Bill Ackman in Q1: Increased holdings in Uber and cleared out Nike before tariffs

Ackman 一季度增持超過 3030 萬股 Uber,成為投資組合第一大持倉股,佔比高達 18.5%。增持全球最大的另類資管巨頭之一的 Brookfield 和谷歌 A 的股票。一季度完全清倉了此前持有的 1876.9 萬股耐克股票,併購入約等值場外看漲期權,減持希爾頓和谷歌 C 類股。

根據週四提交給美國證券交易委員會(SEC)的監管文件,億萬富翁、對沖基金大佬 Bill Ackman 的潘興廣場資本管理公司(Pershing Square)一季度大幅增持 Uber,使其成為投資組合第一大持倉股,還增持了 Brookfield 和谷歌 A 類股,清倉耐克股票,併購買了等值的場外看漲期權,減持希爾頓和谷歌 C 類股。

值得注意的是,谷歌 A 類股和 C 類股不同地方在於,A 類股具有投票權;C 類股沒有投票權。此外,從整個投資組合來看,截至 2025 年第一季度末,Ackman 的投資組合包括 11 只股票,主要集中在消費循環、科技、金融服務、通信服務、房地產和工業六個行業。

投資組合重大調整:Uber 登頂,賣出耐克股票併購入等值看漲期權

根據最新提交的 13F 文件顯示,Bill Ackman 的 Pershing Square 在 2025 年第一季度進行了重大投資組合調整。

文件顯示,Ackman 一季度增持超過 3030 萬股 Uber Technologies 的持倉,總價值達 22.1 億美元,這使得 Uber 一躍成為其投資組合的最大持倉,佔比高達 18.5%。

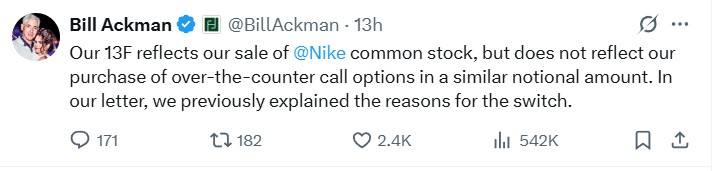

與此同時,Ackman 完全清倉了此前持有的 1876.9 萬股耐克股票,但購買了約等值的場外看漲期權。Ackman 發推表示,在我們的信中,我們之前已經解釋了進行這種轉換的原因。值得注意的是,這是趕在特朗普所謂 “對等關税” 前採取行動。

重要增持:Brookfield 和谷歌 A 類股成為焦點

除了 Uber 之外,Ackman 還增加了全球最大的另類資管巨頭之一的 Brookfield 和谷歌 A 的持倉。

將 Brookfield 的持股增加了 17.52%,新增 611.1 萬股,總持股量達到 4100.5 萬股,總價值約 21.5 億美元,成為投資組合第二大持倉,佔比達到 18.01%。

谷歌 A 持股新增 45.1 萬股,增幅為 11.33%,總持股達到 443.8 萬股,價值約 6.86 億美元。

值得注意的是,Ackman 還增加了對赫茲租車(Hertz Global Holdings)的持股,增幅達 18%。這一舉動是 4 月通過更新的 SEC 文件披露的,原本因保密請求而未在第四季度持股文件中顯示的 1270 萬股購買現已公開。

重大減持:希爾頓遭大幅削減,谷歌 C 類股不被看好

除了清倉耐克之外,在減持方面,Ackman 對希爾頓環球控股 (Hilton Worldwide Holdings) 進行了大幅裁減,減少了 243.98 萬股,降幅高達 44.84%。

此外,Ackman 還減持了谷歌 C 類股票 122.36 萬股,減持幅度 16.21%。值得注意的是,年初至今,谷歌 C 類股票下跌 13.05%