How does the surge in overseas long-term interest rates affect the Hong Kong stock market?

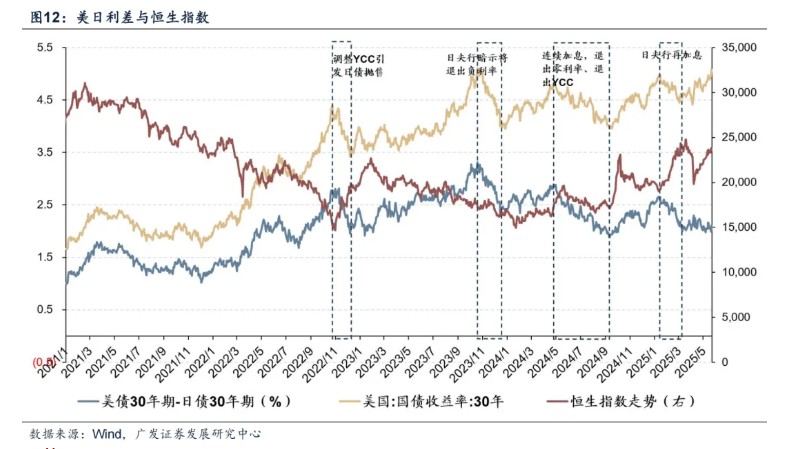

The impact of soaring overseas long-term interest rates on the Hong Kong stock market is mainly reflected in the dynamics of the U.S. and Japanese bond markets. The U.S. bond market is facing short-term supply pressure and long-term narratives, with limited room for interest rate cuts expected within the year; Japan's ultra-long bond yields have reached new highs, with inflation and labor market tensions intensifying, leading to rising interest rate expectations. Changes in the bond markets of both countries may result in significant uncertainty for the Hong Kong stock market against the backdrop of a "weak dollar" and "global liquidity withdrawal."

Core Views

U.S. Bond Market: Short-term Supply Pressure and Long-term Narrative

The recent rise in long-term interest rates has outpaced that of short-term rates, with April pricing term premiums and inflation expectations, while May is based on the bond supply-demand contradiction. The subsequent trend of U.S. Treasury rates mainly focuses on:

1. Short-term Fundamentals and Changes in Rate Cut Expectations: Objectively speaking, since April, the pricing logic of U.S. Treasuries has been easily influenced by news. Considering that the pressure from tariffs in the U.S. will gradually manifest, the fundamentals do not support prolonged high interest rates. Currently, the market only prices in 1-2 rate cuts within the year, with limited room for further downward adjustments in rate cut expectations, thus the short-term upside for U.S. Treasuries is limited.

2. Bond Supply Perspective: There is indeed bond supply pressure around Q3, which will exert some pressure on U.S. Treasury rates, but theoretically, the Federal Reserve has considerable policy hedging space.

3. Finally, the long-term narrative of the U.S. debt issue must return to fundamentals.

Japanese Bond Market: Long-term Rates Hit Record Highs

Last week, the yield on Japan's ultra-long bonds surged significantly, with the 30-year Japanese government bond yield hitting a record high since its issuance in 1999. The recent steep rise in Japanese government bond yields began in 2022 and has been continuously supported by inflation data over the past two years.

From a medium-term market perspective, in addition to the rebound in inflation data and the cooling of bond market trading, the labor market's employment gap also needs attention. Currently, Japan's unemployment rate is at its lowest level since 1995, and the new job openings-to-applicants ratio is at a historical high. With the employment gap, in the 2025 "Shunto" wage negotiations, Japanese companies agreed to an average wage increase of 5.46%, the highest increase in 33 years. Under the "wage-inflation" spiral, the Bank of Japan still has room for interest rate hikes this year.

U.S. and Japanese Bonds Rising Together: Possible Transmission to the Chinese Market

1. Scenario One: Trading "Weak Dollar + Fiscal Expansion" Logic. Historically, during most phases of a weakening dollar index, global equity assets tend to perform strongly. However, this logic is currently being severely impacted by the bond market, facing significant uncertainty.

2. Scenario Two: Trading "Weak Dollar, Carry Trade Liquidation + Global Liquidity Withdrawal" Logic, which is unfavorable for the equity market. Over the past three years, the surge in Japanese bond yields and carry trade liquidation has occurred at least four times, during which the Chinese market performed poorly. If the extreme short-term performance of U.S. Treasuries slows down while Japan continues to maintain expectations for interest rate hikes this year, this mechanism may be triggered again.

3. Scenario Three: Trading "East Rising, West Falling + U.S. Treasury Overflow Funds Flowing to China" Logic. The funds from carry trades returning may not directly purchase Japanese bonds but could also shift towards assets with higher returns or greater safe-haven value. However, an independent market for Hong Kong stocks needs to be built on significantly improved fundamental expectations

Report Body

1. Overseas Long-Term Interest Rates Surge, How It Affects the Hong Kong Stock Market

(1) U.S. Bond Market: Short-Term Supply Pressure and Long-Term Narrative

On May 21, the demand for the U.S. 20-year Treasury bond auction was weak, triggering a surge in the yields of 20 and 30-year U.S. Treasuries, leading to a triple whammy in U.S. stocks, bonds, and currency, affecting global equity markets. The market is concerned that in the second and third quarters, U.S. Treasury yields may trend upwards due to pressures from maturing payments and foreign divestment, resulting in greater volatility in the equity market.

From a pricing mechanism perspective, there are three factors in interest rate pricing: expectations of short-term real interest rates (dependent on expectations of economic growth or monetary policy paths), inflation expectations (long-term inflation expectations of the economy), and term premium (risk compensation for the future, including macro policies, bond supply, etc.).

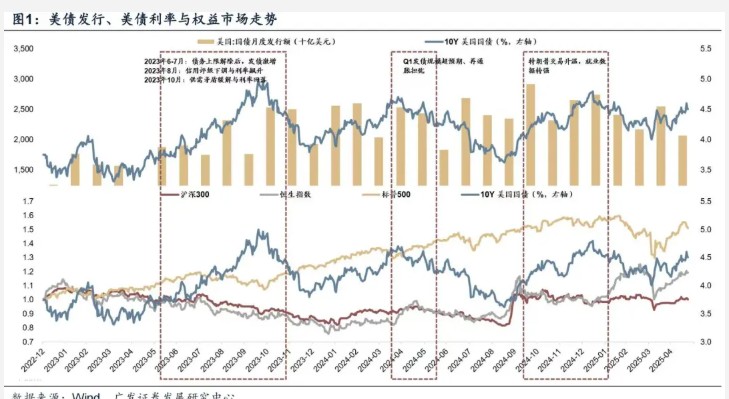

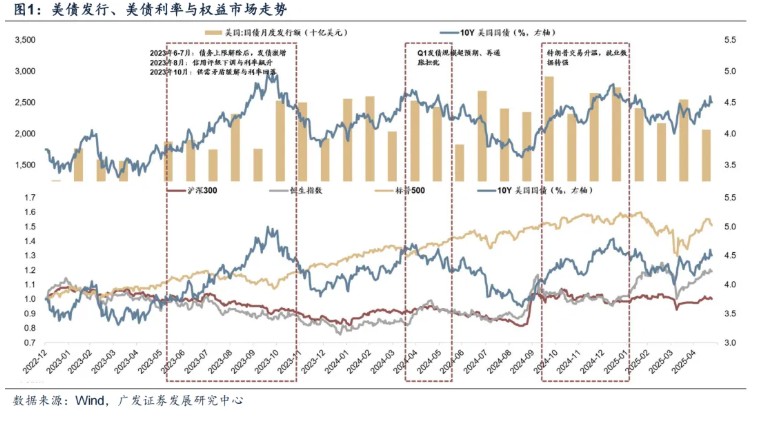

Over the past two years, U.S. Treasury yields have risen due to influences from various levels. For example:

(1) The rise in U.S. Treasury yields in Q3 2023 was mainly influenced by bond supply and demand (surge in bond issuance, Federal Reserve QT) and the increase in real interest rates;

(2) The rise in U.S. Treasury yields in Q1 2024 was mainly influenced by the larger-than-expected bond issuance scale and concerns about re-inflation;

(3) The rise in U.S. Treasury yields in Q3-Q4 2024 was mainly influenced by the cooling of recession trades and rising inflation expectations.

In this round of rising U.S. Treasury yields, the increase in long-term rates is greater than that of short-term rates. In April, under the impact of tariffs, U.S. Treasury yields rose instead, pricing in term premium and inflation expectations, which are liquidity shocks from debt issues, Trump tariffs, and foreign divestment. Since May, it has been more about pricing in subsequent bond supply and demand contradictions, on one hand, foreign divestment, and on the other hand, supply disturbances in Q3, while also being influenced by short-term fundamental resilience, the Federal Reserve's hawkish stance, and continuous downward revisions of interest rate cut expectations.

Objectively speaking, these factors are easily driven by news, even shortening long-term narratives, such as the current impact of the trade war on inflation, the retreat of dollar hegemony, the wave of U.S. Treasury sell-offs, and the significant expansion of deficits brought about by Trump's tax cut plan.

Looking ahead, the trend of U.S. Treasury yields will mainly focus on: first, the short-term fundamentals and changes in interest rate cut expectations; second, bond supply disturbances before and after Q3; third, the long-term narrative of the U.S. debt issue.

First, the game between fundamentals and interest rate cut expectations. Considering that the pressure from tariffs on the U.S. will gradually manifest, the fundamentals do not support high interest rates for an extended period. Currently, the market only prices in 1-2 rate cuts within the year, and there is limited room for further downward revisions of rate cut expectations, so the short-term upward space for U.S. Treasury yields is also relatively limited

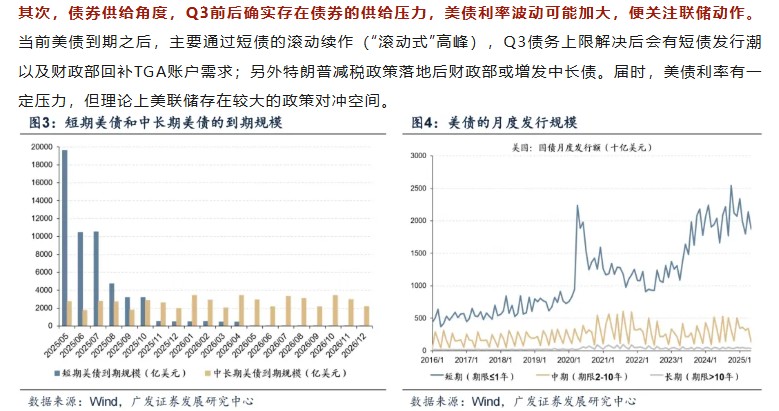

Secondly, from the perspective of bond supply, there is indeed supply pressure on bonds around Q3, and fluctuations in U.S. Treasury yields may increase, so attention should be paid to the Federal Reserve's actions. Currently, after U.S. Treasury bonds mature, they are mainly rolled over through short-term bonds ("rolling" peak). After the debt ceiling issue is resolved in Q3, there will be a wave of short-term bond issuances and a demand for the Treasury to replenish the TGA account; additionally, after the implementation of Trump's tax cut policy, the Treasury may issue more medium- and long-term bonds. At that time, there will be certain pressure on U.S. Treasury yields, but theoretically, the Federal Reserve has considerable policy hedging space.

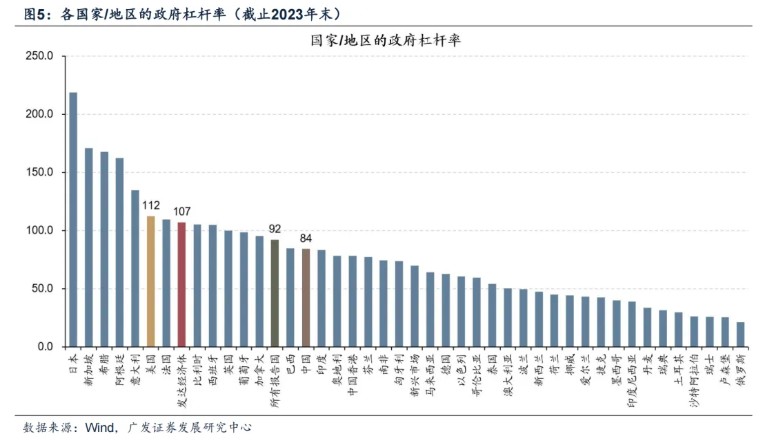

Secondly, from the perspective of bond supply, there is indeed supply pressure on bonds around Q3, and fluctuations in U.S. Treasury yields may increase, so attention should be paid to the Federal Reserve's actions. Currently, after U.S. Treasury bonds mature, they are mainly rolled over through short-term bonds ("rolling" peak). After the debt ceiling issue is resolved in Q3, there will be a wave of short-term bond issuances and a demand for the Treasury to replenish the TGA account; additionally, after the implementation of Trump's tax cut policy, the Treasury may issue more medium- and long-term bonds. At that time, there will be certain pressure on U.S. Treasury yields, but theoretically, the Federal Reserve has considerable policy hedging space.  Finally, the long-term narrative of the U.S. debt issue must return to fundamentals. The concerns about U.S. government debt and fiscal sustainability are another factor affecting the current market pricing of the demand shock for U.S. Treasuries (the liquidity shock from foreign divestment). However, data shows that the U.S. government leverage ratio is about 112% (data from the end of 2023), roughly in line with the average level of developed economies (107%). Essentially, the debt of developed countries is still rolled over through borrowing new to pay off old debts. Unless there is prolonged contention between the two parties that prevents the debt ceiling issue from being resolved, there is currently no need to short-term the long-term uncertainty; the trend of U.S. Treasuries will ultimately still return to a judgment based on fundamentals.

Finally, the long-term narrative of the U.S. debt issue must return to fundamentals. The concerns about U.S. government debt and fiscal sustainability are another factor affecting the current market pricing of the demand shock for U.S. Treasuries (the liquidity shock from foreign divestment). However, data shows that the U.S. government leverage ratio is about 112% (data from the end of 2023), roughly in line with the average level of developed economies (107%). Essentially, the debt of developed countries is still rolled over through borrowing new to pay off old debts. Unless there is prolonged contention between the two parties that prevents the debt ceiling issue from being resolved, there is currently no need to short-term the long-term uncertainty; the trend of U.S. Treasuries will ultimately still return to a judgment based on fundamentals.  ****(2) Japanese Bond Market: Long-term Rates Hit Record Highs

****(2) Japanese Bond Market: Long-term Rates Hit Record Highs

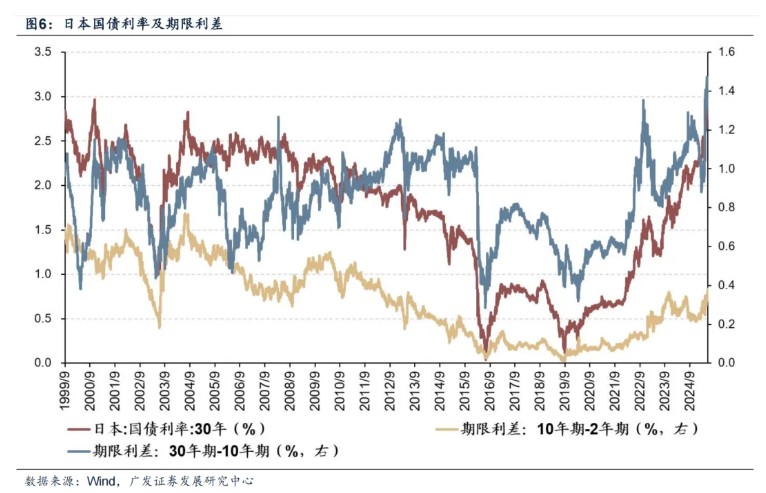

Last week, the yield on Japan's ultra-long bonds surged significantly, with the 30-year Japanese government bond yield rising from 2.6% in early April to 3.14% (on May 21), setting a record since its issuance in 1999; the 40-year Japanese government bond yield broke through 3.6%. The yields on 10-year and 20-year Japanese government bonds also rose, but not as much as the ultra-long bonds. On May 21, the yield spread between the 30-year and 10-year Japanese government bonds reached 1.45%, also the highest level since its issuance in 1999.

The short-term trigger for the surge in Japanese bond yields was first the coordination by the Japanese government in April to draft a supplementary budget for fiscal year 2025 in response to U.S. tariff shocks, which included a large-scale tax cut + cash distribution plan, leading to a significant increase in bond issuance expectations. Secondly, the auction market on May 20 was lukewarm, with the bid-to-cover ratio for the 20-year Japanese government bond auction being only 2.5 times (the lowest since 2012), and the tail difference (the gap between the average price and the minimum accepted price) reached 1.14, setting a new high since 1987.  Looking back at history, Japan's interest rate center has rapidly declined, and the low interest rate era has lasted for over 30 years. Several key windows are:

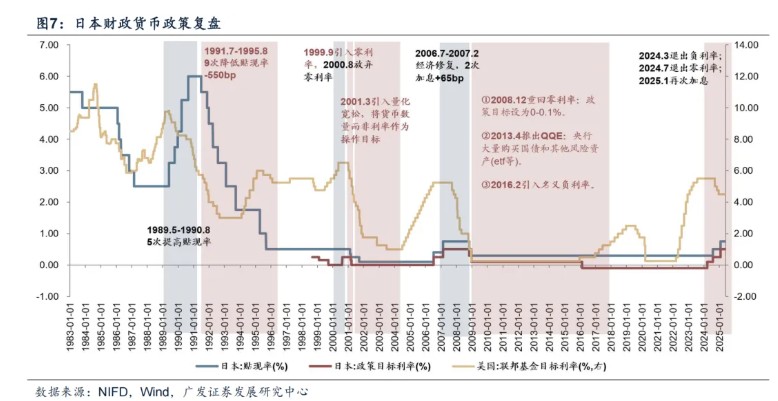

Looking back at history, Japan's interest rate center has rapidly declined, and the low interest rate era has lasted for over 30 years. Several key windows are:

(1) From 1991 to 1995, the discount rate was lowered 9 times consecutively, with a total reduction of 550 basis points; in 1995, a small spring in the Japanese real estate market occurred, and monetary policy was temporarily paused.

(2) In 1999, the concept of "zero interest rate" was introduced and exited in 2000; however, as deflationary pressures intensified, quantitative easing was introduced in March 2001, bringing the policy target interest rate back down to 0%. From 2003 to 2006, Japan's economy, inflation, and stock market showed significant recovery, and the zero interest rate was exited in July 2006.

(3) After the financial crisis, Japan explored a more aggressive monetary policy paradigm to respond. In December 2008, the zero interest rate was restarted; after Shinzo Abe took office at the end of 2012, a series of expansionary policies were quickly introduced, and in 2013, an unprecedented "QQE (Qualitative and Quantitative Easing)" was launched; in 2016, nominal negative interest rates were initiated, aiming to achieve a 2% inflation target.

Therefore, the operations of the Bank of Japan before 2024 can be summarized as: through negative interest rate policy (2016-2024) and YCC (Yield Curve Control) to directly regulate short-term and long-term interest rates, lowering real interest rates to stimulate inflation expectations. Specifically, under the QQE (Qualitative and Quantitative Easing) framework, the central bank continuously purchases government bonds, ETFs, and other assets, expanding the supply of base money, striving to form a transmission chain of "loose money → low interest rates → improvement in corporate financing → growth in household income → expansion of consumption → rebound in inflation."

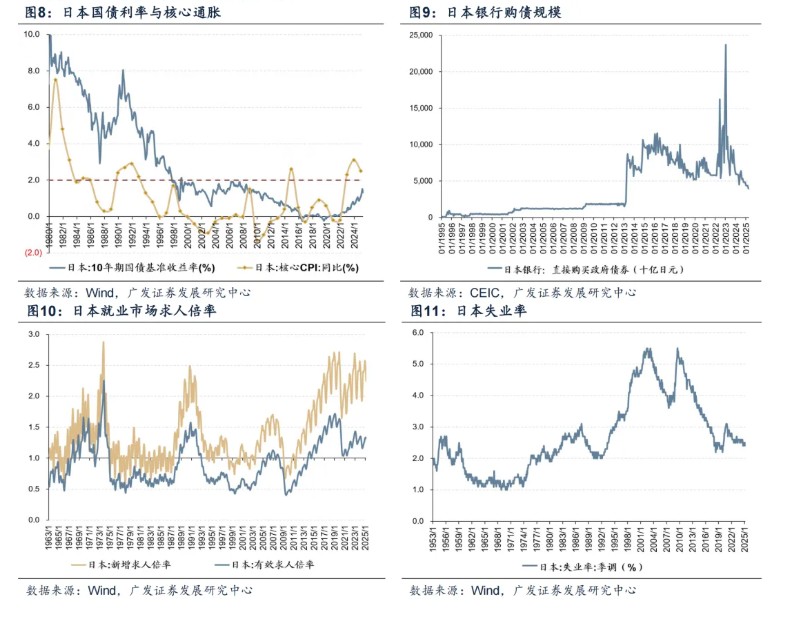

The current round of rising Japanese government bond yields began in 2022 and has been continuously supported by inflation data over the past two years. The core inflation rates in Japan for 2022-2024 are 2.3%, 3.1%, and 2.5%, respectively, remaining above the inflation target level for three consecutive years. Against this backdrop, Japan's monetary policy has begun to shift:

(1) In December 2022, the Bank of Japan unexpectedly adjusted the Yield Curve Control (YCC), expanding the target fluctuation range for the 10-year Japanese government bond yield from ±0.25% to ±0.5%.

(2) In the second half of 2023, the Bank of Japan hinted multiple times that it would soon end the negative interest rate.

(3) In March 2024, it officially exited the negative interest rate and canceled the Yield Curve Control (YCC) policy.

(4) In July 2024, it announced an increase in the target policy interest rate from the 0-0.1% range to 0.25%, while also announcing a specific plan to reduce bond purchases, decreasing the monthly purchase scale by 400 billion yen each quarter.

(5) In January 2025, it raised interest rates again and stated that if economic, price, and market conditions meet expectations, it would continue to raise rates.

From a medium-term market perspective, in addition to the rebound in inflation data and the cooling of bond market trading, the employment market's labor gap also needs to be emphasized. Currently, Japan's unemployment rate is at its lowest level since 1995, and the new job openings-to-applicants ratio is at a historical high Under the labor shortage, in the 2025 "Shunto" wage negotiations, Japanese companies agreed to an average wage increase of 5.46%, the highest increase in 33 years. Under the "wages - inflation" spiral, the Bank of Japan still has room for interest rate hikes this year.

(3) The rise of U.S. and Japanese bonds, how it may transmit to the Chinese market

1. Scenario One: Trading "Weak Dollar + Fiscal Expansion" logic, which points to a strong equity market

We have analyzed the performance of global equity assets during periods of a weakening dollar index since the 1970s, and most phases have shown a resonant increase. The reason is that in a weak dollar environment, the attractiveness of non-dollar currencies and assets increases, driving international capital towards emerging markets; at the same time, since the beginning of this year, both the U.S. and European countries have announced or forecasted fiscal expansion plans, which may alleviate concerns about a further decline in the global economy to some extent. However, this logic is currently being severely impacted by the bond market, and the outlook faces significant uncertainty.

2. Scenario Two: Trading "Weak Dollar, Carry Trade Liquidation + Global Liquidity Recovery" logic, which is unfavorable for the equity market

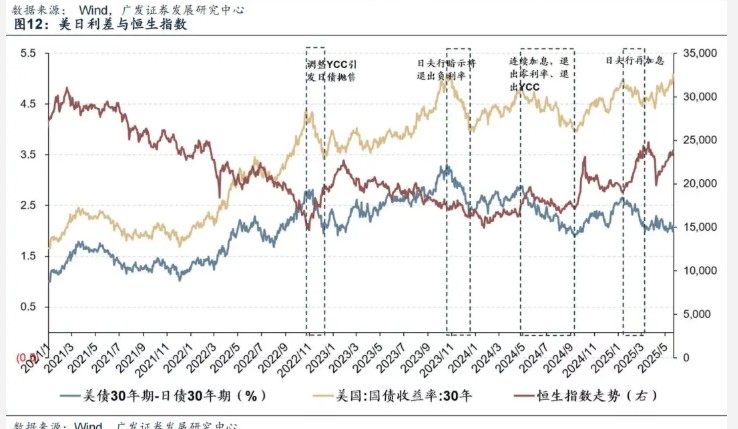

In the past three years, the surge in Japanese bond yields/carry trade liquidation has occurred at least four times, namely:

(1) In December 2022, U.S. bond rates fell while the Bank of Japan unexpectedly adjusted its YCC policy, triggering a wave of Japanese bond sell-offs;

(2) At the end of 2023 to the beginning of 2024, U.S. bond rates fell while the Bank of Japan hinted at exiting negative interest rates;

(3) From May to August 2024, expectations of a U.S. recession and interest rate cuts intensified, but during this period, the Bank of Japan raised interest rates twice, pushing the carry trade liquidation in the third quarter of 2024 to a climax;

(4) At the beginning of 2025, expectations of a U.S. recession resurfaced, during which the Bank of Japan raised interest rates again.

During these four periods of rising Japanese bonds, coupled with the narrowing of the U.S.-Japan interest rate spread, the performance of the Chinese market has been poor. The main logic is the global carry trade liquidation, where positions financed in yen to purchase U.S. assets were reversed, prompting funds to flow back into yen, and potentially forming a feedback mechanism of "liquidation → yen appreciation → further liquidation," which also indicates a tightening of global liquidity.

In the recent market, due to supply pressure on U.S. bonds pushing up U.S. bond yields, the decline in the U.S.-Japan interest rate spread has not been significant. If the extreme short-term performance of U.S. bonds slows down while Japan continues to maintain expectations for interest rate hikes this year, this mechanism may be triggered again

3. Scenario Three: Trading "East Rising West Falling + US Treasury Overflowing Funds Flowing to China" Logic

3. Scenario Three: Trading "East Rising West Falling + US Treasury Overflowing Funds Flowing to China" Logic

Carry trades (such as borrowing yen to buy US Treasuries) are often high-leverage operations. When the interest rate differential between the US and Japan narrows, traders need to close positions to stop losses. The return of funds must first consider repaying yen liabilities, leading to a surge in short-term yen demand and currency appreciation. However, the repatriated funds may not directly purchase Japanese bonds; they may also shift towards assets with higher expected returns (such as emerging markets) or assets with higher safe-haven value (such as gold ETFs).

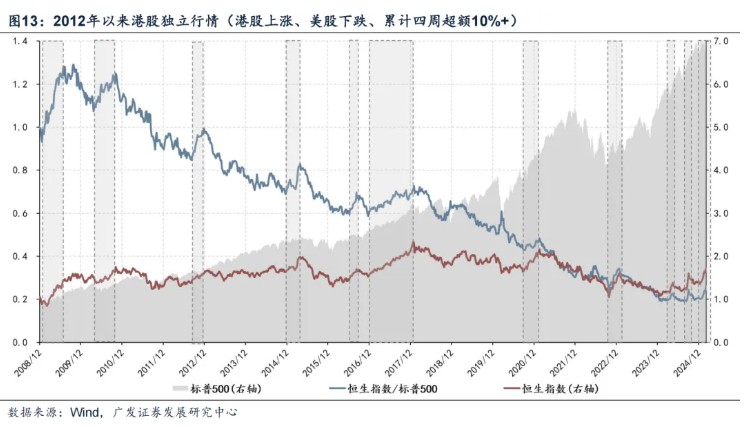

The Hong Kong stock market, with its relatively low absolute valuation, is one option for fund repatriation, but this choice is necessarily based on the prosperity of the Chinese market and the profit-making effect. In our March report "The Independent Market of Hong Kong Stocks Relative to US Stocks Over the Past 15 Years," we noted that independent market behavior of Hong Kong stocks relative to US stocks is rare historically; when it occurs, it is often seen in the context of stagflation or stagflation-like characteristics in the US, while expectations for the Chinese fundamentals improve significantly—this improvement can be based on traditional cycles or on global comparative advantages in industries (such as this year's artificial intelligence and innovative drug trends).

From the high-frequency data of the second quarter, if there is no unexpected fiscal expansion, the elasticity of the traditional cycle upward may be relatively limited. Therefore, if the logic of global funds increasing allocation to the Chinese market is played out, the market may be pushed towards a strongly structured trend again.

II. Global Fund Flows This Week

(I) A/H Share Market

1. AH Connectivity

The average daily trading volume of northbound funds decreased this week. This week (May 19 - May 23), the total trading amount of northbound funds was CNY 630 billion, with an average daily trading volume of CNY 159.3 billion, a decrease of CNY 23.1 billion compared to last week's average daily trading volume. Southbound funds saw a significant net inflow this week. This week (May 19 - May 23), the net inflow of southbound funds was HKD 18.95 billion, compared to a net outflow of HKD 8.68 billion last week. At the individual stock level, the stocks with the highest net purchases by southbound funds included China Construction Bank (net purchase of HKD 5.72 billion), Meituan-W (net purchase of HKD 3.625 billion), and China Mobile (net purchase of HKD 2.249 billion); the stocks with the highest net sales included Tencent Holdings (net sale of HKD 7.671 billion) and Tracker Fund of Hong Kong (net sale of HKD 3.165 billion).

2. Foreign Capital Flow: Active Outflow of Foreign Capital Slows Down, Passive Foreign Capital Turns to Outflow

2. Foreign Capital Flow: Active Outflow of Foreign Capital Slows Down, Passive Foreign Capital Turns to Outflow

Active foreign capital outflow from A-shares and H-shares decreases, passive foreign capital turns to outflow. As of this Wednesday (May 15 - May 21), active foreign capital outflow from A-shares was USD 140 million (a decrease from USD 270 million outflow last week), and passive foreign capital outflow was USD 1.25 billion (a reversal from USD 630 million inflow last week); active foreign capital outflow from H-shares was USD 6 million, a decrease from USD 8 million outflow last week, and passive foreign capital outflow was USD 21 million (a reversal from USD 55 million inflow last week).

(2) Major Overseas Markets

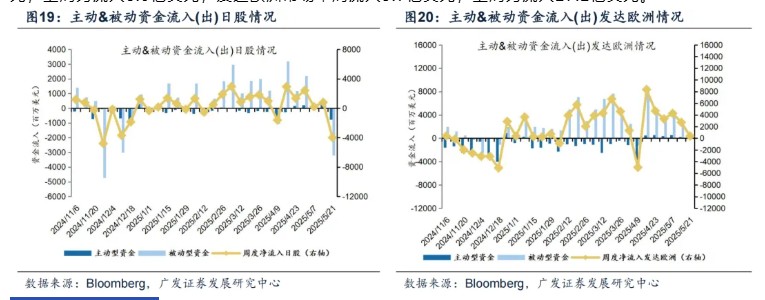

1. US Stock Market Capital Flow

Active capital outflow from US stocks, significant passive capital outflow. As of this Wednesday (May 15 - May 21), active capital outflow from US stocks was USD 510 million, a reversal from USD 2.48 billion inflow last week; passive capital outflow was USD 130 million, a reversal from USD 1.71 billion inflow last week.

2. Other Major Markets Capital Flow: Significant Outflow from Japan, Slight Inflow into Developed European Markets

This week, there was a significant outflow of capital from the Japanese market, and the scale of inflow into developed European markets decreased. Specifically, the Japanese market saw an outflow of USD 3.99 billion this week, compared to an inflow of USD 800 million last week; developed European markets saw an inflow of USD 370 million this week, down from USD 2.72 billion inflow last week.

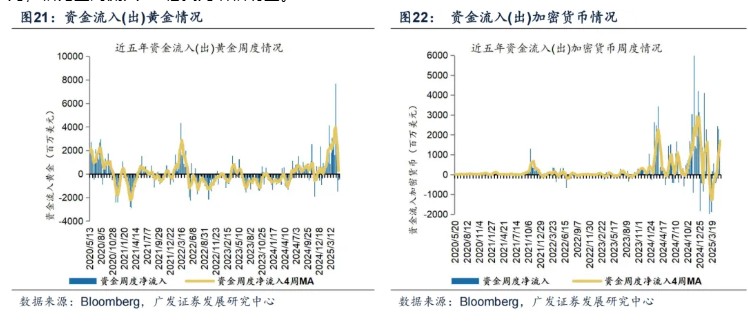

(3) Other Major Asset Classes

This week, the outflow of funds from gold expanded, while the cryptocurrency sector maintained inflow. As of this Wednesday (May 15 - May 21), the net outflow of funds from gold was USD 2.92 billion, a significant increase from USD 430 million outflow last week. The weekly net inflow into cryptocurrency assets was USD 2.34 billion, a noticeable increase from USD 890 million inflow last week.

This article is sourced from: [Morning's Strategic Deep Thinking](https://mp.weixin.qq.com/s? __biz=MzAxNjAwNTMwNQ==&mid=2652382548&idx=1&sn=facaf2fe7a4199b1827052ba908c78a2&chksm=81909228f437ebc60412e5d369c30c582aeaf55bd3a8fc9a798dfd576a390e2ec4ced700d6ac&mpshare=1&scene=23&srcid=05267a1wLHDmJYxRxoUeBIjr&sharer_shareinfo=fd049352bcbf359ee9e64d37b939cf89&sharer_shareinfo_first=fd049352bcbf359ee9e64d37b939cf89#rd), Author: Liu Chenming, Original Title: "Overseas Long-term Interest Rates Soar, How Will It Affect the Hong Kong Stock Market?"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk