Concerns about a U.S. recession combined with renewed tensions in the Middle East have pushed gold above $3,000, setting a new historical high

週二現貨黃金上破 3020 美元/盎司,再創歷史新高,日內漲幅為 0.66%。美國零售銷售不及預期,為經濟前景蒙上陰影,再加上中東戰火重燃,提振避險黃金需求。

週二 3 月 18 日,黃金、白銀價格再度攀升,續創紀錄新高,原因是投資者對美國經濟放緩的擔憂日益加劇,以及中東緊張局勢升級進一步凸顯了黃金的避險吸引力。

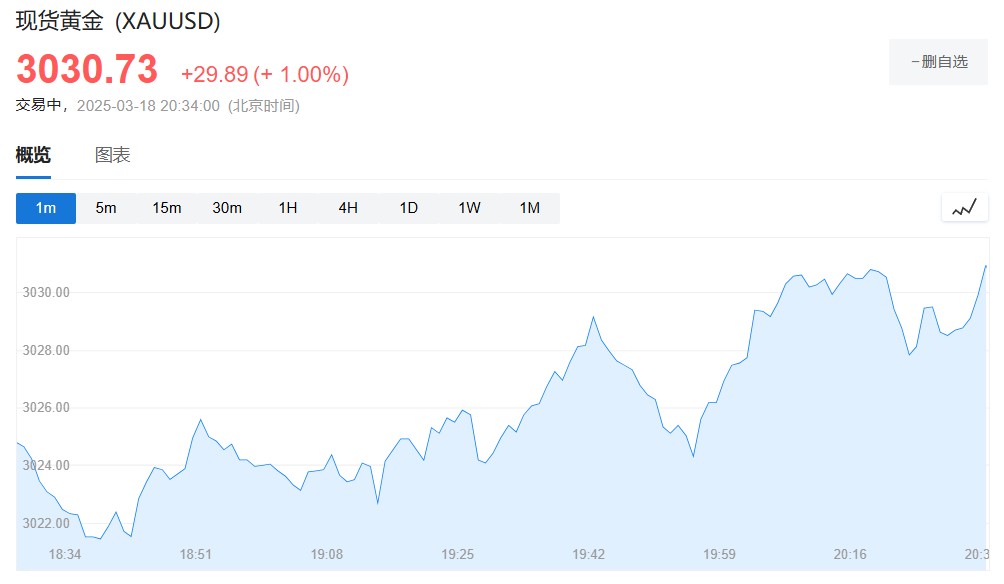

截止發稿,現貨黃金上破 3030 美元/盎司,再創歷史新高,日內漲幅為 1%。

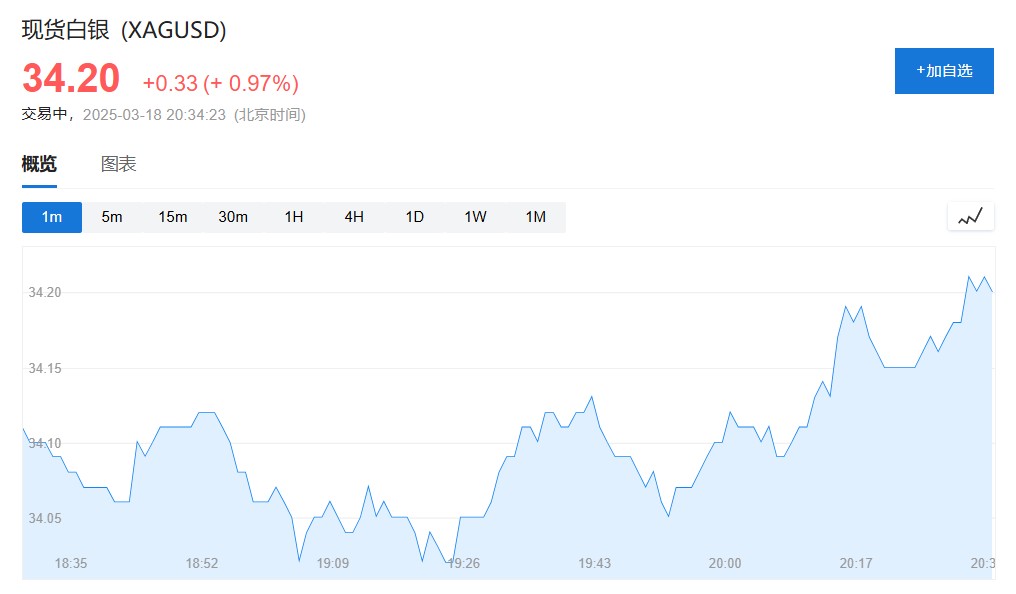

現貨白銀站上 34 美元/盎司,日內漲近 1%。

脆弱的經濟數據,吹響衰退號角?

美國最新公佈的零售銷售數據令人失望。週一(3 月 17 日),美國商務部公佈的數據顯示,美國 2 月零售銷售環比 0.2%,遠不及預期的 0.6%,前值由-0.9% 下修至-1.2%,引發了人們對消費者支出放緩的擔憂。

數據公佈之後,10 年期美國國債收益率應聲下跌,提振金價走勢。由於近期出爐的經濟數據顯示,美國消費者信心惡化,通脹預期升温,再加上美國總統特朗普的關税政策變化無常,市場對於美國經濟衰退擔憂日益加劇。

中東戰火重燃,避險情緒升温

除了令人不安的經濟數據,地緣政治風險也黃金的走勢火上澆油。以色列週二表示,已對加沙的哈馬斯目標發動了軍事打擊,這有可能破壞脆弱的停火協議。巴勒斯坦居民報告説,加沙地帶多個地區遭到以色列多次空襲。地緣政治緊張局勢的升級,無疑增加了黃金作為避險資產的吸引力。

今年迄今為止,金價已上漲超過 14%,延續了 2024 年的強勁漲勢。最近幾周,華爾街多家投行紛紛上調了今年的金價目標。

瑞銀認為,未來四個季度,黃金價格將達到每盎司 3200 美元。瑞銀分析師 Wayne Gordon 和 Giovanni Staunovo 在研報中指出,特朗普計劃於 4 月 2 日實施的廣泛互惠關税和額外的行業特定關税,將成為刺激市場持續尋求避險的風險事件。

據華爾街見聞此前報道,幾周之前,高盛大幅上調 2025 年底金價預期,預計 2025 年底金價將達到 3100 美元/盎司,高於此前預測的 2890 美元/盎司。同時,高盛貴金屬研究團隊重申 “做多黃金” 的投資建議,指出各國央行的長期買盤需求是推動金價持續走高的核心因素。