Tonight, is PCE "renaming" the Fed's rate cut in September?

The US May PCE inflation data is about to be released, and investors expect the data to reinforce rate cut expectations. Economists predict that the year-on-year growth rate of the US May core PCE price index will decrease from 2.8% last month to 2.6%. The already released CPI and PPI data show a cooling inflation trend, and the PCE data is expected to bring "good news"

According to Zhitong Finance, the highly anticipated US May PCE inflation data is about to be released. As of the time of writing, the three major US stock index futures rose before Friday's market opening, with investors betting that the US PCE price data to be released later on Friday will reinforce expectations of a rate cut. S&P 500 index futures and Nasdaq 100 index futures both rose by nearly 0.4%, with both indices expected to rise for the third consecutive quarter.

Economists expect that the "inflation indicator favored by the Federal Reserve," the US May core PCE price index year-on-year growth rate, will decrease from 2.8% last month to 2.6%, the lowest level since March 2021, although still above the Fed's 2% inflation target. The index is expected to increase by 0.1% month-on-month, slower than the 0.2% in April. The overall PCE price index year-on-year growth rate is also expected to slightly decrease to 2.6%, below the previous value of 2.7%.

The core PCE price index is likely to show the lowest annual reading since March 2021—a noteworthy date when the core PCE index first exceeded the Fed's 2% inflation target in this cycle. Despite a series of aggressive rate hikes by the Fed since then, the pace of price increases has not yet been brought back into its target range.

Published CPI and PPI show cooling inflation, will PCE bring "good news"?

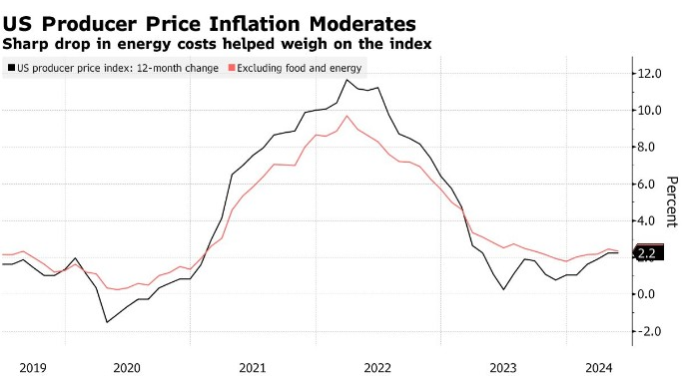

The US Bureau of Labor Statistics (BLS) reported earlier this month that the US May CPI rose by 3.3% year-on-year, lower than the expected and previous value of 3.4%; while the core CPI annual rate dropped to 3.4%, the lowest level in over three years, expected at 3.5%, and previous value at 3.6%. Meanwhile, the US May PPI unexpectedly fell, marking the largest decline in seven months, seemingly further proving that inflation pressures in the US are easing. Data previously released by the US Bureau of Labor Statistics showed that the US May PPI annual rate was 2.2%, lower than the expected 2.50% and previous value of 2.20%.

Moreover, it is worth noting that key categories of the core PCE, the inflation indicator favored by the Federal Reserve, showed significant declines in the PPI report. Several categories used to calculate the Fed's preferred inflation indicator (PCE price index) in the PPI report showed signs of cooling inflation in May. Among them, airfare prices fell by 4.3%, investment management service prices fell by 1.8%. Doctor care costs remained flat, while hospital outpatient costs rose by 0.5%.

Meanwhile, several data releases on Thursday showed that the Fed's stance on maintaining higher interest rates for a longer period has slowed US economic growth. Data released on Thursday showed that the US government lowered the first-quarter personal consumption expenditure to an annualized rate of 1.5%. Additionally, data showed a decline in durable goods orders and shipments, initial jobless claims data indicated a weak job market, and there were signs of a slowdown in the US housing market - with a decline in US pending home sales in May, indicating a decrease in the number of home purchases by Americans.

Senior Fed officials are also closely monitoring the inflation levels at the 3-month and 6-month annualized rates to understand the latest trends in prices. The core PCE price index's 3-month annualized rate fell to 1.6% in December last year, surged to 4.4% in March, and then fell to 3.5%. The 6-month core inflation rate annualized rate has been relatively stable, but rose at a rate of 3.2% in April. Fed Governor Cook said in a speech on Tuesday that, due to the high levels in 2023, the 12-month PCE inflation rate will remain near current levels for the remainder of this year.

However, she also said that she expects the 3-month and 6-month annualized inflation rates to be closer to the Fed's 2% target. She said: "My forecast is that the 3-month and 6-month period inflation rates will continue to decline on a bumpy road, as consumer resistance to price increases is reflected in inflation data."

Renaming September Rate Cut?

Cook and other Federal Reserve officials have been cautious about the timing and pace of rate cuts, although most people believe that a rate cut may occur at some point this year as long as the data remains consistent. In the current situation, the Fed may cut rates at least once this year, and possibly even twice. This week, Atlanta Fed President Bostic stated that he still expects a rate cut this year due to signs showing a decline in inflation. Earlier this month, the Fed's dot plot projected only one rate cut in 2024. However, the swap market reflects market expectations of a 45 basis point rate cut in 2024, equivalent to less than two rate cuts, with the first rate cut expected to begin in September.

With clear cracks appearing in the U.S. labor market, and data measuring U.S. business and consumer spending showing a significant cooling, some analysts believe that the expectations presented in the hawkish dot plot may be difficult to achieve. If the core PCE index continues to grow at extremely low rates or even declines on a month-on-month basis, it may continue to push the Fed to cut rates twice this year, with the probability of the first rate cut starting in September.

Goldman Sachs economists still believe that the Fed will cut rates twice this year (in September and December), and believe that the U.S. labor market is at a turning point. In a report to clients, Goldman Sachs economists including Jan Hatzius wrote that the strength of labor demand has clearly cooled, with initial jobless claims and continuing claims rising despite healthy nonfarm payrolls. Hatzius and other economists wrote that the main driver of labor demand is economic activity, and with GDP growth slowing significantly, we are confident in our forecast that the Fed will cut rates twice this year.

Overall, if tonight's PCE inflation report actual data aligns with expectations, Fed policymakers may become more convinced that inflation is moving towards the central bank's 2% target. For the Fed, overall economic resilience and higher-than-expected inflation mean that restrictive monetary policy still needs to be maintained. Patient Fed officials need several months of data to confirm the inflation path before considering rate cuts. Nevertheless, if tonight's PCE inflation data does indeed see a milestone decline as expected, the Fed's rationale for cutting rates twice this year will be strengthened.

Beth Ann Bovino, Chief Economist at Bank of America, also stated: "We do expect the real economy to soften—not fall off a cliff, just soften—which suggests that inflation will soften later as well. This gives us reason to expect the Fed may cut rates for the first time in September. Now we all know it depends on the data, which the Fed is still watching. Can they wait? Can they get it all done this year?"I cannot rule out this possibility. But it seems that these numbers may provide the Federal Reserve with an excuse to cut interest rates twice this year.”