with a net open position of 34,435 contracts. The settlement date for the Hang Seng Index futures is May 29, 2024, for this period's index settlement.

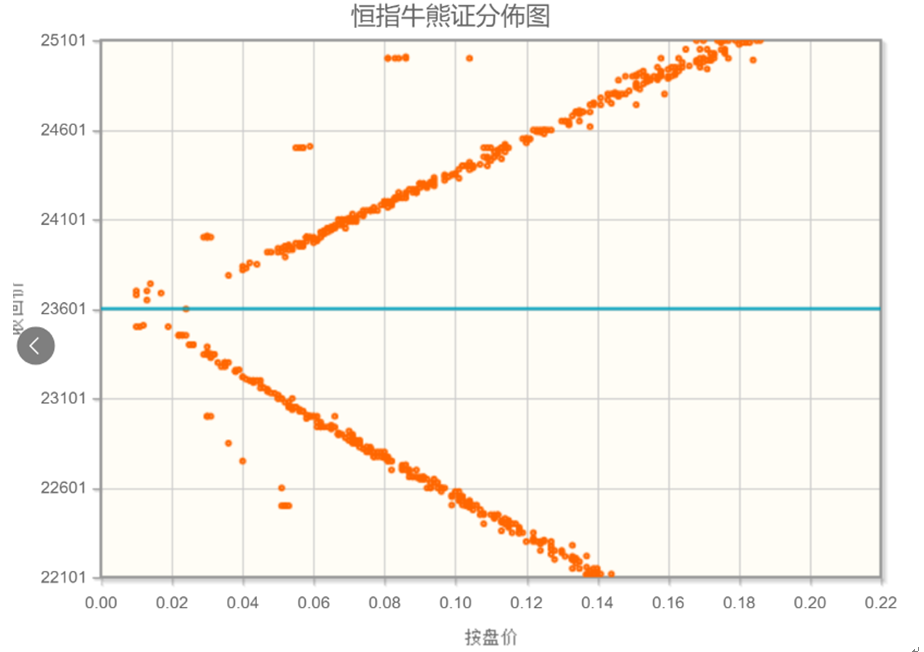

Last week, the long-term bond markets in Japan and the United States plummeted, raising concerns about rising funding costs. Japan has over 1,000 trillion yen in net assets overseas, and part of this capital returning could impact global financial markets. U.S. Treasury bonds are the anchor for funds, which may affect all asset types in all countries. From the distribution of bull and bear certificates at the 23,601 point level of the Hang Seng Index, the dense area of bull and bear certificates is close to the central axis, indicating hesitation in the Hong Kong stock market, with a bearish outlook for the Hang Seng Index this week.

[Editor's Note]

Currently, the liquidity in the Hong Kong stock market remains abundant. Despite the rising U.S. Treasury yields, the strong demand for Hong Kong dollars has prompted the Hong Kong Monetary Authority to release a large amount of liquidity, effectively hedging against overseas interest rate pressures. Moreover, the correlation between Hong Kong stocks and U.S. stocks has weakened, and the instability in external markets may further solidify the position of Hong Kong stocks in holding an overweight of U.S. dollar assets. In the medium term, a relatively optimistic outlook can still be maintained