The tariff stick cannot suppress the AI-driven wave of device replacement. Is Apple and the "Apple supply chain" stock price counterattack reaching a climax?

高盛指出,市場對蘋果營收增速放緩的關注掩蓋了其強大的生態系統和需求擴張能力。特朗普政府暫時豁免對核心電子產品的關税,提升了美股科技股投資者情緒,尤其是蘋果和英偉達。隨着蘋果 AI 功能的推出,預計將引發新一輪換機潮,推動蘋果及其供應鏈股價反彈。

智通財經 APP 獲悉,隨着特朗普政府暫時豁免對於智能手機、個人電腦以及高性能服務器芯片等核心電子產品的所謂 “對等關税” 之後,美股科技股投資者情緒在近期明顯回暖,尤其是對於蘋果與英偉達這兩大極度依賴全球供應鏈體系的科技巨頭的市場看漲情緒大舉反攻,並且帶動全球 “蘋果代工與供應鏈” 與 “英偉達 AI 服務器代工與供應鏈” 的重要公司股價大幅上漲。

近日特朗普表示無意解僱美聯儲主席鮑威爾並且無意干預美聯儲獨立性,以及透露將 “大幅降低” 對中國的高額關税之後,股票等風險資產進一步反彈。截至週三美股收盤,美國股債匯三市齊漲,其中包含蘋果與英偉達等科技巨頭的 “七巨頭” 指數 (Magnificent Seven) 漲超 3%,“七巨頭” 佔據高額權重的納斯達克 100 指數兩日累計反彈超 5%。

展望未來全球科技股走勢,“果鏈” 中的蘋果 iPhone 等消費電子核心供應商股價有望跟隨蘋果 AI 功能 (即 Apple Intelligence) 帶來的新一輪消費電子升級換代需求,以及跟隨全球消費者們在特朗普正式確立半導體等科技行業關税政策前掀起的 “提前購買浪潮”而持續反彈。蘋果本身的估值與基本面預期有望在 Apple Intelligence 所驅動的全新換機週期、提前囤積 iPhone、蘋果強大的閉環生態、供應鏈韌性與強大議價能力推動下重新步入上行軌跡。

華爾街大行高盛近日發佈研報稱,蘋果 AI 功能所驅動的新一輪 iPhone 換機週期開啓,以及消費者們對於關税政策的擔憂引發蘋果旗下消費電子產品需求大幅前置強化換機邏輯、iPhone 16e/M4 芯片產品創新所推動新一輪 iPhone 與 Mac 銷售渠道補庫存,再加之蘋果憑藉全球最強大的品牌忠誠度、持續的產品/模塊創新和服務業務大幅增長,有望保持強勁的業績增長趨勢。

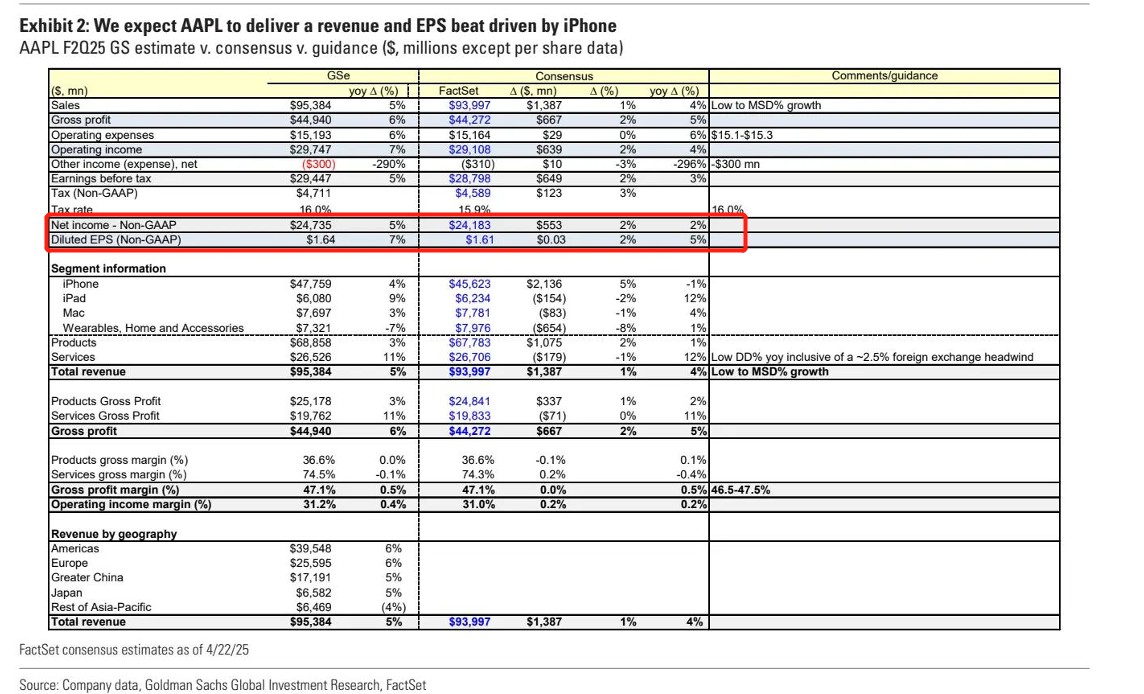

因此,高盛分析團隊預計 F2Q25(即蘋果 2025 財年第二財季) 每股收益 (EPS) 將達到 1.64 美元 (超過華爾街平均預期的 1.61 美元),營收有望達到 954 億美元 (超平均預期的 940 億)。高盛預計第二財季蘋果 Q2 業績增長驅動力主要來自於 iPhone 出貨量同比 +10%,Mac 系列營收則受益基於 M4 的新品,iPad Air 漲價策略有望顯著見效,iCloud 等服務業務 CAGR 至少 10% 預期 (年複合增長率至少 10% 預期) 有望繼續構築蘋果生態護城河。

高盛的股票分析師團隊維持對於蘋果股票的 “買入” 這一最樂觀的看漲評級,12 個月內目標價從 259 美元小幅下調至 256 美元,意味着高盛仍然堅持看漲蘋果股價。截至週三美股收盤,蘋果股價收於 204.600 美元,意味着在高盛看來蘋果未來 1 年內股價潛在漲幅高達 25%。估值方面,高盛表示,相對於蘋果歷史估值平均水平——無論是絕對還是相對,以及其他的六大科技巨頭相比,目前蘋果估值對於全球資金來説具有強大的投資吸引力。

高盛前瞻蘋果 Q2 業績:AI iPhone 將驅動 EPS 超預期,聚焦關税帶來的需求前置爆發

高盛研究團隊表示,予以蘋果業績強勁增長預期主要源於:(1) Apple Intelligence 所驅動的全新換機週期,以及 iPhone 16e、基於 M4 芯片的 MacBook Air/Mac Studio/iPad 等新品渠道補庫存來滿足持續超預期強勁的需求;(2) 關税擔憂下的 iPhone 需求大幅前置 “強化換機邏輯”;(3) 美國運營商競爭加劇的趨勢下,對於 iPhone 捆綁促銷的力度持續升級;(4) 依託於蘋果強大的 Apple 生態護城河,服務業務的持續強勁表現。

對於蘋果業績貢獻力量最大的 iPhone 營收方面,高盛預計 Q2 iPhone 業務線的營收約為 478 億美元 (即同比增長 4%),高於華爾街平均預期的 456 億美元。高盛表示,iPhone 營收增長應由銷量同比增長 10% 所驅動,這得益於 (1) 價格更加親民且體驗感不屬於旗艦機型的 iPhone 16e 的發佈;(2) 因美國關税政策的巨大不確定性導致的需求提前集中,以及 AI 驅動的換機週期。

高盛的 iPhone 銷量預期與市場研究機構 IDC/Canalys(同比增長 10%) 預期一致。其次,蘋果服務業務營收預計同比增長 11% 至 265 億美元 (對比華爾街共識預期的 267 億美元),得益於 App Store 計費有望同比增長約 13% 以及 iCloud+、AppleCare+、Apple One 訂閲和 Apple Pay 有望共計同比增長 44%,其中高盛預計 Apple TV+F2Q25 營收有望高達 15 億美元,訂閲用户可能超過 6000 萬。

Mac 業務線方面,高盛預計 F2Q25 營收大約 77 億美元 (意味着將同比增長 3% ),M4 新品有望拉動 Mac 系列整體出貨量大幅增長 15%。蘋果的 iPad 業務線方面,高盛分析團隊則預計 F2Q25 營收大約 61 億美元 (意味着將同比增長 9% ),ASP 有望超預期同比提升 5%(iPad Air 13 寸的溢價策略)

高盛預計蘋果 2025 財年的整體毛利率預期將為 47.1%(對比共識預期也為 47.1%),處於業績指引區間 (46.5%-47.5%) 的中間值區域。此外,蘋果管理層可能將宣佈新的股票回購授權,有望大幅提振市場對於蘋果股價的看漲情緒;蘋果通常在第二財季宣佈新的回購計劃,例如去年在 2024 財年第二財季宣佈了新的高達 1100 億美元股票回購授權)。

關於蘋果業績以及未來業績前景的核心爭議點方面,高盛經過與機構投資者深度交流以及持續的市場調研之後,表示關於蘋果基本面前景的爭議點則在於以下的核心要點:

(1) 關税影響或將再度來襲。4 月 11 日智能手機/PC 等電子產品的關税豁免短期內將緩解關税衝擊,但是美國商務部 232 條款半導體調查可能導致新的面向半導體等科技領域的關税政策 (若半導體關税出爐,智能手機/PC 必然也將波及)。據悉,美國商務部在特朗普授權下已啓動對進口至美國的藥品以及半導體、智能手機等下游產品對美國國家安全影響的調查,這被市場廣泛視為對全球製藥領域以及半導體等行業徵收關税的前奏,並有可能令特朗普政府掀起的全球貿易戰進一步升級。

(2) 需求韌性考驗。經濟衰退風險 (高盛預測 12 個月內美國經濟衰退概率達到 45%) 背景下,新一輪換機週期的具體需求增長進程可能不如預期、潛在的摺疊屏智能手機,以及 iPhone 17 等創新消費電子與衰退環境下的消費支出疲軟形成動態平衡。

(3) 反壟斷尾部風險。美國司法部訴谷歌反壟斷案聽證會,可能要求谷歌大幅調整與蘋果的 TAC 協議,但高盛分析團隊仍然維持現有的 TAC 相關營收預測 (2024-2029 年 CAGR 10% 至大約 375 億美元)。據悉,在一份壟斷裁決報告中,美國法官指出,谷歌通過向蘋果等科技公司或其他利益方支付逾 260 億美元,使其搜索引擎成為智能手機和網頁瀏覽器上的默認瀏覽器選項,從而非法主導了線上搜索與線上廣告投放市場,有效地阻斷了任何其他競爭者的成功之路。

Apple Intelligence 驅動的新一輪換機週期才剛剛開始

高盛表示,蘋果股票 2025 年年初以來股價下跌了 20%(截至 2025 年 4 月 22 日),相對於美股大盤——標普 500 指數的表現極度不佳,可謂大幅跑輸大盤 (標普 500 指數同期下跌 10%),主要邏輯在於中國市場競爭激烈導致毛利率和營收增速方面的擔憂情緒升温,以及關税政策帶來的不確定性——由於蘋果的全球供應鏈佈局,這些因素對蘋果構成了影響。

儘管自 4 月 11 日美國商務部宣佈智能手機和個人電腦享受對等關税豁免以來,市場情緒有所改善 (4 月 4 日到 4 月 22 日期間蘋果股價反彈近 8%),但市場普遍認為關税政策不確定性和業績增長前景的不確定性仍是該股的懸頂之劍。

高盛分析團隊表示,Apple Intelligence 驅動的新一輪換機週期已經悄然拉開帷幕,有望驅動蘋果業績自下半年以來踏入顯著的上行增長軌跡。高盛預計年中時,市場情緒可能大幅升温,屆時金融市場的關注焦點將轉向年底之前發佈的新一代 iOS 系統以及更新迭代之後的功能更加強大的 “Apple Intelligence”(蘋果智能) 功能模塊,以及 2025 年秋季即將發佈的 iPhone 17 系列,高盛預計這些因素都將驅動市場對於蘋果股價以及整個 “果鏈” 的看漲情緒升温。

將人工智能大模型與 PC、智能手機等消費電子終端全面融合,打造出能夠在本地設備上離線運行推理性能愈發強大的大模型,同時也能夠調用龐大的雲端 AI 算力資源適配用户更深層次私人需求的 “端側 AI”,已經成為全球眾多科技公司 “AI 規劃藍圖” 的最核心內容。

在果粉們的 Siri 更新迭代設想中,雲端與端側 AI 大模型加持之下,蘋果 Siri 的定位或將不再是笨拙的形式化語音助手,通過結合雲端 AI 算力資源以及端側生成式人工智能功能,蘋果 iPhone 機型有望實現更符合用户個人需求的 “私人 AI 助理”,類似於電影《HER》那樣的 “全能 AI 伴侶”。蘋果公司曾表示,更新迭代後的 Siri 語音助手將能夠利用用户個人信息,在各類應用程序中回答問題並執行操作。

多次精準提前透露 iPhone 更新細節的蘋果產品爆料人馬克·古爾曼 (Mark Gurman) 近日發文稱,蘋果即將開始分析 “客户們設備端數據” 以改進其 iPhone 等消費電子端人工智能平台——即所謂的蘋果智能 (即 Apple Intelligence) AI 模塊,這一最新的獨家讀取性質的舉措旨在保護用户信息安全的同時,助力該公司追趕 AI 智能手機以及其他端側 AI 設備,乃至生成式 AI 領域的競爭對手們。

近期有不少 AI 研究團隊指出,過度依賴合成數據的做法存在巨大缺陷,比如實際的生成式 AI 工具曾出現通知信息誤讀,某些情況下無法提供準確的文本摘要,這些也是蘋果的 Apple Intelligence 功能自問世以來就被一些用户所詬病的核心影響因素。

理論上,經過真實世界校驗與詳細核對後的新系統可大幅提升 Apple Intelligence 的綜合性能,這也將是蘋果 Apple Intelligence 成為 AI 領域有力競爭者的關鍵一步。值得注意的是,蘋果公司人工智能團隊所推出的生成式 AI 產品長期落後於 AI 智能手機競品以及 OpenAI 等 AI 大模型領域的競品,近期蘋果公司甚至已經對數字版基於 AI 功能的 Siri 語音助手及相關軟件業務管理層進行改組。

根據另一華爾街大行摩根士丹利旗下 AlphaWise 的智能手機調查數據,蘋果公司新一代更先進 Siri 數字助手被消費者廣泛視作推動 iPhone 升級的 “頭號 AI 應用”。AlphaWise 調查結果顯示,“獲得更先進的 AI 功能” 首次躋身智能手機換代的前五大驅動力之一。其中,“升級後的 Siri 數字助手” 是全球潛在 iPhone 16 購買羣體中最感興趣的 Apple Intelligence 功能,重要程度超過了圖像相關優化、ChatGPT 整合等其他 AI 功能。

據瞭解,摩根士丹利週二發佈報告指出,Apple Intelligence 功能已獲得美國消費者高度認可,最新 AlphaWise 調研數據顯示,Apple Intelligence 的用户接受度 “好於預期”,消費者對其功能認知度顯著提升,並表現出明確的付費意願。調研數據顯示,過去六個月中,近 80% 符合條件的美國 iPhone 用户已下載並使用 Apple Intelligence 功能,多數用户評價其操作簡便、富有創新性且能顯著提升使用體驗。

摩根士丹利 AlphaWise 調研報告顯示,美國消費者平均願意為無限制使用 Apple Intelligence 支付每月 9.11 美元,較 2024 年 9 月的調研數據上漲 11%。此外,調查還顯示接近 42% 的受訪羣體表示下一代 iPhone 具備 Apple Intelligence 功能極其或非常重要的;而在未來 12 個月可能更換 iPhone 的用户中,這一比例達到 54%。