Trump's second term sees a resurgence of "whimsicality," and U.S. stock investors urgently need a new action guide

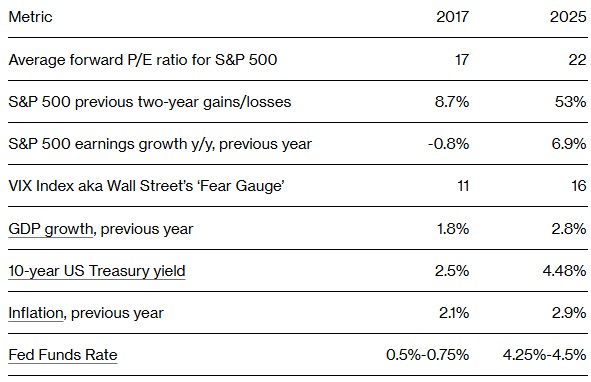

Former U.S. President Donald Trump's erratic attitude towards tariffs has led to significant market fluctuations, presenting new challenges for investors. Compared to his first term, current market volatility is higher, with the S&P 500 index rising a cumulative 53% in 2023 and 2024. Analysts recommend adopting defensive investment strategies and staying alert to potential trade wars and changes in the macro environment. Although the economy continues to grow, the outlook for U.S. stocks is concerning, as any vulnerabilities could disrupt the market

According to the Zhitong Finance APP, last week, U.S. President Donald Trump’s erratic attitude towards his signature tariffs caused significant market turbulence. Investors attempting to adjust their stock portfolios to cope with this ongoing uncertainty found that referencing the former president's strategies from his first term was not very helpful.

Trump's strategy remains unchanged, promising to impose aggressive tariffs on trade partners and then quickly retracting them, either delaying their implementation or completely canceling them. Beyond that, basically everything else is changing.

First, the range of goods affected by the proposed tariffs will be broader than during his first term. More importantly, investors are in a completely different, more volatile paradigm. The S&P 500 is experiencing a hot upward momentum, cumulatively rising 53% in 2023 and 2024, pushing valuations to bull market highs. In contrast, the S&P 500 had a total increase of only 8.7% over the previous two years in 2017, which allowed for greater room for stock price increases after Trump took office.

For Tim Hayes, Chief Global Investment Strategist at Ned Davis Research, this means adopting a defensive approach when allocating risk assets. He stated, “If tariffs trigger a trade war, leading to rising bond yields, a deteriorating macro environment, and a massive outflow from the tech sector and U.S. markets,” the company’s investment model may consider reducing stock allocations.

This caution underscores that the macro environment has also changed. Inflation is intensifying, and interest rates are much higher. Compared to eight years ago, the federal deficit is a more pressing issue. In summary, although the economy is still thriving, the backdrop for U.S. stocks is much more concerning.

Todd Sohn, ETF and Technical Strategist at Strategas Securities LLC, stated, “We are in a high-expectation environment as the bull market enters its third year, whereas in 2017 we had just emerged from a bear market. When any form of weakness appears, any catalyst could disrupt the market.”

Higher Exposure

Data compiled by Mislav Matejka, Global Equity Strategist at JP Morgan, shows that asset management companies' exposure to stock futures is currently above 40%. In 2017, this ratio was below 10%. This means that compared to Trump’s first term, investors have much less “dry powder” to buy stocks in the coming months.

From one indicator, investor expectations for the stock market have never been so high at the beginning of a presidential term. Charlie Bilello, Chief Market Strategist at Creative Planning, stated that at the end of January, the cyclically adjusted price-to-earnings ratio (CAPE) was close to 38, which is an “extremely high” level.

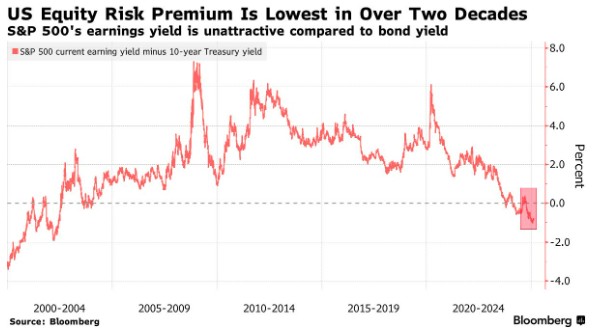

“Historically, this means that the stock market's return over the next 10 years will be below average,” he added The position situation is also very similar. The equity risk premium (ERP) in the U.S. stock market, which measures the expected return difference between stocks and bonds, is deeply entrenched in negative territory, something that has not occurred since the early 2000s. Whether this is a negative indicator for stock prices depends on the economic cycle. Lower numbers can be seen as indicating that corporate profits will rise, but they may also suggest that stock prices have risen too quickly, far exceeding their actual value.

However, so far, the fourth-quarter earnings season has shown a disturbing trend. Fewer U.S. companies are exceeding earnings expectations, tariff negotiations are dominating earnings call discussions, and the outlook for 2025 has begun to be impacted.

Due to investor concerns that tariff factors will affect this year's automotive industry earnings, Ford Motor Company (F.US) and General Motors (GM.US) saw their stock prices plummet after announcing earnings. Industrial giant Caterpillar (CAT.US) is seen as a representative of the trading tensions, as the company warned that revenues would decline under demand pressure, and the rising prices of the high-priced equipment it sells would only worsen the situation.

Reducing Bubbles

Meanwhile, some investors are focusing on niche markets within the stock market, where valuation bubbles are smaller and historical patterns are more favorable. Scott Welch, Chief Investment Officer of the securities investment firm Certuity, is reallocating funds to a sector that typically performs well when the Federal Reserve cuts interest rates but has been forgotten by the market: mid-cap stocks.

Welch stated in an interview, "The pricing of large-cap tech giants is perfect, so it won't cause too much disruption. They have been rising because they have strong earnings and cash flow, but nothing is eternal."

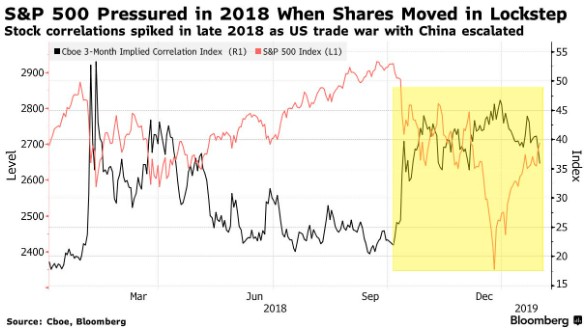

Large-scale macro risks, such as Trump's tariffs, often cause the stock market to move like a giant boulder. In fact, stock prices became highly correlated at the end of 2018, when U.S.-China trade tensions were brewing, and the path of the Federal Reserve's interest rate policy had a broad impact on the stock market. The Chicago Board Options Exchange (CBOE) three-month implied correlation index soared at that time, and the S&P 500 index recorded its largest annual decline since the global financial crisis.

Currently, this correlation index hovers near historical lows, indicating that stock market movements are not consistent. This is generally a healthy signal for the market, suggesting that company-specific fundamentals have a greater impact on macroeconomic developments. However, the downside is that it exposes investors to more risk Ultimately, in this situation, the biggest challenge facing investors is interpreting the political winds and figuring out the direction the Trump administration will take regarding tariffs and trade policies. The lack of clarity has prompted many Wall Street professionals to closely monitor everything, but no action has been taken yet.

Mark Newton, the Chief Technical Strategist at Fundstrat, stated, "We always tell investors not to focus on politics, as politics rarely has a direct impact on the stock market. There are always terrifying things for investors to worry about each year, but overall, the stock market has remained relatively resilient."