CITIC Construction Investment: Tariffs land, gold soars, copper and aluminum resist decline and lie in wait

中信建投發佈研報指出,春節假期受 DeepSeek 和特朗普關税新政影響,黃金價格創歷史新高,美元和美債走強,大宗商品價格普遍下跌。美聯儲偏鴿派表態及低於預期的美國 GDP 推動黃金上漲,工業金屬如銅鋁在流動性寬裕和消費需求增長的背景下,表現出抗跌特性。關税政策的不確定性進一步增強了黃金的避險屬性。

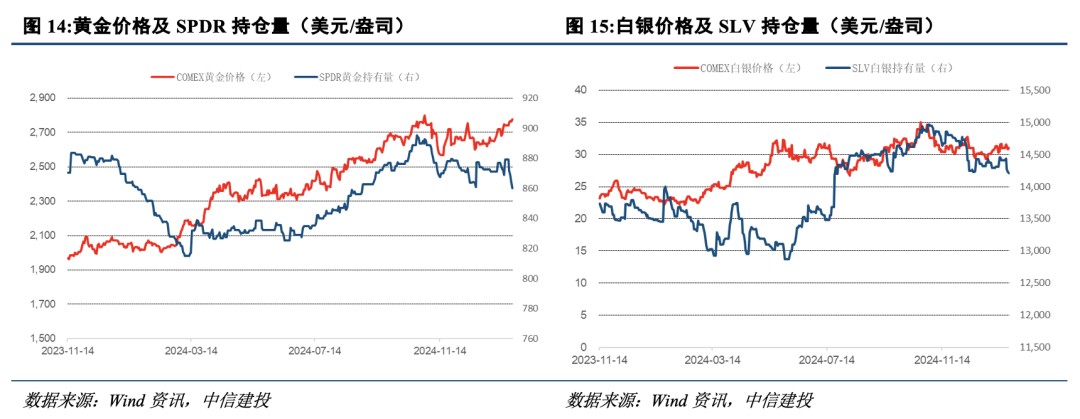

智通財經 APP 獲悉,中信建投發佈研報稱,春節假期,DeepSeek 和特朗普關税新政兩條主線主導海外資產避險情緒,黃金領漲創歷史新高,美元、美債走強,大宗商品價格多數下跌。美聯儲 1 月議息會議表述偏鴿而美國四季度 GDP 低於預期,特朗普政府大面積徵收關税強化主要經濟體的對抗情緒,均有利於黃金價格挑戰新高,黃金股有望盈利修復。此外,流動性寬裕背景下,消費相對確定疊加供應受限的基本金屬也仍是推薦配置的方向。

中信建投主要觀點如下:

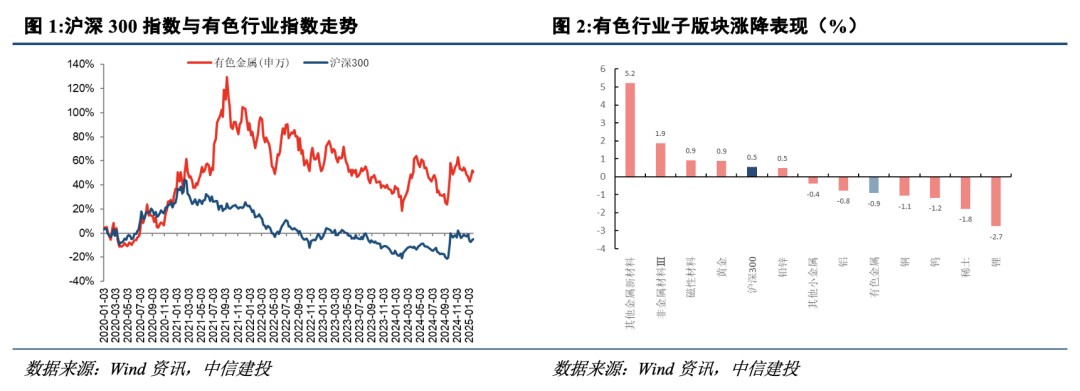

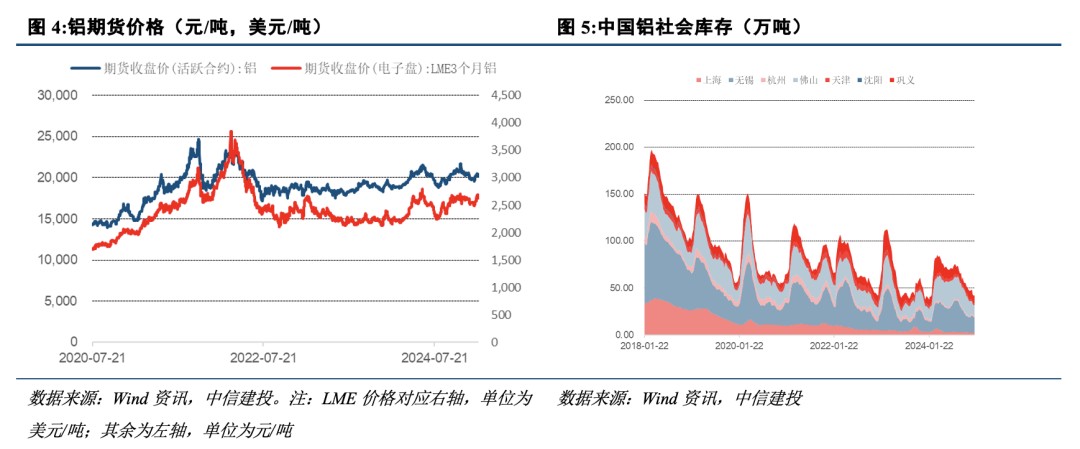

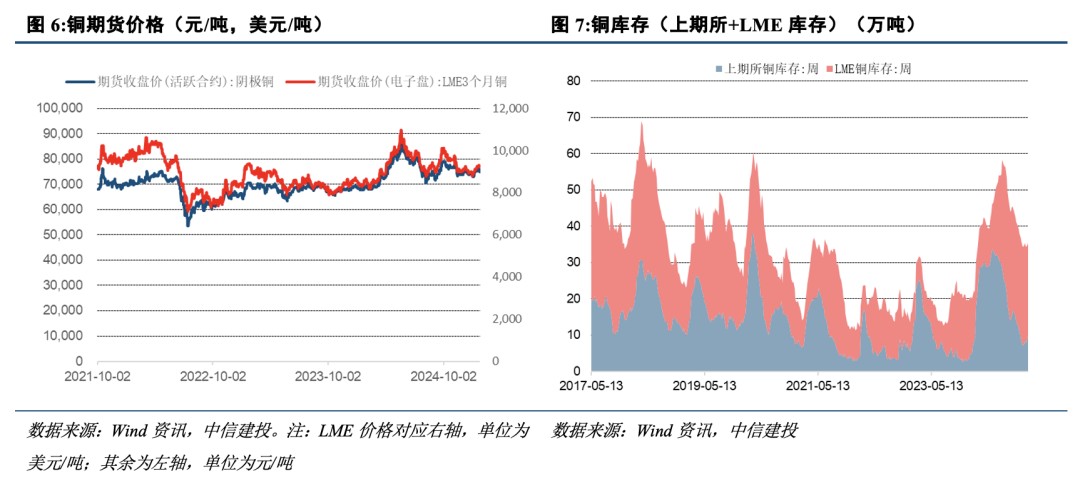

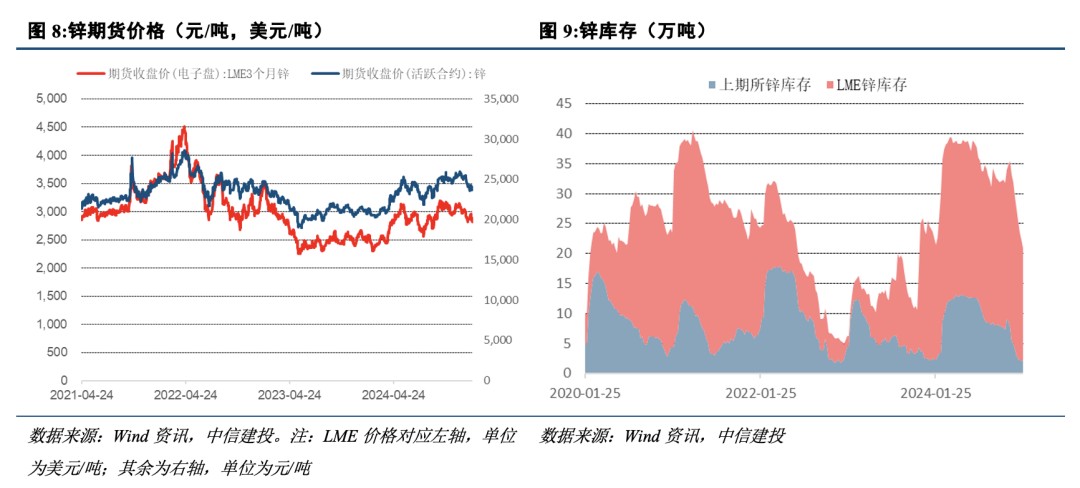

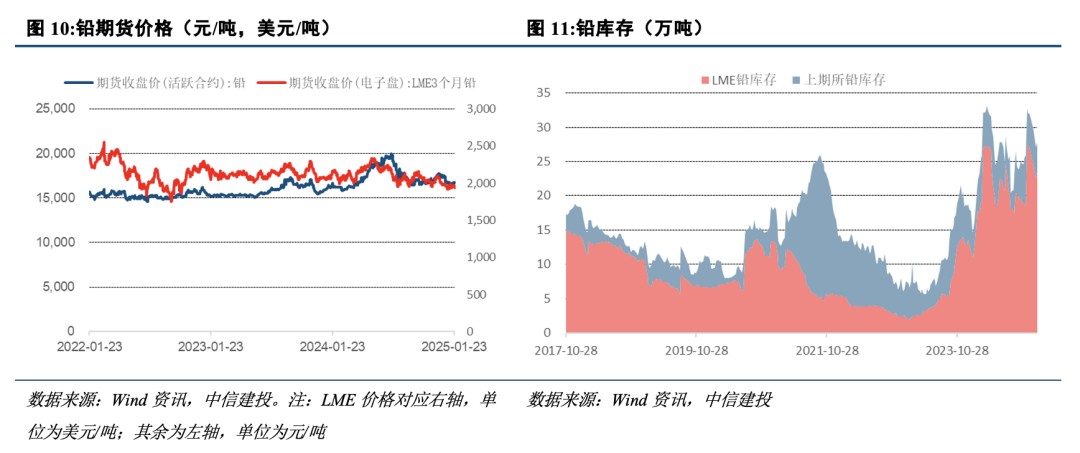

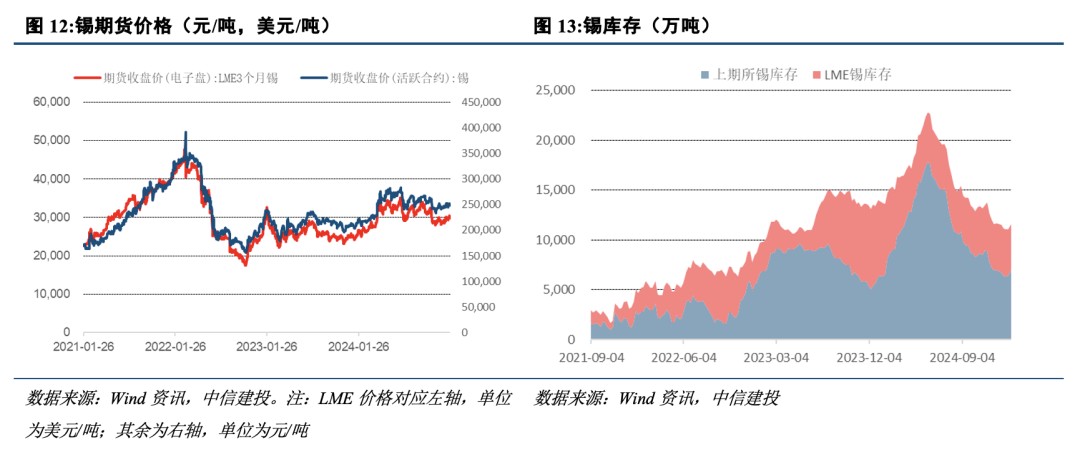

工業金屬:節前一週 LME 銅、鋁、鉛、鋅、錫價格變化為 1.0%、-1.8%、-1.5%、-4.1%、1.0%;春節期間 (1 月 27 日至 2 月 3 日) LME 銅、鋁、鉛、鋅、錫價格變化為-1.7%、-0.4%、0.4%、-0.5%、-0.7%;工業金屬價格由 “金融屬性” 及 “商品屬性” 共同決定,從金融屬性來看,美聯儲已開啓降息週期;從商品屬性來看,全球銅鋁庫存均處於相對低位,中國經濟復甦可期,疊加新能源行業的拉動,銅鋁需求增長將有所好轉。

關税落地,黃金起飛,銅鋁抗跌蟄伏

(1) 偏鴿的 FOMC 與偏低的美國 GDP 及偏不確定的特朗普關税,共同推動黃金價格邁向新高。美聯儲 1 月議息會議維持政策利率 4.25-4.5% 不變,但鮑威爾會後表示當前利率仍遠高於中性利率水平,表述偏鴿派。美國 2024 年四季度 GDP 按年率計算增長 2.3%,環比下降 0.8 個百分點,GDP 全年增長 2.8%,低於市場預期。特朗普 2.0 貿易戰全面開啓,對墨西哥、加拿大加徵 25% 關税,對中國加徵 10% 關税,儘管美國宣佈暫緩實施對墨西哥和加拿大的關税徵收,但是特朗普關税政策導致全球經濟走向的不確定性,推動了黃金的避險屬性。此外,DeepSeek 衝擊美國科技股基本面,強化黃金去美元化邏輯。全球經濟體從合作走向分化甚至是對抗,奠定黃金持續挑戰新高的底層邏輯,黃金股也將迎來修復行情。

(2) 銅鋁價格在關税威脅前的不屈表現。截止 2 月 4 日下午 15:00,LME 銅報收 9147.5 美元/噸,較中國節前收盤價跌 0.85%,LME 鋁報收 2619 美元/噸,基本持平於中國節前收盤價。面對美國大規模徵收貿易關税的威脅,春節期間銅鋁價格表現抗跌。首先,全球主要經濟體的製造業數據表現尚佳:中國 1 月財新制造業 PMI 為 50.1,景氣度連續第四個月保持擴張;美國 1 月 ISM 製造業 PMI 為 50.9,預期 49.8,前值 49.3。其次,美國對中國加徵 10% 的關税,存在預期差。其三,市場流動性充裕,市場對中國節後經濟復甦存在樂觀情緒。其四,銅鋁的供應並不那麼寬裕,2025 年全球銅鋁的產量增量分別為 2.4%、1.6%,而消費端全球電動汽車、人工智能蓬勃發展對銅的電需求及鋁的輕量化前景廣闊,墊高銅鋁價格重心。

風險提示

1、全球經濟大幅度衰退,消費斷崖式萎縮。世界銀行在最新發布的《全球經濟展望》中預計 2025 年和 2026 年全球 GDP 增速為 2.7%。該機構認為,隨着通脹放緩和增長平穩,全球經濟正在通往軟着陸的道路上,但風險仍然存在。歐美經濟數據已經出現下降趨勢,若陷入深度衰退對有色金屬的消費衝擊是巨大的。

2、美國通脹失控,美聯儲貨幣收緊超預期,強勢美元壓制權益資產價格。美國無法有效控制通脹,持續加息。美聯儲已經進行了大幅度的連續加息,但是服務類特別是租金、工資都顯得有粘性制約了通脹的回落。美聯儲若維持高強度加息,對以美元計價的有色金屬是不利的。

3、國內新能源板塊消費增速不及預期,地產板塊繼續消費持續低迷。儘管地產銷售端的政策已經不同程度放開,但是居民購買意願不足,地產企業的債務風險化解進展不順利。若銷售持續未有改善,後期地產竣工端會面臨失速風險,對國內部分有色金屬消費不利。