How profitable is the food delivery business that JD.com and Meituan are competing for?

The competition between JD.com and Meituan in the food delivery market is intensifying. Meituan's profit margin for its food delivery business was approximately 6.4% in 2021, while JP Morgan expects the net profit margin for mainstream food delivery platforms to be between 1.5% and 3.3% in 2024. JD.com announced that its daily order volume has surpassed 10 million and plans to hire 100,000 delivery riders within three months. The stock prices of both companies have significantly dropped due to market concerns over intensified competition, with a combined market value evaporating by over HKD 100 billion

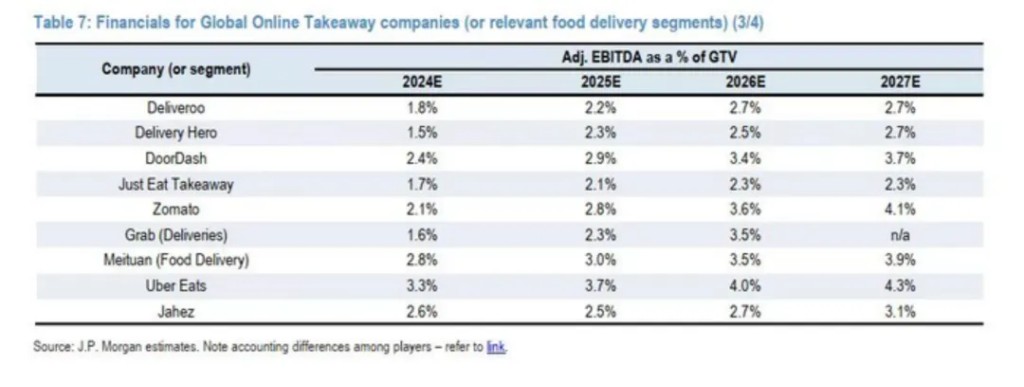

Meituan's last disclosed operating profit margin for its takeaway business in 2021 was approximately 6.4%; JP Morgan estimates that the net profit margin for nine major global takeaway platforms in 2024 will be between 1.5% and 3.3%.

Recently, the takeaway battle between JD.com (9618.HK, JD.US) and Meituan (3690.HK) has intensified. What intrigues the public is how profitable the takeaway business that these two giants are competing for really is.

JD.com first announced its entry into the takeaway market two months ago, launching the "JD Takeaway" service. Subsequently, JD.com was the first to announce that it would pay social insurance for full-time delivery riders, and recently, due to the controversy over the "two-choice" policy for riders, a new round of the takeaway battle has erupted. Meanwhile, photos of JD.com founder Liu Qiangdong personally delivering takeaways have recently gone viral on social media.

Amid a series of hot events and Liu Qiangdong's "strong promotion," on April 24, JD.com announced that as of April 22, the daily order volume for JD Takeaway had surpassed 10 million. Meituan's total order volume for takeaway in 2023 is projected to be 22 billion orders, with an average daily order volume of about 60.27 million orders. Based on this data, JD Takeaway's daily order volume is close to one-sixth of Meituan's.

At the same time, JD.com is also accelerating the expansion of its delivery rider team to capture market share, with many riders posting videos of their switch to JD riders on social media. On April 27, JD.com announced that it would recruit 100,000 riders in the next three months. On the other hand, Meituan has issued clarifications regarding recent issues such as "dual app account bans," "exclusive takeaway lockers," and "shrinkflation meals," as the takeaway battle continues to escalate.

Due to market concerns that intensified competition in the takeaway business may affect future dynamics, the stock prices of Meituan and JD.com have both seen significant declines in recent trading days. On April 22, Meituan's stock price fell by 5.62%, and JD.com's stock price fell by 6.32%. After a slight rebound the following trading day, on April 24, the stock prices fell again, with Meituan down 5.15% and JD.com down 6.19%. In just three days, the combined market value of Meituan and JD.com evaporated by over HKD 100 billion. As of April 28, Meituan and JD.com have fallen approximately 15.36% and 4.25% respectively since the beginning of the year, with market values of HKD 788.7 billion and HKD 403.2 billion.

As JD.com and Meituan engage in the takeaway battle, the question of "how profitable is the takeaway industry" has also attracted market attention.

In a public letter on April 21, JD.com rarely mentioned relevant data about the takeaway industry: over 60% of restaurants in the catering industry are operating at a loss, and some platforms have a gross profit margin for takeaway business exceeding 40%, with the proportion of "ghost kitchens" continuing to rise.

On the evening of April 15, a speech by Liu Qiangdong within JD.com was leaked, in which he stated that JD Takeaway's net profit margin should not exceed 5%. He mentioned, "I heard that the (commission rate) has now averaged as high as 25%, and with advertising fees, some even exceed 30% Why has it become like this today, with no reverence for the things entering the market? Essentially, it is still monopolized by delivery platforms, leading to excessive commission fees charged by these platforms."

So, what is the commission rate for the delivery business? How profitable is the delivery business? A review of Meituan's financial report reveals that since 2021, Meituan no longer discloses data on its delivery business separately. In 2021, the operating profit margin of Meituan's delivery service was approximately 6.4%. In the same period, the in-store hotel and travel business, which does not require delivery, was even more profitable, with an operating profit margin of 43.3%. In 2020, the operating profit margin for Meituan's delivery service was 4.3%. In 2024, the operating profit margin for Meituan's core local business, including delivery and in-store hotel and travel, is approximately 20.9%.

So, what is the net profit margin for Meituan's delivery service? Since Meituan's financial report does not disclose the net profit of its delivery business separately, it is difficult to calculate the net profit margin for Meituan's delivery service based on the financial report.

On April 15, JP Morgan released a global online delivery industry report ("Global Online Takeaway (2024)") showing that the projected net profit margin for nine major global delivery platforms in 2024 (adjusted EBITDA as a percentage of gross transaction value, Adj. EBITDA as a % of GTV) is between 1.5% and 3.3%, with an arithmetic average of 2.2%. Among them, Meituan's estimated net profit margin for 2024 is 2.8%.

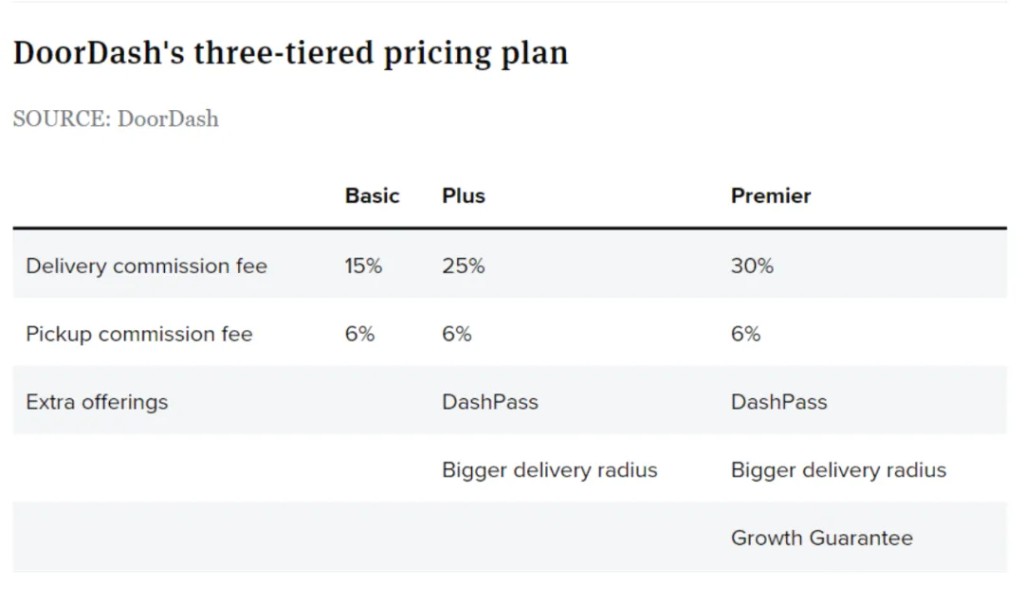

In addition, regarding the commission issue that the public is concerned about, there are some discrepancies between Meituan and merchants. Meituan claims that the actual commission rate charged to merchants is 6%-8%. However, many merchants indicate that the commission rate charged by Meituan's delivery service is around 25%. It is also understood that the total commission rate charged by the American delivery platform DoorDash varies between 36% and 51%, depending on the service items.

01 What is the commission rate?

01 What is the commission rate?

The commission rates charged by platform companies have always been a focus of market attention. So, what is the commission rate for Meituan's delivery service?

After JD.com announced its entry into the delivery business in February 2025, there were rumors in the market that "Meituan's delivery service charges merchants a high commission of 30%." In response, Meituan officially stated on February 9, 2025, that this data is severely inaccurate and emphasized that the actual technical service fee (i.e., commission) charged to merchants by its delivery platform is only 6%-8%, and additional fulfillment service fees only apply when merchants choose Meituan's delivery service On December 25, 2024, Meituan published an article on its official website titled "What is the Real Commission Rate of Meituan Takeaway?" which provided a detailed analysis of its commission rates. It stated that the actual merchant commission rate for Meituan Takeaway is 6%-8%.

It further explained the meaning of the commission: Before the takeaway fee reform in 2021, Meituan Takeaway charged merchants based on a fixed rate agreed upon with them, calculated on the order amount, which mainly included platform commissions and delivery service fees for takeaway orders.

After the fee reform in 2021, Meituan Takeaway split the fixed takeaway rate into two parts: technical service fees and fulfillment service fees. The technical service fee is charged by Meituan for providing services such as information display, technical support, traffic support, and operational guarantees when merchants conduct business and complete transactions on the takeaway platform, which is the actual commission. The fulfillment service fee is incurred when merchants choose Meituan for delivery, used to pay for delivery costs, delivery stations, and operational costs related to capacity scheduling.

However, many merchants have stated that the commission rate charged by Meituan Takeaway is around 25%. In response, industry insiders indicated that the 6%-8% refers to the fees charged to merchants on the Meituan platform, while the 25% may include comprehensive costs for merchants such as commissions, delivery fees, and advertising promotion fees.

According to Caijing, various restaurant merchants have reported differing views on how much commission is charged. Many merchants indicated that Meituan Takeaway takes a cut of over 20%, with some stating that including delivery fees, it can reach 30%. This includes the deducted commission, promotion fees, insurance fees, etc.

"Sometimes the promotional coupons for activities are also paid by us merchants, which is equivalent to paying 'rent.' Therefore, sometimes we will slightly raise the prices for takeaway, making them higher than in-store prices," a restaurant merchant told Caijing.

Additionally, information released by the American takeaway platform DoorDash shows that after 2021, it adjusted its rates, dividing takeaway commissions into basic channel fees and delivery commissions. The basic channel fee is 6%, while delivery commissions are divided into three levels: Basic 15%, Plus 25%, and Premier 30%. Furthermore, the platform charges customers a service fee of 15% of the order amount. It is evident that depending on the service items, the total commission rate charged by DoorDash ranges from 36% to 51%.

Commission structure of the American takeaway platform DoorDash. Source: DoorDash

Commission structure of the American takeaway platform DoorDash. Source: DoorDash

Did Meituan disclose relevant data in its financial report?

On March 21, 2025, Meituan announced its full-year performance for 2024, achieving operating revenue of 337.6 billion yuan, a year-on-year increase of 22%; and a net profit attributable to shareholders of 35.8 billion yuan, a year-on-year increase of 158.4% From a business segmentation perspective, Meituan divided its operations into food delivery, in-store dining and travel, and new businesses before 2022. Starting in 2022, it merged food delivery and in-store dining and travel into its core local commercial business. As of now, Meituan's business is divided into core local commerce and new businesses.

The core local commerce includes food delivery and flash purchase services, in-store dining and travel, and other main businesses of Meituan. In 2024, this segment achieved revenue of 250.2 billion yuan, a year-on-year increase of 20.9%. New businesses include Meituan Preferred, Little Elephant Supermarket, Fast Donkey (B2B catering services), bike-sharing, power banks, and other newly developed businesses in recent years, achieving revenue of 87.3 billion yuan in 2024, a year-on-year increase of 25.1%.

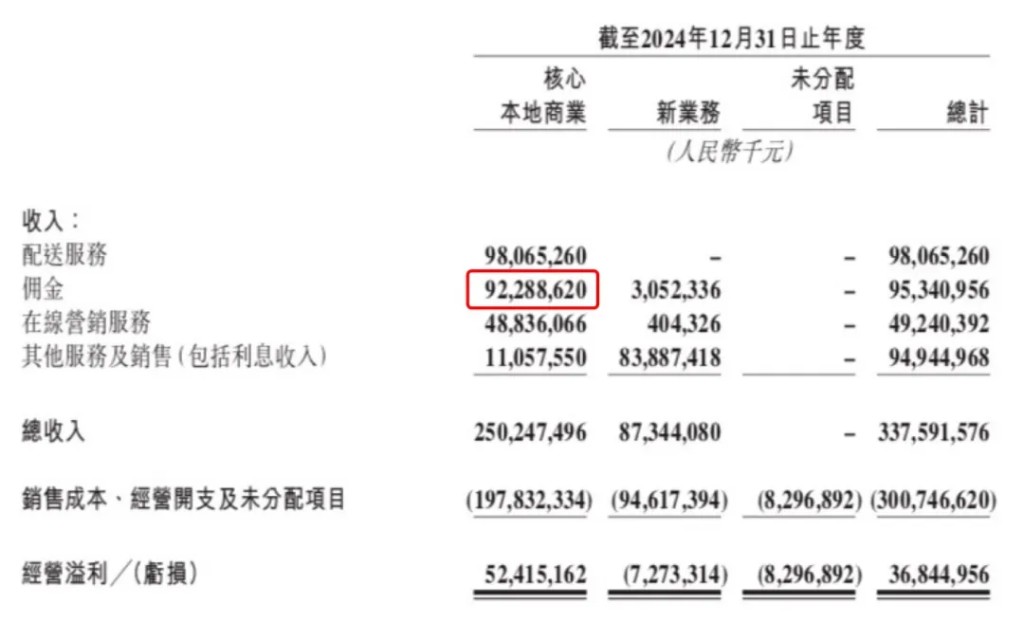

In its financial report, Meituan further categorized its revenue into four segments: delivery services, commissions, online marketing services, and other services and sales (including interest income). In 2024, these four segments achieved revenues of 98.07 billion yuan, 95.34 billion yuan, 49.24 billion yuan, and 94.94 billion yuan, respectively, accounting for 29.05%, 28.24%, 14.59%, and 28.12%.

Within the core local commerce, delivery services, commissions, online marketing, and other services and sales achieved revenues of 98.07 billion yuan, 92.29 billion yuan, 48.84 billion yuan, and 11.06 billion yuan, respectively. Delivery services mainly refer to the costs of fulfilling food delivery, commissions are primarily the fees Meituan collects from merchants, and online marketing mainly refers to the advertising expenses merchants spend on Meituan. In other words, in 2024, Meituan collected nearly 100 billion yuan in commissions from merchants, and combined with online marketing advertising fees, the total exceeded 140 billion yuan.

However, since Meituan did not disclose the transaction amount for Meituan Delivery in 2024, it is not possible to calculate its commission rate for that year.

Image source: Meituan financial report

Image source: Meituan financial report

02 How Profitable is the Delivery Business?

02 How Profitable is the Delivery Business?

From the financial report, Meituan Delivery's revenue mainly comes from three parts: delivery services, commissions, and advertising revenue.

From the financial report when Meituan separately disclosed food delivery in 2021, the company achieved a total revenue of 96.3 billion yuan from its delivery business that year, of which delivery service revenue was 54.2 billion yuan, commission revenue (technical service fees) from merchants was 28.5 billion yuan; online marketing advertising revenue was 11.4 billion yuan. The total revenue from these three business segments was 94.1 billion yuan, accounting for about 98% of that year's Meituan Delivery business revenue Looking at the three business segments separately, Meituan's real profit from food delivery does not come from the delivery service itself, but rather from the commissions and advertising revenue charged to merchants as a result.

In terms of delivery service revenue, Meituan will no longer disclose the volume of instant delivery orders starting from the fourth quarter of 2024. According to 2023 data, Meituan's delivery order volume was 22 billion orders, with delivery service revenue of 82.2 billion yuan. Based on this, the average delivery revenue per order is approximately 3.7 yuan. According to its 2023 financial report, the delivery-related costs disclosed were 90.7 billion yuan, which means that the cost per delivery order is about 4.1 yuan, resulting in a loss of approximately 0.4 yuan per order.

According to Meituan's disclosure in December 2024, most of the delivery fee revenue obtained from merchants and users is used to cover rider salaries, i.e., delivery costs. For example, in the first half of 2024, Meituan's delivery service revenue was 44.1 billion yuan, while delivery-related costs were 48 billion yuan. This indicates that Meituan's delivery service is operating at a slight loss.

Therefore, the other two revenue streams—commissions charged to merchants and advertising revenue—are the main contributors to Meituan's food delivery profitability.

From the financial report when Meituan separately disclosed its food delivery business in 2021, the transaction amount for the Meituan food delivery platform was 702.1 billion yuan, with 14.4 billion transactions, and an average transaction amount of 48.8 yuan. Its food delivery business achieved total revenue of 96.3 billion yuan, of which delivery service revenue was 54.2 billion yuan, with a delivery fee rate (delivery service revenue/transaction amount) of approximately 7.72%; commission revenue obtained from merchants (technical service fees) was 28.5 billion yuan, with a commission rate (commission revenue/transaction amount) of approximately 4.06%; and online marketing advertising revenue was 11.4 billion yuan, with a monetization rate (online marketing revenue/transaction amount) of approximately 1.63%. The total revenue from these three business segments was 94.1 billion yuan, accounting for about 98% of Meituan's food delivery business revenue that year.

Based on this estimation, the cost rate for Meituan's food delivery, commissions, and online marketing advertising combined in 2021 was approximately 13.41%, while Meituan's operating profit for food delivery was 6.2 billion yuan, with an operating profit margin of approximately 6.4%. In the same period, Meituan's offline hotel and travel business, which does not require delivery, was even more profitable, with an operating profit margin of 43.3%. In 2020, the operating profit margin for Meituan's food delivery was 4.3%.

Starting in 2022, Meituan no longer separately discloses financial data for its food delivery business, instead merging food delivery and offline hotel and travel into its core local commercial business. According to the 2024 financial report, the core local commercial business achieved revenue of 250.2 billion yuan, a year-on-year increase of 20.9%, and an operating profit of 52.4 billion yuan, a year-on-year increase of 35.4%, with an operating profit margin of approximately 20.9%.

In contrast, Ele.me, which ranks second in the domestic food delivery industry, is still in a loss-making state. According to Alibaba (9988.HK, BABA.US) disclosed in its third-quarter report for the 2025 fiscal year (April 1, 2024 - December 31, 2024), the local life group, including Ele.me and Amap, achieved cumulative revenue of 50.942 billion yuan Year-on-year growth of 13%, achieving a cumulative loss of 1.373 billion yuan, a year-on-year narrowing of 79%. In the subsequent earnings call, Alibaba's management stated that Amap has achieved profitability for the first time, while most loss-making businesses are expected to reach breakeven in the next one to two years and gradually start contributing profits.

JP Morgan's report on the global online food delivery industry released on April 15 shows that the nine major food delivery platforms globally are projected to have net profit margins between 1.5% and 3.3% in 2024, with an arithmetic average of 2.2%. Among them, Uber Eats, a subsidiary of Uber, ranks first with a net profit margin of 3.3%, followed by the American food delivery platform DoorDash at 2.4%, and Grab's food delivery business in Southeast Asia at 1.6%. According to JP Morgan's estimates, Meituan's food delivery net profit margin in 2024 is approximately 2.8%, slightly above the average.

Image source: JP Morgan Research Report

Image source: JP Morgan Research Report

According to DoorDash's disclosed financial report, the company's gross profit margin for 2024 is 48.31%, and the net profit margin is 1.09%. Previously, the company had incurred losses for several consecutive years.

Meituan once provided guidance for food delivery stating "100 million orders a day, with a profit of one yuan per order." Meituan stated in 2022 that the average operating profit per order (UE) for food delivery in the third quarter of 2022 had reached 1.05 yuan per order. According to the latest research report from CMB International, Meituan's food delivery average operating profit per order in 2023 is estimated to be 1.2 yuan per order, and in 2024, it is estimated to be 1.4 yuan per order. Based on this estimate, the operating profit of Meituan's food delivery business for the first three quarters of 2024 is approximately 26.32 billion yuan, and the operating profit for the entire year of 2023 is approximately 26.4 billion yuan. In 2021, Meituan's financial report disclosed an operating profit of 6.2 billion yuan for its food delivery business.

From Meituan's overall financial data, it is expected to achieve operating revenue of 337.6 billion yuan in 2024, with a net profit attributable to the parent company of 35.8 billion yuan, an overall gross profit margin close to 40%, at 38.44%, and a net profit margin of 10.61%.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk