Trump's "tariff big stick" has crashed the Vietnamese stock market! Nike, Adidas, and Puma's stock prices have collectively plummeted

越南股指 VN 指數週四大跌 6.7%,創下自 2001 年以來最大單日跌幅,耐克美股暴跌超 13%,阿迪、彪馬等其他依賴越南製造業的美國企業股價全線大跌。關税預計將對越南經濟造成嚴重衝擊,然而,面對特朗普關税大棒,越南政府仍維持今年至少 8% 經濟增長目標不變。

特朗普的全球 “關税大棒” 終於落地,嚴重依賴對美出口的越南成了最大受害者之一。

據央視新聞,當地時間 4 月 2 日,美國宣佈對所有國家徵收 10% 的 “基準關税”,對美國貿易逆差最大的國家徵收個性化的更高 “對等關税”,其中對越南進口產品徵收高達 46% 的 “對等關税”,遠高於其他大多數國家。關税將於 4 月 9 日正式生效。

這明顯超出了市場預期,關税公佈後,全球股市應聲大跌,越南股市直接血崩。週四截止收盤,越南股指 VN 指數大跌 6.7%,創下自 2001 年以來最大單日跌幅。

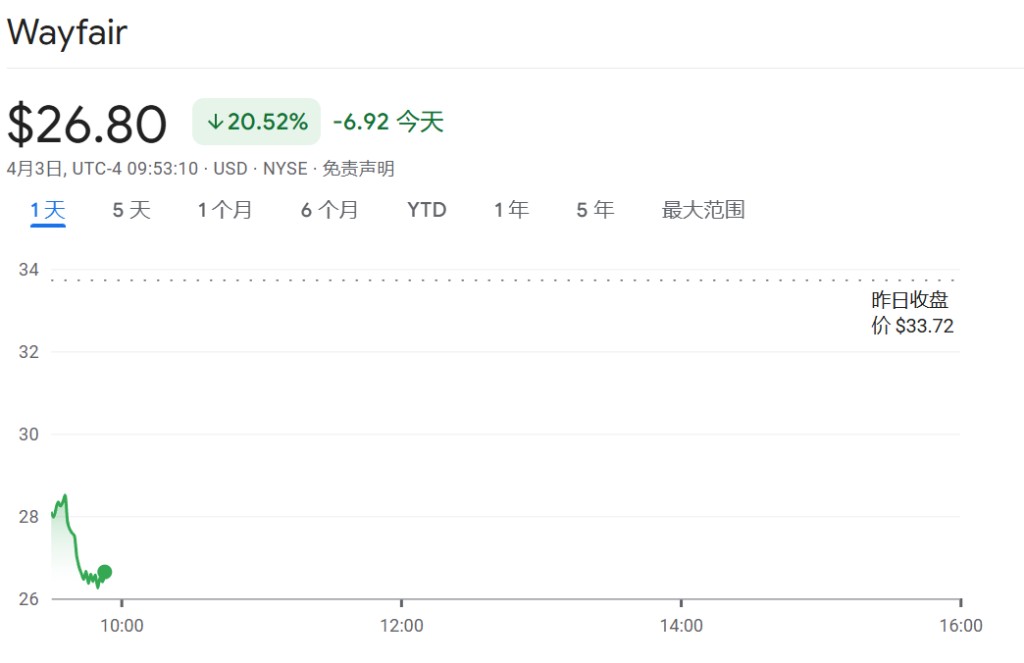

與此同時,依賴越南製造業的美股上市公司全線暴跌。週四美股盤初,耐克一度暴跌 13%,Five Below 和 Wayfair 跌超 21%,SharkNinja 和斯凱奇跌超 17%,Gap 跌 16.8%,ELF 跌 14.9%,安德瑪跌 14.8%,百思買跌 14.5%,德克斯户外跌 13.3%,彪馬跌超 12%,阿迪達斯跌超 7%。

此次關税政策可能意味着需要重新評估全球供應鏈戰略佈局,尤其是那些在越南擁有大量製造業投資或依賴越南進口的企業面臨重大風險。

8% 的經濟增長目標,還能保住嗎?

美國是越南最大的出口市場,2024 年越南對美出口額高達 1420 億美元,佔其 GDP 的近 30%。然而,越南對美國的貿易順差在 2024 年達到了超過 1200 億美元,成為美國第三大貿易逆差來源國。這一巨大的順差正是引發特朗普政府不滿的主要原因。

這也意味着,特朗普政府的關税政策將對越南經濟造成直接且實質性的衝擊。根據高盛此前的分析,若美國將對越關税提高 10%,越南的 GDP 增長可能受到約 1% 的拖累。如今 46% 的關税將對越南經濟造成更加嚴重的衝擊。

在這種情況下,越南今年經濟增長至少 8% 的目標,無疑面臨巨大的挑戰。

面對這一嚴峻形勢,越南政府總理範明政在特朗普宣佈關税政策後,立即召開緊急政府會議,商討應對策略。在會後發表的一份政府聲明中,越南仍維持今年至少 8% 經濟增長目標不變。

越南總理範明政表示:

這是一個調整經濟結構、實現快速而可持續發展的機會……擴大市場,使產品市場和供應鏈多樣化,並促進本地化。

此前,越南曾試圖通過一系列 “魅力攻勢” 來避免美國關税的打擊,包括削減對美進口關税,甚至為特朗普集團在越南的高爾夫球場和酒店投資提供支持。然而,這些努力顯然未能奏效,美國依然對越南實施了高關税。

誰將受到最大沖擊?

美國對越南的新關税政策,預計將對依賴越南製造業的美國企業造成重大沖擊,尤其是服裝、鞋類、傢俱和玩具行業。

在鞋履行業,耐克一半的鞋和近三分之一的服裝生產集中在越南,阿迪達斯有 39% 的鞋類和 18% 的服裝依賴於越南工廠,UGG、Hoka 母公司 Deckers Brands、VF Corporation(Vans 母公司)等其他主要鞋履品牌也高度依賴越南的生產能力。

另據美國鞋類經銷商與零售商協會(FDRA)的數據,2023 年美國近三分之一的鞋類進口來自越南,越南在美國鞋類供應鏈中的地位可見一斑。

傢俱行業同樣面臨挑戰。根據投行 Mann, Armistead & Epperson 數據,2023 年,美國 26.5% 的傢俱進口來自越南。美國最大居家電商 Wayfair 和越南傢俱生產商有緊密的合作,美股盤初,Wayfair 股價重挫 21%。

而在玩具行業,孩之寶、SpinMaster、美泰和蠟筆等知名玩具製造商均與越南 GFT 集團建立了緊密的合作關係。該集團在越南北部運營着五座生產設施,僱傭了超過 1.5 萬名工人。

製造商下一步該何去何從?美國牛仔褲和服裝品牌 American Eagle Outfitters 首席財務官 Michael Mathias 在此前的財報電話會上表示,計劃將把公司位於越南的生產比例下降至個位數。

全球產業鏈重塑困境:沒有贏家的零和遊戲?

從當前形勢來看,特朗普的關税政策可能不僅不能促進美國製造業回流,反而可能加劇全球經濟衰退風險,堪稱一場 “殺敵一千,自損八百” 的零和遊戲。

關税政策公佈後,全球股市和債券收益率同步暴跌,兩者的相關性達到兩年來的最高水平。這表明市場正在為可能到來的全球經濟衰退做好準備。

美國家居用品製造巨頭 Baum Essex 首席財務官兼首席運營官 Peter Baum 沮喪表示,對等關税將對他的公司造成巨大損害。在 2019 年特朗普第一屆政府期間,Baum Essex 將工廠從中國遷至菲律賓、柬埔寨、越南和印度。

Baum 還説:

這就是全球經濟衰退的開始。經過 80 年和五代人的努力,特朗普讓我們破產了。

隨着 4 月 9 日關税正式生效日期的臨近,市場將密切關注越南政府的應對措施以及全球供應鏈的進一步調整。正如花旗所指出的,4 月 2 日或許只是 “貿易戰 2.0” 的一個階段性節點,而非終點。