The overnight market experienced a "V-shaped reversal," and the market is more "confident" now. Did Goldman Sachs get it right again?

Analysis indicates that the market is skeptical about the threat of tariffs, viewing it as a typical "carrot and stick" diplomatic strategy. As tariff-related news flooded in, U.S. stocks experienced a decline in early trading, but the drop among tech giants was limited. Subsequently, Trump announced a delay in the tariff policy, leading to a significant market reversal, with European and American stock indices and U.S. Treasury yields quickly narrowing their declines. Goldman Sachs optimistically pointed out that, despite the unclear outlook, tariffs against Canada and Mexico "may be short-term."

Trump's tariff threat plays out like a "roller coaster," when will the market stop being startled?

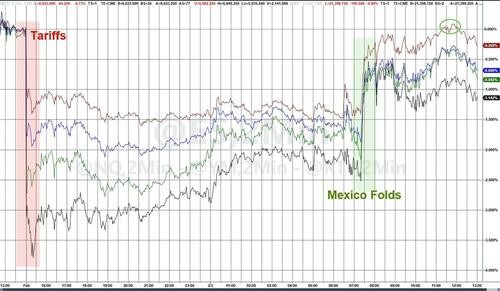

Last week, Trump's tariff threat heightened market risk aversion. On Monday, U.S. and European stocks fell across the board, with the S&P 500 index dropping more than 1% at one point. However, the tariff policy quickly reversed. According to CCTV news, U.S. President Trump agreed to postpone the plan to impose a 25% tariff on Canada and Mexico for one month after a call with the leaders of these two neighboring countries on Monday. Market sentiment eased accordingly, and the declines in European and American stock indices and U.S. Treasury yields narrowed, with the S&P 500 index's maximum drop only about 2%, far from the collapse of the global trade system.

"V-shaped reversal"

"V-shaped reversal"

Analysts pointed out that the market was initially skeptical about Trump's tariff policy, which was seen as a typical "stick and carrot" diplomatic strategy; the tariff threat was more of a bargaining chip rather than a long-term strategy, with Trump mainly using tariffs to gain concessions in other areas. In the past two days, as tariff news flooded in, U.S. stocks fell in early trading, but the decline in tech stocks was limited. Shortly after Trump announced the postponement of the tariff plan, the market quickly breathed a sigh of relief, leading to a significant reversal.

This view echoes Goldman Sachs' previous prediction, as an earlier article from Wall Street Journal pointed out, Goldman Sachs chief economist Jan Hatzius stated in his analysis report that despite the uncertain outlook, tariffs on Canada and Mexico "may be short-term."

Why did the market experience a "big reversal"? Does Trump not want to raise tariffs?

Analysts pointed out that the market is "confident" that Trump does not genuinely want to raise tariffs. After all, following the election, the market had previously misjudged and bet that he would first fulfill his promises of tax cuts and deregulation before considering tariff measures.

There are several reasons why the market is skeptical about Trump's tariff threat:

First, during Trump's first term, tariff policies frequently changed, supporting the view that tariffs are merely a short-term measure.

Second, tariffs would disrupt certain industries; for example, General Motors' stock price once fell by 6% due to the highly integrated cross-border supply chain of the North American automotive industry Thirdly, Stephen Innes of SPI Asset Management pointed out that "the art of the deal" remains an important principle for Trump. Trump has been closely monitoring the performance of the U.S. stock market, which may influence his decisions.

Despite the current easing of tensions, traders still need to remain vigilant given Trump's unpredictability. As a Wall Street analyst stated: "Today's carrot may turn into a big stick tomorrow." The market will continue to focus on whether the U.S., Canada, and Mexico can reach a long-term agreement. If this delay is merely another "false alarm," the market may experience severe fluctuations again, and volatility will rise once more.

Moreover, tariffs may pose a risk to long-term policy, with several points worth noting. First, Trump has repeatedly mentioned using tariffs to help finance the federal budget, which requires widespread implementation of tariffs. Second, he warned companies that they need to relocate back to the U.S., which would only happen under permanent tariffs. Third, Trump believes that the U.S. can endure economic pain, stating, "We have all the oil we need, we have all the trees we need." This resilience only becomes significant under long-term tariffs.

Tariff Policy Triggers Divergence in the Tech Industry

Trump's tariff policy has caused a divergence within the tech industry. Overnight, tech giants represented by Google, Amazon, Meta, and Microsoft, which primarily rely on cloud computing, online advertising, and other service businesses, were less directly affected by tariffs. The maximum drop in their stock prices did not exceed 2%, aligning closely with the decline of the S&P 500 index, demonstrating strong resilience.

However, hardware manufacturers represented by Tesla, Nvidia, and Apple faced greater pressure. These companies rely on global supply chains and cross-border trade, and the uncertainty brought by tariff policies directly impacts their production and sales. On Monday, the stock prices of these three companies fell approximately 8%, 6%, and 4% during intraday trading, although they later rebounded, their performance still significantly lagged behind the broader market.

Analysts suggest that this difference arises from supply chain and market risks. For example, Tesla relies on the North American automotive supply chain, and tariff increases will disrupt production arrangements. Apple has a large production and export business in China, and Nvidia holds a significant share in the Chinese chip market, with trade frictions increasing cost pressures.

Additionally, there is valuation pressure, with Apple, Nvidia, and Tesla having price-to-earnings ratios of 31, 30, and 131, respectively. These high valuations make companies highly sensitive to future profit expectations. Any policy changes will amplify market concerns about their profit outlook, leading to sharp fluctuations in stock prices