U.S. stock market performance is weak, will actively managed funds 迎来春天?

At the beginning of 2025, the performance of individual stocks in the stock market became increasingly polarized, with over 49% of S&P 500 constituents outperforming the index, creating opportunities for actively managed funds. The S&P 500 has risen 2.4% year-to-date, while less than 30% of constituents outperformed the index in 2023 and 2024. Financial experts believe that the rise in individual stock differentiation is a positive signal for active management strategies, potentially ushering in a "golden era." The individual stock differentiation index from Cboe Global Markets recently hit a three-year high, reflecting improvements in corporate earnings and market uncertainty

At the beginning of 2025, the stock market has shown new characteristics, with a significant increase in the degree of differentiation in individual stock performance, allowing more stocks to outperform the S&P 500 index. After experiencing a highly concentrated market performance over the past two years, this change provides investors with broader opportunities, especially for stock pickers looking to beat the benchmark index.

According to Zhitong Finance APP, as of last Friday, the S&P 500 index has risen 2.4% year-to-date, with over 49% of its constituent stocks outperforming the index. If this trend continues, it will mark the broadest market participation since 2022. In contrast, in 2023 and 2024, less than 30% of S&P 500 constituents were able to outperform the index. At that time, the market's rise was primarily driven by a few mega-cap tech stocks, particularly NVIDIA (NVDA.US), leading to the S&P 500's gains exceeding 20% for two consecutive years. This phenomenon last occurred in 1998 and 1999.

This change, along with options traders expecting greater performance disparities among individual stocks, may signal the arrival of spring for actively managed funds. Financial experts have indicated to the media that the increased differentiation in individual stock performance is a positive signal for active management investment strategies.

Ben McMillan, Chief Investment Officer of IDX Advisors, stated, "The increased degree of market differentiation is good news for active management." He even believes that active investment strategies may be entering another "golden age."

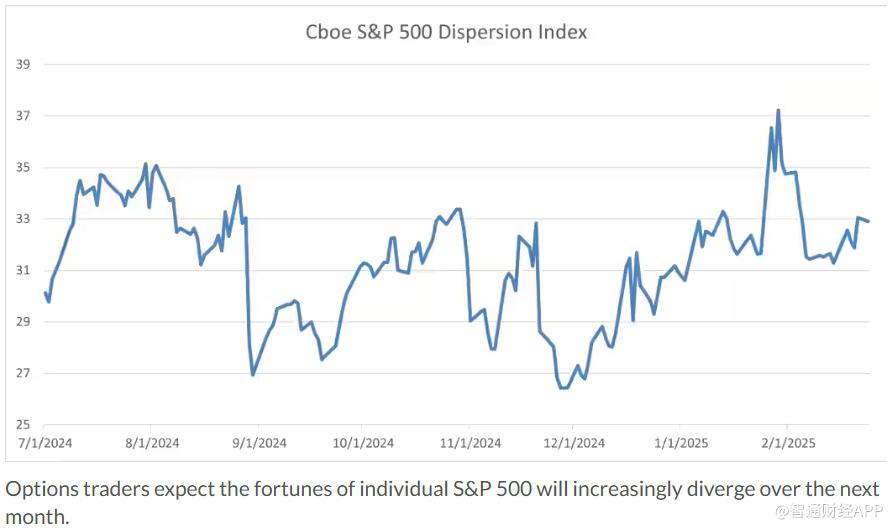

The Dispersion Index of individual stocks at the Chicago Board Options Exchange (Cboe) has recently continued to rise, reaching a three-year high at the end of January. Typically, this index declines during corporate earnings season, but it has been rising in recent weeks.

The reasons for this phenomenon are as follows:

-

Improvement in corporate earnings: In the fourth quarter of 2024, the market generally expects earnings growth to become more widespread rather than concentrated among the "seven giants." This situation is indeed gradually being realized, reducing the extreme concentration in the market.

-

Uncertainty in the market and economy: Investors are beginning to focus on the risks that President Trump's policy agenda may bring, as well as whether large-scale investments by companies in artificial intelligence infrastructure are wise. Additionally, the fundamental stability of the U.S. economy is also being questioned.

-

Uncertainty regarding artificial intelligence, tariffs, and macroeconomic prospects: Mandy Xu, head of derivatives market intelligence at Cboe, stated in a media interview that even though the earnings season has ended, the volatility of individual stocks remains high, primarily influenced by AI investments, tariff policies, and economic outlook.

and Vistra (VST.US), they were almost certain to underperform the S&P 500 index.

In the first half of 2024, the performance of actively managed funds remains challenging, particularly for funds investing in U.S. and global equities. Anu Ganti, head of U.S. index investment strategy at S&P Dow Jones Indices, stated, "The first half of 2024 is likely to be recorded in history as another difficult period for the active management industry."

It is noteworthy that market styles are changing. The previously overvalued information technology sector has recently underperformed, while undervalued sectors such as consumer staples, financials, and healthcare have seen good gains at the start of 2025.

Most companies among the "seven giants" have performed poorly since the beginning of 2025, with the only exception being Meta (META.US), whose stock price surged significantly at the start of the year. Other members either declined or remained flat. However, despite a decrease in market concentration, the top 10 stocks by market capitalization in the S&P 500 index (including all "seven giants") still account for over 37% of the total market capitalization of the index. This proportion has, however, retreated from its peak in 2024.

Jeff Schulze, head of economic and market strategy at ClearBridge Investments, pointed out that historical data shows that when the concentration of the S&P 500 index exceeds 24%, equal-weighted indices tend to outperform market-cap-weighted indices in the following years. This pattern has been validated 96% of the time since 1989.

Although the historical sample is small, this pattern still appears applicable at present. Since 2025, the Invesco S&P 500 Equal Weight ETF (RSP.US) has risen nearly 3%, while the S&P 500 index has only increased by 2.3%.

In addition to the U.S. market, global stock markets are also on a strong upward trend. European and Chinese stock markets have recorded double-digit gains in 2025, far exceeding the S&P 500 index. Meanwhile, as actively managed funds continue to underperform benchmark indices, investors are increasingly shifting their funds to lower-cost index ETFs. Among them, the Vanguard S&P 500 ETF (VOO.US) has recently surpassed the SPDR S&P 500 ETF Trust (SPY.US) to become the largest ETF in the U.S., with assets under management reaching $632 billion