Yang Dong has made a "big move"

Yang Dong's Ningquan Asset made significant adjustments in April, reducing convertible bonds and heavily investing in real estate stocks, which became its primary sector. Yang Dong believes that real estate is a key link in boosting domestic demand and expects to stabilize the housing market and the stock market this year. Despite the market's cautious attitude towards real estate, Yang Dong's team still chose to go against mainstream views, demonstrating its unique investment strategy

At a critical moment, the investment portfolio of the big shot Yang Dong once again sent out "important signals."

Information from the industry indicates that Ningquan Asset, led by Yang Dong, made a "significant adjustment" to its portfolio in April.

Not only did it reduce its holdings in convertible bonds, which it has consistently favored, but it also significantly increased its positions in real estate stocks, making this sector the "largest weighted industry" under Yang Dong's management.

Is this a sign of confidence in real estate prices? Or is it an expectation of related policies?

Faced with a challenging and actively transforming Chinese economy, Yang Dong chose the real estate industry chain, while his "disciple" Dong Chengfei opted for AI semiconductors.

Who is the clairvoyant? Who is premature?

Major Portfolio Adjustment

Zhitang noticed that after significant changes in the international situation at the beginning of April, Yang Dong made adjustments to his investment portfolio in two directions.

First, he increased holdings in power stocks, real estate management stocks, photovoltaic stocks, and leading chemical stocks, a significant portion of which are Hong Kong stocks.

Second, he significantly reduced his holdings in convertible bond assets.

However, these actions are still the boldest.

The biggest "move" in Yang Dong's adjustment was the substantial increase in real estate stocks. Reports indicate that products under Yang Dong's management have increased their allocation to real estate stocks, making it the largest weighted industry in their products, with an allocation ratio exceeding 10 percentage points.

The next largest allocations are in basic chemicals, communications, and power equipment.

Why Increase Real Estate Holdings

Regarding the increase in real estate stocks, Ningquan's products provided a specific explanation:

"We focus on domestic demand growth in our investments, and stabilizing and activating the real estate market is an essential aspect that cannot be overlooked. Achieving stability in the real estate market and stock market this year is highly probable."

Yang Dong's team believes there is a "fundamental" change:

The world is facing a severe situation of anti-globalization and anti-free trade, making China's previous growth model reliant on exports and investments unsustainable. China will make significant efforts to boost internal demand.

In other words, Yang Dong places real estate in a "leading position" for boosting internal demand.

Moreover, it continues to affirm that real estate is a key aspect that cannot be overlooked in internal demand.

Such thinking is clearly evaluating the relationship between the economy, policies, and the market from a higher dimension.

Most Funds Do Not Favor Real Estate

Interestingly, Yang Dong's team, which is accustomed to diverging from public sentiment, has once again created an "unexpected" situation.

Zhitang noticed that although major buy-side institutions have been increasingly optimistic about domestic demand investment opportunities in the past two months, most of their betting directions differ from Yang Dong's. Some institutions have directed funds toward emerging consumer goods, while others have invested in companies related to aviation and hotels.

As of the latest statistics, the allocation ratio of real estate stocks by large private equity institutions is overall "not strong."

According to statistics from China Resources Trust: As of the end of April 2025, the allocation of real estate stocks by large subjective long private equity institutions accounted for less than 1% of total holdings, which is also lower than the allocation ratio a year ago.

Since the sample covered by China Resources Trust includes mainstream stock private equity in mainland China, it is somewhat indicative and basically reflects the allocation status of leading private equity firms This situation also appears in the asset allocation of public funds during the same period. Huatai Securities' research report shows that as of the end of the first quarter of 2025, public funds' allocation to real estate companies was less than two percent, but higher than the proportion in the same period of 2024.

Other Institutions "Heavily Invest" in Emerging Growth

In contrast, major securities investment private equity institutions remain most "interested" in emerging growth stocks.

This can be glimpsed from the changes in the number of stock private equity entering the top ten shareholders of listed companies.

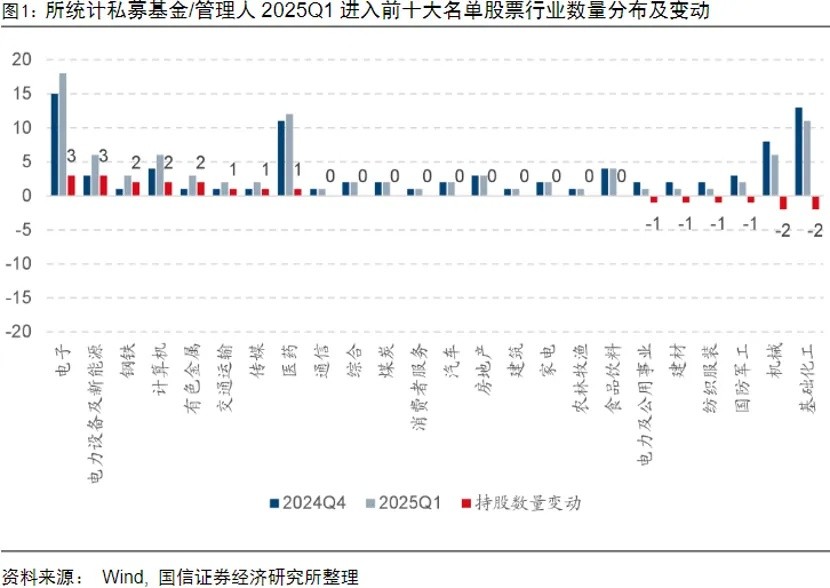

According to a sell-side report from Guosen Securities: as of the end of the first quarter of 2025, there were a total of 18 electronic listed companies in which stock private equity appeared among the top ten shareholders, an increase compared to the end of last year.

Convertible Bonds Becoming "Chicken Rib"?

Apart from real estate, Yang Dong has recently made significant reductions in convertible bonds.

The latter has historically been a favorite among Yang Dong and his "old friends." For instance, Du Changyong and Yang Yun from Ruijun were once investment managers at Xingzheng Global Fund and have long favored convertible bonds.

Yang Dong is even more so, as the allocation of convertible bonds in his Ningquan products once reached 20%. However, after this adjustment, the proportion of convertible bonds is only 0.38%.

In this regard, Yang Dong explained: "As the price of convertible bonds continues to rise, the cost-performance ratio has become like chicken rib."

Reaffirming the 2025 Return Target

In every report to investors, Yang Dong has kept the fund return expectations "low."

He has repeatedly mentioned a viewpoint over the past two years: if investors reasonably allocate equity investments, obtaining more considerable returns than fixed deposits, government bonds, and bank wealth management products is not difficult.

In his latest operational report, Yang Dong maintained the above viewpoint, stating, "Our confidence in investment comes from our clear understanding of the assets we are buying. Although the stock market seems to be in a bleak moment, we are still very confident about this year's positive returns."

In other words, this fund manager's trading expectation is summed up in three words: positive returns.

Yang Dong also likened investing to flying a plane: in investing, the more confident you are about the final outcome, the more calmly you can handle the bumps along the way. Just like flying, ordinary turbulence does not make us panic because we trust the aircraft's high safety and the pilot's professional control ability. Of course, if you think the pilot is unprofessional, then the feeling of fear is hard to suppress.

Additionally, Yang Dong reminded holders: the drastic changes after the Qingming Festival once again reflect the market's unpredictability. The world is full of changes, and human predictive ability is extremely limited, so it is essential to cultivate a mindset of uncertainty in investing Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk