Intel Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Intel Corporation is set to release its Q1 earnings on April 24, with expectations of $0 earnings per share, down from 18 cents a year ago, and projected revenue of $12.30 billion, down from $12.72 billion. The company plans to cut over 20% of its workforce under new CEO Lip-Bu Tan. Analysts have revised their price targets, with Wedbush lowering it from $20 to $19, Bernstein from $25 to $21, and others making similar cuts. Intel shares rose 5.5% to $20.59 on Wednesday.

Intel Corporation INTC will release earnings results for the first quarter, after the closing bell on Thursday, April 24.

Analysts expect the Santa Clara, California-based company to report quarterly earnings at $0 per share, down from 18 cents per share in the year-ago period. Intel projects to report quarterly revenue at $12.30 billion, compared to $12.72 billion a year earlier, according to data from Benzinga Pro.

Intel reportedly plans to reduce more than 20% of its workforce as part of a major overhaul under new CEO Lip-Bu Tan.

Intel shares gained 5.5% to close at $20.59 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

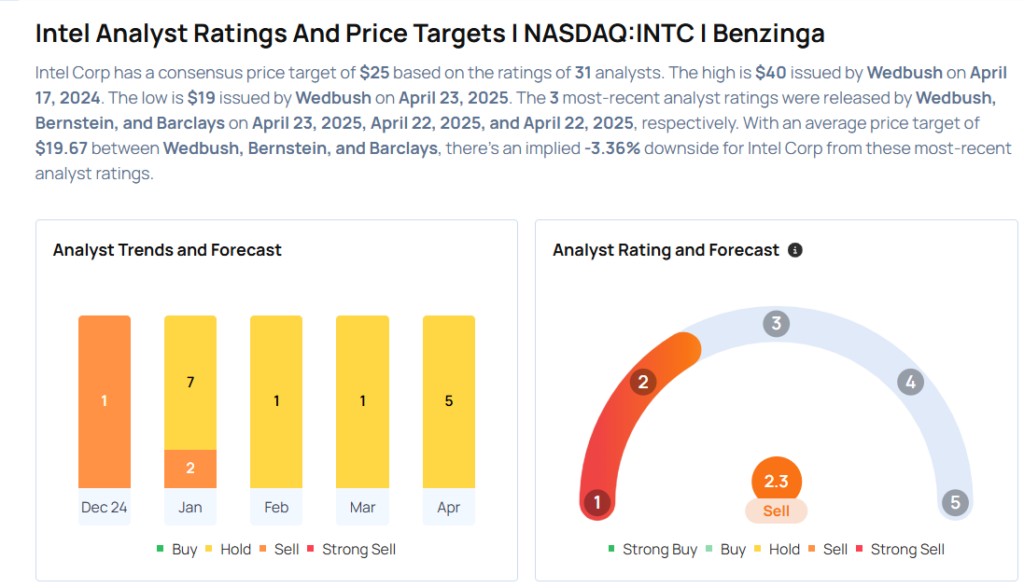

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Matt Bryson maintained a Neutral rating and cut the price target from $20 to $19 on April 23, 2025. This analyst has an accuracy rate of 76%.

- Bernstein analyst Stacy Rasgon maintained a Market Perform rating and slashed the price target from $25 to $21 on April 22, 2025. This analyst has an accuracy rate of 69%.

- Susquehanna analyst Christopher Rolland maintained a Neutral rating and slashed the price target from $24 to $22 on April 16, 2025. This analyst has an accuracy rate of 71%.

- UBS analyst Timothy Arcuri maintained a Neutral rating and cut the price target from $23 to $22 on April 14, 2025. This analyst has an accuracy rate of 73%.

- Needham analyst Quinn Bolton reiterated a Hold rating on April 14, 2025. This analyst has an accuracy rate of 76%.

Considering buying INTC stock? Here’s what analysts think:

Read This Next:

- Top 2 Consumer Stocks That May Implode This Month

Photo via Shutterstock