Moody's credit downgrade shocks the market, will US stocks fall into a new bear market? Perhaps it's just a "minor episode" in the bull market

穆迪將美國政府信用評級從 Aaa 下調至 Aa1,引發市場動盪。儘管短期內美股和全球市場可能面臨調整,但華爾街分析師普遍認為美股暴跌至熊市的可能性微乎其微。Cestrian Capital Research 指出,市場看漲氛圍依然存在,預計美股將經歷温和回調後再創新高。此次評級下調可能成為機構投資者獲利了結的藉口,並可能促使美聯儲加速降息。

全球投資者們自本週伊始起,可能在短期內將再度面臨金融市場劇烈動盪,導火索無疑在於上週五國際三大信用評級機構之一的穆迪將美國政府的信用評級從最高評級 Aaa 下調至 Aa1,這也意味着美國主權債務已經被三大評級機構全部剔除出 “最高信用評級” 行列。在本週一亞盤市場開盤後,“拋售美國資產” 的悲觀情緒即 4 月初特朗普政府公佈面向全球的對等關税後可謂再度攀升,亞洲股市週一全線下挫,且美國三大股指期貨和美債攜美元指數共同下跌。

短期層面而言,美股乃至全球股市,以及全球債市因美國信用評級從最高評級被下調而陷入下行調整可謂 “板上釘釘”,當另外兩大信用評級機構——標準普爾與惠譽在當時宣佈下調美國評級時,均在短期內引發全球金融市場動盪。

當前投資者們核心聚焦點在於:至於從中長期角度來看,穆迪這次主權信用評級下調會否推動美股劇烈拋售大浪潮,進而使得美股深陷新一輪熊市呢? 從當前華爾街分析師們的普遍觀點來看,無論是技術分析層面還是實質基本面角度來看,美股暴跌至陷入熊市的概率可謂微乎其微。

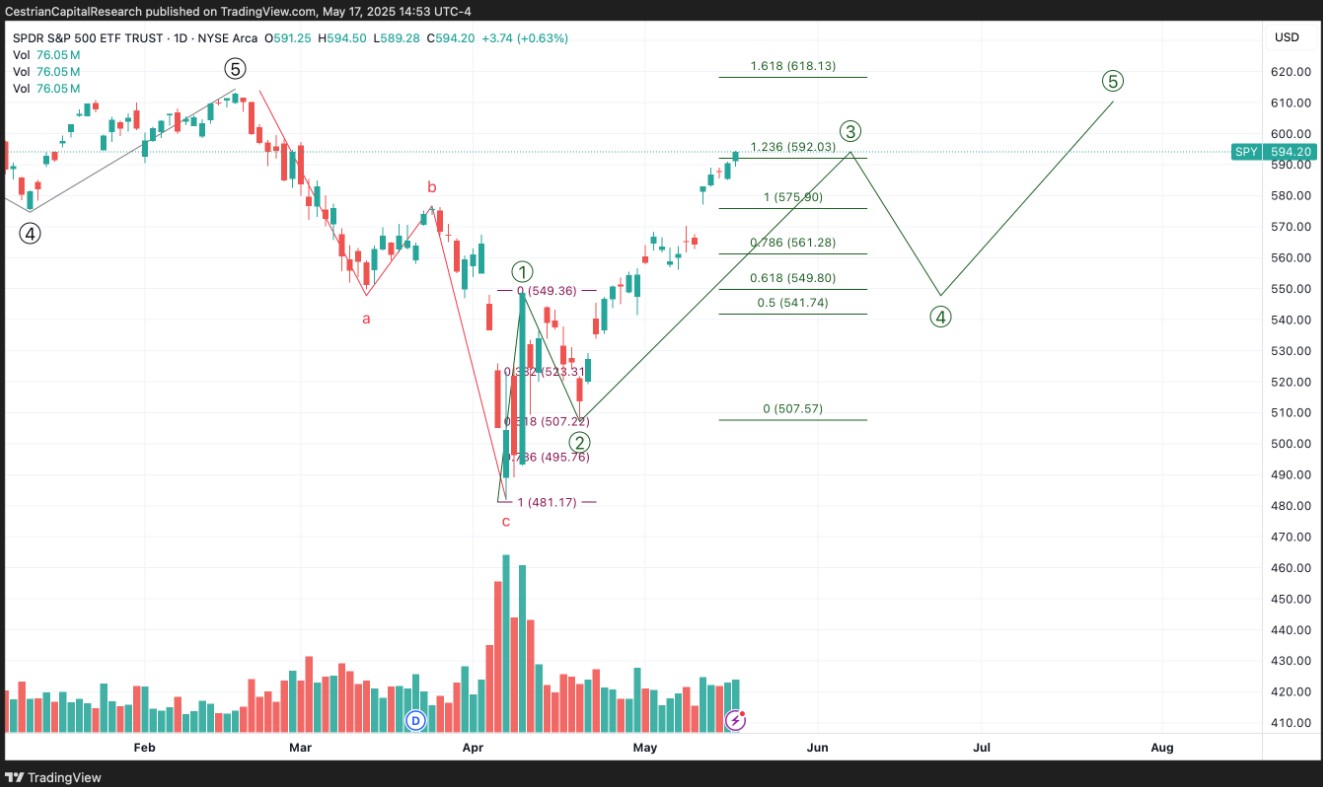

獨立投資研究公司 Cestrian Capital Research 近日發文稱,目前 CBOE 波動率指數 (即 VIX 恐慌指數) 處於近期低位,顯示市場看漲氛圍,該機構預計接下來美股勢必將出現一次顯得温和的短期 “回調小插曲”,而非重大的下行調整,隨後美股有望再創歷史新高。

穆迪下調美國主權信用評級可能更多地充當了一些機構投資者 “獲利了結” 的藉口或誘因,且他們可能在隨後選擇逢低買入,而非美國股市出現熊市跌幅的負面催化劑。此次評級事件甚至可能成為促使美聯儲加速轉向降息步伐的催化劑,在短暫消化之後反而將推動美股繼續走高並再創新高。

永無寂靜的興奮情緒,有望在經歷短暫休整後持續

美國在週五盤後失去了最後一個最高主權評級——穆迪意外宣佈將美國主權信用評級從 Aaa 下調至 Aa1(展望調整至 “穩定”)。這一消息引發市場立即作出反應:跟蹤標普 500 指數的 ETF(SPY.US) 在週五盤後交易中下跌約 1%,週一盤前繼續走弱,納斯達克 100 指數 ETF(QQQ.US) 盤後跌幅更達到 1.3%。美國國債期貨價格走低、收益率攀升,美元指數週一也出現下行趨勢。這些都表明投資者對美國政府陷入違約的財政前景擔憂情緒有所升温。

然而,需要指出的是,此次降級並非突發的歷史級別黑天鵝事件——標普公司和惠譽早在此前數年間就已下調美國信用評級,因此穆迪的調降動作在短期內即有望被市場徹底定價與消化,對美國經濟基本面的影響程度相比於標普公司和惠譽此前降級也相對有限。

更值得關注的是波動率指標、市場技術分析以及美國經濟基本面。當前 VIX 波動率指數處於近階段低位,徘徊在年內罕見的低水平,透露出投資者們仍然沉迷於看漲情緒。一般而言,當 VIX 如此低迷時,往往意味着市場缺乏恐慌拋壓以及保護性押注,這種過度樂觀情緒常常出現在短期頂部附近。

換言之,從波動率指標來看,市場可能已經積累了一定的回調壓力。儘管此次穆迪降級從消息面看似重大利空,美股盤後在消息公佈後出現下跌,但結合波動率和情緒指標來看,當前的回調更有可能是多頭獲利回吐、短期消化強勁反彈漲幅的正常過程,而不大可能演變成類似去年以及 4 月初那樣的大幅拋售行情。

從主要的技術面角度來看,SPY、QQQ、SOXX 等主要跟蹤美股估值的 ETF 的技術圖形顯示市場已處於局部頂部,目前很可能正處於第五浪上漲攻勢行情中的小幅第四浪回調階段,這種調整屬於牛市趨勢中的正常修正,而非新一輪熊市的開始。

SPY(標普 500ETF)、QQQ(納指 100 ETF) 以及 SOXX(費城半導體指數 ETF),等代表性指數的價格形態,都已顯露出短期見頂的技術面跡象。根據艾略特波浪理論的波浪結構劃分,自今年春季以來的這一輪上漲行情可以劃分為五浪推進,目前市場大概率已運行至第三浪尾聲、即將進入第四浪調整階段。上述 ETF 的技術圖形顯示,指數在近日衝高後出現乏力跡象——這很可能就是局部頂部的信號。第四浪調整通常以温和回調的形式出現,幅度相對有限,有助於消化此前的漲幅。

從技術分析派的角度來看,至關重要的是,第四浪屬於上升趨勢中的正常修正,而非趨勢反轉。只要第四浪的回調不跌破關鍵技術支撐位 (例如前一浪的頂部區域),那麼上漲的大格局將得以維持,後續第五浪的上行有望將指數推向更高的高點。這意味着,我們當前看到的下跌更像是美股牛市進程中的暫歇,而不是新一輪熊市的開端。技術指標也佐證這一觀點:一些超買指標出現回落,但整體技術面仍處於多頭控制的關鍵區域;成交量並未出現恐慌放大的跡象。這些都表明市場正在進行健康的調整而非趨勢反轉。

從美國經濟基本面以及基本面未來展望角度來看,當前美國經濟數據仍顯示較強韌性,無論是高頻消費商品統計數據還是耐用品訂單,抑或美國仍然韌性十足的整體消費者支出數據,都未顯示美國經濟明顯的深度放緩或者衰退跡象。並且高盛等華爾街投行在中美貿易緊張局勢出現顯著緩和跡象之後不再預計美國經濟今年下半年將陷入經濟衰退,並大幅上調了今年美國經濟增長預期。

巴克萊銀行 (Barclays) 在週四晚間發佈的一份研究報告中表示,現在預計美國經濟今年將增長 0.5%,明年則有望增長 1.6%,高於此前分別預期的-0.3% 和增長 1.5% 的預測。這也意味着,巴克萊的經濟學家團隊加入高盛、摩根大通等華爾街大行的行列——即不再看衰 2025 年美國經濟以及下調美國經濟衰退概率,同時對於美股的前景展望變得樂觀得多。

高盛的經濟學家團隊預期 2025 年美國經濟有望增長 1%,相比於高盛此前的預期上調 0.5 個百分點,並將未來 12 個月美國國內出現經濟衰退的概率從 45% 下調至 35%。中美達成期限 90 天內的臨時貿易共識後,另一華爾街大行摩根大通火速上調了該機構對美國經濟增長的預期,不再堅持其此前作出的 “2025 年全球最大經濟體美國將陷入經濟衰退” 的預測。

美股牛市邏輯未崩壞:回調正是逢低買入的好時機,準備好迎接回調後的超級漲勢

綜合消息面、技術面以及經濟基本面的整體情況來看,穆迪的降級報告很可能恰逢其時地成為市場短期回調的導火索。近期美股持續反彈,主要指數紛紛收復了 4 月份關税政策引發的全球股市劇烈動盪導致的回落失地並創下階段新高,多頭積累了可觀的浮盈。

在這種背景下,投資者們本就有獲利了結、降低風險敞口的意願,而穆迪的評級下調正好提供了這樣一個契機或 “藉口”。換句話説,該消息觸發的拋壓更多是市場內在技術調整需求與短期獲利了結的直接體現——投資者借題發揮暫時撤出部分資金,而非基本面預期的巨大惡化。正因如此,獨立投資研究公司 Cestrian Capital Research 認為此次降級對市場中長期趨勢的殺傷力有限。

不僅如此,此次評級風波還有可能帶來意料之外的積極後果。從政策層面看,如果評級下調引發的市場短期波動加劇以及美債拋售加劇,使美國金融狀況收緊,美聯儲可能被迫重新審視其貨幣政策路徑,不排除會考慮在下半年儘早降息、定向擴表等寬鬆措施以穩定市場預期。

雖然美聯儲官員們尚未就評級事件明確表態,但歷史經驗表明,當金融市場受到衝擊時,貨幣政策往往會傾向於更寬鬆。這意味着穆迪的降級舉動反而可能加速政策轉向的時間表,成為推動美國股市牛市行情愈發堅挺的潛在重大催化劑。畢竟,一旦投資者開始預期美聯儲可能放鬆政策,長期利率下行和流動性改善將對股票估值形成支持,使三大股指在短暫休整後有望繼續攀升。

基於上述分析,Cestrian Capital Research 在具體的操作上也採取相對謹慎但仍傾向看多的策略。目前,該機構僅持有少量空頭頭寸作為保險,目的是對沖短期可能出現的波動風險——這只是很小的倉位,相當於買一份 “保險單”。整體而言,Cestrian Capital Research 對市場中期前景依舊保持樂觀看法,並未因為穆迪降級而轉為看空。

在不少分析師看來,經歷 4 月強勁反彈後的市場,尤其是估值高企的大型科技巨頭們股價,本來就需要一次温和的獲利了結性質技術性回調;而穆迪的此次降級恰恰可能為這種回調提供契機,並在調整過後有望成為推動美股再創新高的助力。

換言之,穆迪降級並沒有 “殺死” 標普 500 指數以及納斯達克 100 指數的這波牛市行情,反而在經歷短期向下調整後,可能在不經意間替多頭們點燃了新一輪強勁牛市漲勢的導火索。在 Cestrian Capital Research 等多頭勢力看來,在經過小幅的第四浪整理後,美股市場有望重拾升勢,標普 500 指數也將挑戰並超越此前的歷史最高點。