After giving up on bearish views, Morgan Stanley continues to be bullish on the Chinese stock market: foreign capital has not yet truly participated, and they still have significant allocation space

大摩中国首席股票策略师 Laura Wang 表示,尽管 A 股和港股自 1 月底以来已经出现显著上涨,但外资尚未真正参与这轮反弹,仍有很大的配置空间。大摩邢自强团队指出,近期的技术突破、民营企业座谈会以及阿里巴巴的高额资本支出计划是 “动物精神” 回归的早期迹象。

摩根士丹利在放弃看空立场后,继续表达了对中国股市的乐观预期。

摩根士丹利中国首席股票策略师 Laura Wang21 日在接受彭博采访时表示,尽管 A 股和港股自 1 月底以来已经出现显著上涨,但外资尚未真正参与这轮反弹,仍有很大的配置空间。她表示:

"投资者对中国的配置仍然严重不足。因此,他们从现在开始增加配置还有很大空间。"

Laura Wang:外资还有很大配置空间

根据大摩的分析和数据显示,推动这波反弹的主要增量资金来自 “南向交易”,即通过沪港通和深港通流入香港市场的内地资金。今年迄今为止,已有高达 250 亿美元的资金流入香港。此外,一些区域性和专注于中国市场的基金也积极参与了这轮反弹。

然而,值得注意的是,总部位于美国或欧洲的积极管理型基金或被动型基金,尚未真正参与到这轮反弹中来。这意味着,大量潜在的外资仍在场外观望。Laura 表示:

“如果你看美国或欧洲的主动型基金或被动型基金,他们实际上还没有真正参与地缘政治变化、中国技术创新突破以及周一座谈会(引发的市场反弹)。”

大摩认为,几个关键因素的变化正在提升中国市场的吸引力。首先,地缘政治局势的缓和为市场注入了信心。其次,中国在技术创新方面的突破,特别是在 2 月 17 日召开的民营企业座谈会释放强烈信号,进一步增强了市场的长期增长潜力。

Laura 强调,这些积极变化发生得非常迅速,许多投资者对中国市场的配置仍然严重不足。因此,外资未来有很大的空间增加对中国股市的配置。

20 日,Laura Wang 团队发文表示转向看多中国股市,预计 MSCI 中国指数有望再涨 4%。报告表示,中国股市(尤其是离岸市场)终于发生了结构性的质变,这让人比去年 9 月的反弹更加确信,MSCI 中国指数近期表现的改善能够持续。

此前,大摩一直对中国股票持谨慎态度。有观点指出,大摩此次上调评级是一个大转向,表明全球投资者对中国市场的态度可能正在发生根本性转变。即使在 10 月份,当中国的货币刺激举措引发股市大涨时,摩根士丹利几乎不改其志——只是缩减了其低配仓位。

邢自强:中国市场 “动物精神回归”

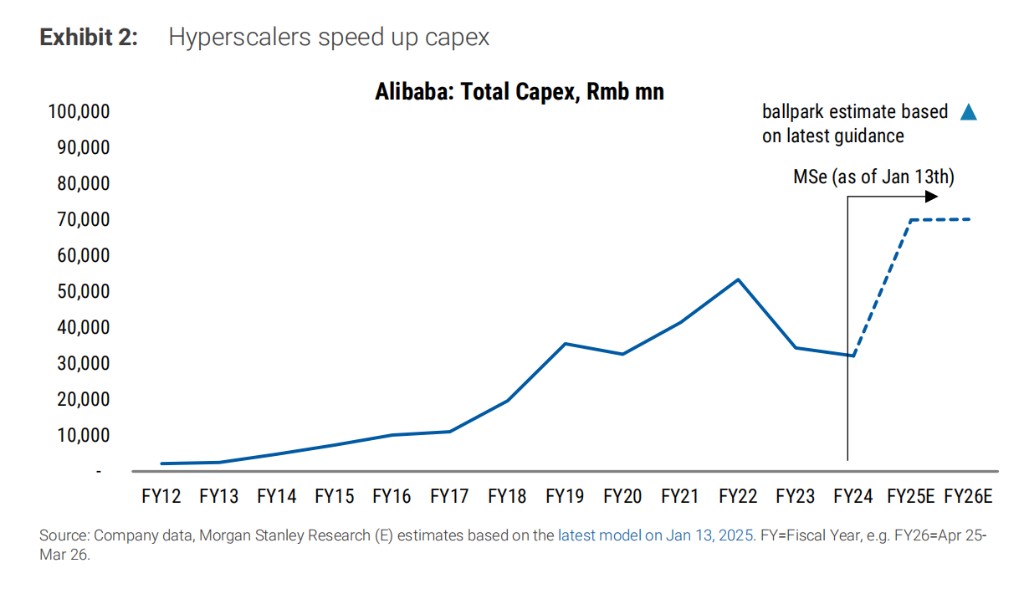

21 日,摩根士丹利中国区首席经济学家邢自强团队发表研报也指出,近期的技术突破、民营企业座谈会以及阿里巴巴的高额资本支出计划被认为是 “动物精神” 回归的早期迹象,不过这种精神目前仅限于科技行业。

报告提到,本次座谈会的重点转向了人工智能、机器人技术和自动驾驶等新兴技术领域。摩根士丹利认为,这种政策导向的变化反映了中国经济发展优先级的调整,科技行业正逐渐成为推动经济增长的新引擎。

与此同时,阿里巴巴宣布的资本支出计划大幅超出市场预期,显示出科技行业对未来发展的强烈信心。分析指出,国内成本效益较高的大型语言模型(LLMs)降低了训练和推理成本,这将推动相关技术的更快普及和应用。