Industrial Securities: The current valuation of Hong Kong stocks still has room for improvement and is significantly discounted compared to U.S. stocks

兴业证券发布研报指出,港股当前估值相对美股存在明显折价,且在多个行业中,港股的 EPS 增速占优。尽管港股经历了大幅上涨,但恒生指数和恒生科技指数的绝对估值和相对美股估值仍显示出提升空间。具体数据显示,恒生指数 PE_TTM 为 10.36,恒生科技 PE_TTM 为 24.69,均低于历史高点,表明港股在估值上仍有上升潜力。

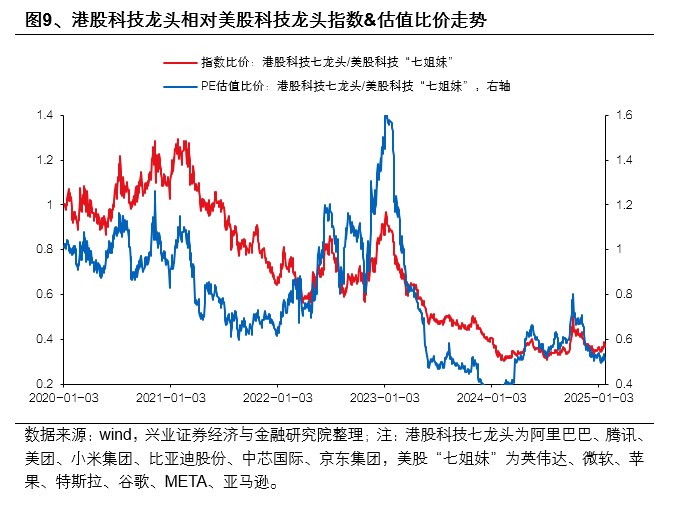

智通财经 APP 获悉,兴业证券发布研报称,今年以来港股引领中国资产,吸引全球投资者关注。经历近期的大幅上涨后,从宽基指数层面,以恒生指数和恒生科技指数为例,无论是绝对估值、ERP,还是相对美股估值,均展现出一定的折价与提升空间;行业对比中,多数港股行业较美股显著折价,且部分行业在估值与盈利增速上优势明显;龙头企业层面,港股科技龙头较美股科技存在显著折价,众多港股公司相较可对标美股也被低估。

兴业证券主要观点如下:

(一) 宽基指数

从绝对估值来看,截至 2 月 26 日,恒生指数 PE_TTM 分别为 10.36,处于近五年 65.1% 的分位数水平,略低于 23 年 1 月 27 日股价高点的水平,较 21 年 2 月 17 日的高点还存在 40.8% 的折价。

从绝对估值来看,截至 2 月 26 日,恒生科技 PE_TTM 分别为 24.69,处于近五年 29.6% 的较低分位数水平,相比 23 年 1 月还有超 130% 的提升空间,较 21 年 2 月 17 日折价 50.3%。

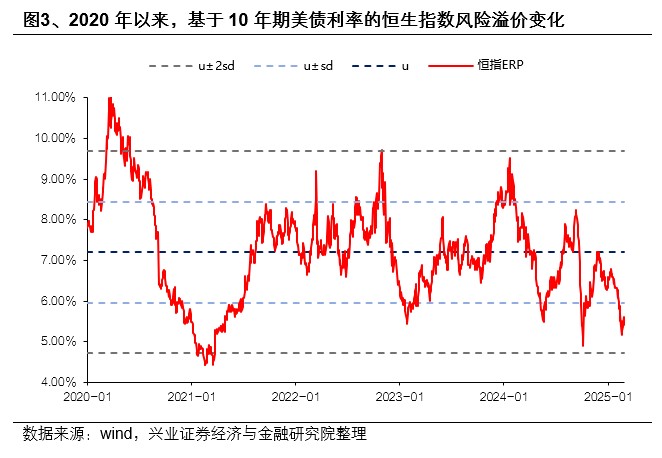

从 ERP 来看,截至 2 月 26 日,恒生指数 ERP(基于 10 年期美债利率,全文同) 为 5.4%,处于近五年 6.7% 的分位数水平,已向下突破均值-1 倍标准差的水平,和 23 年 1 月的水平相当,较 21 年 2 月 17 日还有 1% 的下降空间 (假设 10 年期美债利率不变的话,隐含的估值提升空间为 11.3%)。

从 ERP 来看,截至 2 月 26 日,恒生科技 ERP 为-0.2%,处于近五年 30.4% 的分位数水平,尚未突破均值-1 倍标准差,但已低于 21 年 2 月的水平,较 23 年 1 月 27 日还有 1.6% 的下降空间 (假设 10 年期美债利率不变的话,隐含的估值提升空间为 65.7%)。

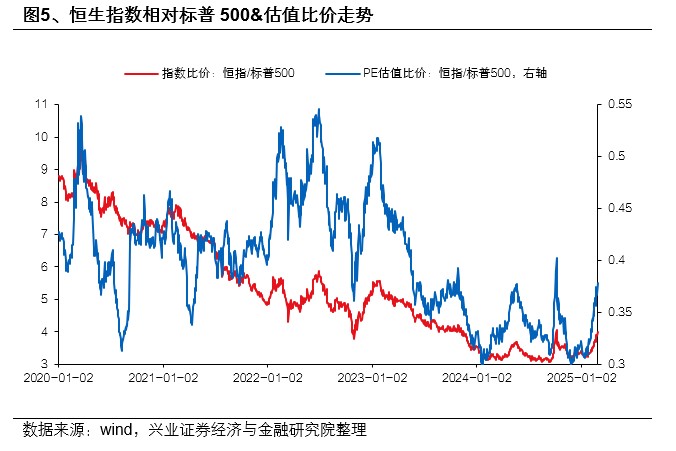

从相对美股估值来看,截至 2 月 26 日,恒指较标普 500 相对 PE 为 0.38,处于近五年 38.5% 的中等偏低分位数水平。按照当前美股估值推算,恒指较 23 年 1 月 27 日还有 35.7% 的提升空间,较 21 年 2 月还有 13.3% 的提升空间。

从相对美股估值来看,截至 2 月 26 日,恒生科技较纳斯达克 100 相对 PE 为 0.70,处于近五年 32.9% 的中等偏低分位数水平。按照当前美股估值推算,恒生科技较 23 年 1 月还有 199.4% 的提升空间,较 21 年 2 月还有 69.7% 的提升空间。

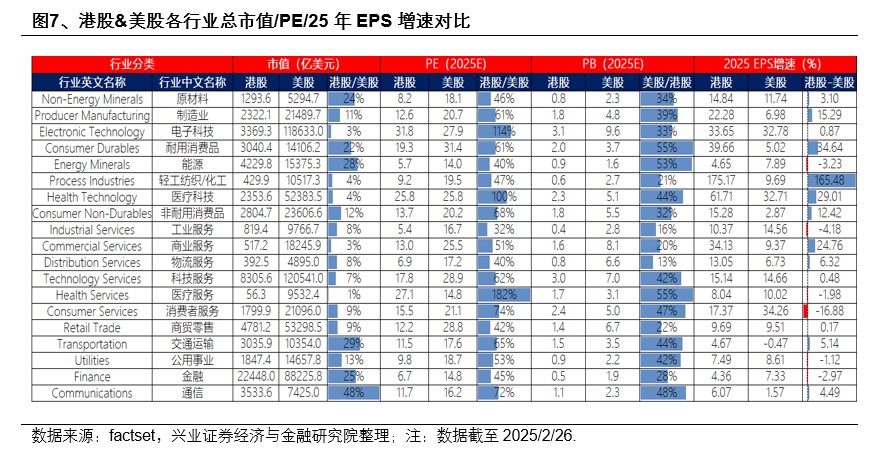

(二) 行业

对比港股和美股 25 年预期 PE 和 PB,该行发现多数港股行业显著折价。具体而言,港股商贸零售 (含阿里巴巴)、原材料、金融和能源等板块较美股折价超 50%,而电子科技、医疗服务、医疗科技等部分港股行业估值高于美国对应行业。进一步从 PE-G 框架来看,以互联网为代表的港股多数行业估值相对美股折价且 25 年 EPS 增速占优。

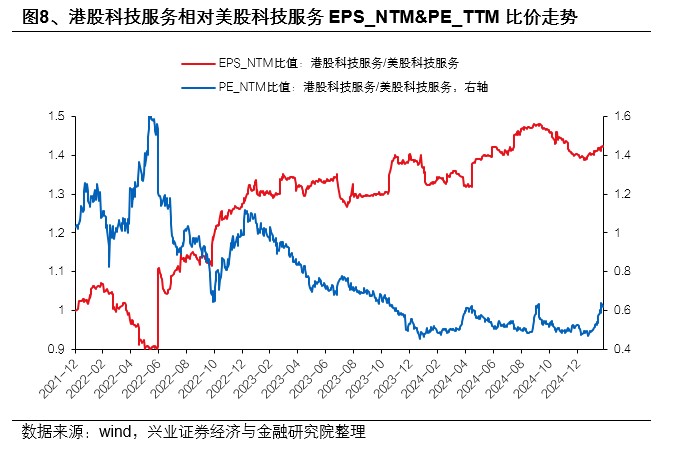

其中,作为本轮 AI 行情的主线和港股最核心的科技服务行业 (包括腾讯、网易、百度、阿里健康、金山云等),其 EPS 优势较美股同类 (包括微软、甲骨文、IBM、Palantir、Servicenow 等) 持续提升,但估值折价却不断扩大。此外,原材料、能源、物流服务、金融、公用事业、交通运输商业服务等行业较美股同类行业同样具备估值和盈利的优势。

(三) 龙头企业

整体来看,港股科技龙头较美股科技显著折价。截至 2 月 26 日,港股科技七龙头较美股科技 “七姐妹”(个股名单见图表 10 备注) 相对 PE 为 0.71,处于近五年 44.2% 的中等分位数水平。按照当前美股估值推算,港股科技七龙头较 23 年 1 月还有 117.9% 的提升空间,较 21 年 2 月还有 55.8% 的提升空间。

具体到个股来看,基于自下而上梳理出的各行业市值靠前且有特色业务的港股公司,无论从 25 年预期 PB 还是 PE 来看,其大多相对可对标美股存在一定低估。其中,理想汽车、比亚迪股份、京东、工商银行、中石油、阿里巴巴、百度、安踏等企业较美股性价比依然较高。

风险提示:本文为数据分析报告,不构成对行业或个股的推荐和建议