Bank of America Securities: After tariff relief, adjustments to the outlook for the U.S. interest rate market

Bank of America Securities released a research report, maintaining its interest rate forecast for 2025, and suggested adjusting the interest rate curve strategy to "flattening at the long end," recommending a "December 2025 vs December 2026" interest rate swap curve flattening trade. It expects the 10-year U.S. Treasury yield to stabilize in the range of 4.5-4.75%, with inflation trades leaning neutral, closing the 1-year inflation short position while retaining the 2y3y inflation long position. Bank of America believes that after tariff relief, the actual average tariff will decrease, reducing inflation and stagflation risks, with core PCE expectations revised down to 3%

According to the Zhitong Finance APP, Bank of America Securities has released a research report stating that it maintains its interest rate forecast for 2025 unchanged. The recommendation for its interest rate curve strategy has been adjusted to "long-end flattening," with the bank recommending a "December 2025 vs December 2026" interest rate swap curve flattening trade (from a target of -34bps to -70bps). The bank maintains a slightly bullish allocation for the mid-duration (5Y), advocating for a gradual increase in duration at a more stable interest rate position, expecting the 10Y U.S. Treasury yield to stabilize in the range of 4.5-4.75%. The inflation trade is neutral, closing the 1-year inflation short position while retaining the 2y3y inflation long position, anticipating that medium-term inflation still has upward potential.

Key Points from Bank of America Securities:

After the easing of U.S.-China tariffs, Bank of America maintains its interest rate forecast for 2025 unchanged

After the tariff reductions, the average U.S. tariff has decreased from over 20% to 12%, with inflation and stagflation risks declining, and core PCE expectations adjusted down from 3.5% at year-end to 3%. Therefore, Bank of America believes there is no need to adjust the current interest rate forecast, maintaining the 2-year Treasury yield at 3.75%, the 10-year at 4.5%, and the 30-year at 4.9% by the end of 2025.

Interest rate curve strategy recommendation adjusted to "long-end flattening"

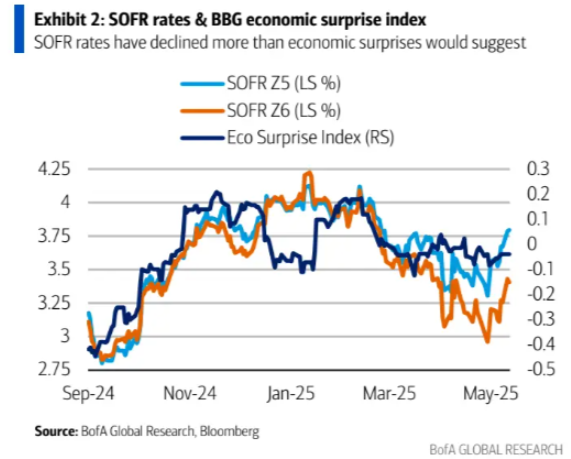

With the likelihood of short-term rate cuts decreasing, Bank of America recommends a "December 2025 vs December 2026" interest rate swap curve flattening trade (from a target of -34bps to -70bps). Reasons include: (1) decreased pressure for rate cuts in 2025; (2) further decline in inflation in 2026; (3) potential strategy divergence under the new Federal Reserve leadership.

Maintaining a slightly bullish allocation for mid-duration (5Y)

Despite the market previously overestimating recession risks and underestimating hard data support, Bank of America still advocates for a gradual increase in duration at a more stable interest rate position, expecting the 10Y U.S. Treasury yield to stabilize in the range of 4.5-4.75%.

Regarding spreads

Neutral in the short term, bearish on the long-term 30-year spread: Due to fiscal deficits and U.S. Treasury supply pressures, Bank of America maintains a "short" recommendation on the 30-year spread. The short end (2-5Y) spread remains neutral to slightly bullish due to a stable short-term financing environment.

Inflation trade is neutral

Closing the 1-year inflation short position while retaining the 2y3y inflation long position, anticipating that medium-term inflation still has upward potential, especially more pronounced relative to the Eurozone.

The volatility strategy leans towards short-term longs and long-term conditional steepening: recommending a 6-month "costless" 2s10s lower volatility trade, as well as a long-term "bear steepening" combination based on the 5s30s interest rate spread to address market repricing risks.